Living in New England, the weather can be inconsistent—so I never really trust that warm days could be here to stay until the second week of April. Watching the Masters this Thursday and seeing the beautifully manicured greens and blooming azaleas will get me excited for golf season (even if the grass isn’t as green up here and the weather is still in the 40s). But along with the start of spring and golf season, we also get ready to kick off the earnings season.

Living in New England, the weather can be inconsistent—so I never really trust that warm days could be here to stay until the second week of April. Watching the Masters this Thursday and seeing the beautifully manicured greens and blooming azaleas will get me excited for golf season (even if the grass isn’t as green up here and the weather is still in the 40s). But along with the start of spring and golf season, we also get ready to kick off the earnings season.

Optimism in the Air

Looking at the first-quarter earnings season, markets are certainly taking an optimistic view, with S&P 500 valuations just over 20x forward earnings estimates. Of course, these are not quite the levels we saw at the beginning of 2022. But with interest rates much higher than they were then, we’ll likely have to rely on earnings growth to drive the S&P 500 higher from its current levels.

FactSet consensus analyst estimates are for 11 percent growth in 2024 and 13 percent growth in 2025. So, there is certainly reason for optimism from an earnings perspective. Much of this growth is expected to be driven by margin expansion, as revenue is anticipated to see growth of only 5.1 percent and 5.9 percent for 2024 and 2025, respectively. Margins had slipped to a post-pandemic low in 2023, so a bounce back could be reasonable. But margins are still well above their 20-year averages. Companies have been investing to improve productivity, and additional AI investments could also pay off to help improve margins.

Setting the Tone for the Year

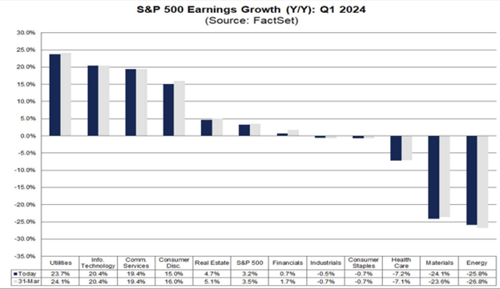

Last year, we had low expectations for much of the year. In the second half of the year, we saw earnings beats, but those would be offset to a degree by lowered expectations for the following quarter or by pushed-out growth expectations to future quarters. The bar remains low in the first quarter, with earnings expected to grow by only 3.2 percent over the last year. Still, this is a higher bar than we’ve seen for the past few quarters.

Earnings expectations then pick up significantly for the rest of the year and are expected to see growth of 9.4 percent, 8.5 percent, and 17.5 percent in the second, third, and fourth quarters, respectively. Forward guidance by firms will play an important role in how the markets view earnings given the markets' high expectations for the next few quarters. Beating the first-quarter number alone likely won’t be enough to see a significant boost in stock prices.

Keep an Eye on the Growth Sectors

Growth companies and sectors have been driving much of the gains in stock prices and earnings over the past year. Tech, consumer discretionary, and communication services make up 71 percent of the Russell 1000 Growth Index and nearly 50 percent of the S&P 500. Each of these sectors is expected to see first-quarter earnings growth of more than 15 percent and will play a major role in whether we see a positive quarter for earnings.

These sectors also have some narrow leadership. Earnings growth from Nvidia (tech), Meta (communication services), and Amazon (consumer discretionary) are expected to make up half or more of the growth of their sectors. Analysts expect the consumer discretionary sector to report a loss without accounting for Amazon’s growth. Valuations will also play a role in returns, with tech trading at a 54 percent premium to its 20-year history on a forward P/E basis. Consumer discretionary is also trading at a 27 percent premium.

Source: FactSet Consensus Analyst Estimates (as of April 5, 2024)

Don’t Overlook the Value Sectors

Earnings season will kick off on Friday with several of the big banks reporting. Like several other value sectors, expectations aren’t high for financials. Last quarter began with some surprise losses from the banks due to FDIC charges, but those were quickly forgotten as other sectors reported earnings beats. This quarter, it will be important to watch how the banks are provisioning for credit losses on consumer credit and commercial real estate to look for cracks in the health of an otherwise strong economy.

Materials and energy are expected to see significant losses in the first quarter, but they make up less than 7 percent of the S&P 500. Health care is an interesting one to watch. One of the larger weights in both the Russell 1000 Growth and Value Indices, earnings are expected to fall by 7 percent in the first quarter but grow by 14 percent for the year. Several pharmaceutical companies are expected to start seeing losses bottom, which could be an inflection point for the sector. On the whole, however, the sector is still trading at a premium to its long-term averages. Energy and real estate are the only two sectors trading at slight discounts to their 20-year averages.

Cautious Optimism Ahead

We haven’t yet seen the high earnings growth that analysts expect, but there are signs that the economy is continuing to improve. It still doesn’t feel quite like spring here, but I know to keep my expectations grounded and enjoy the nice days when they arrive. And for all those who celebrate—Happy Masters Week!

Print

Print