The good news is that the pandemic remains under control, with continued improvement. Case growth has gone down further over the past two weeks, and the case growth rate remains below the lows seen in mid-June. The control measures are working.

The good news is that the pandemic remains under control, with continued improvement. Case growth has gone down further over the past two weeks, and the case growth rate remains below the lows seen in mid-June. The control measures are working.

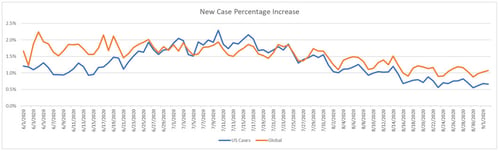

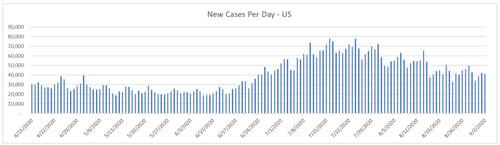

At the national level, as of September 3, the daily spread rate is 0.7 percent per day and has held steady around that level since mid-August. The seven-day average of the daily number of new cases is about 42,000, down from just under 45,000 two weeks ago. If this trend continues to hold, the pandemic will remain under control. The continued improvement in new cases is a positive, but the stabilization in the growth rate suggests that further improvements will be slower.

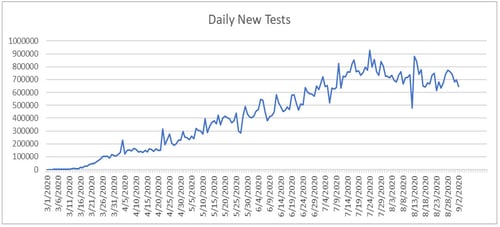

The testing news continues to be less good. The number of tests has remained relatively steady over the past two weeks, from around 650,000 to 750,000 per day. This testing level is insufficient, as the positive rate has held at more than 5 percent. This is a metric that will need to improve to keep the virus under control.

Beyond the headline numbers, state-level data is generally good, although there are concerns about states in the Midwest. Overall, the national risks remain under control.

With the medical news better, the economic recovery remains on track. The job market continues to improve and spending is holding up, although signs of declining confidence are something to keep an eye on. Before today's drop, financial markets had continued to move higher in response to the positive developments. Let’s take a look at the details.

Pandemic Growth Rate Remains at Low Levels

Growth rate. Over the past two weeks, the daily case growth rate has remained relatively steady at around 0.7 percent per day. It has been at that level since mid-August, and it is the lowest level of the pandemic thus far. Even as the case count declines, however, the spread has remained steady, which suggests future improvements will be slower. At this rate, the case-doubling period is about 15 weeks, leaving the infection curve flatter at a national level and leaving the risk to health care systems at a low level.

Source: Data from worldometer.com

Daily testing rate. As infections have dropped, testing has remained steady although variable, and it has stayed in the range of 650,000 to 750,000 per day for the past two weeks. This appears to be below the level of testing needed to develop a full understanding of the pandemic, despite the recent improvements in the spread rate.

Source: Data from the COVID Tracking Project

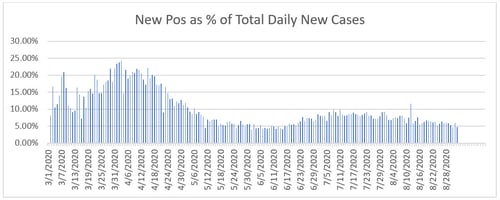

Positive test results. We can see this lack of improvement by the positive rate on tests. If we look at the percentage of each day’s tests that are positive, lower numbers are better, as we want to be testing everyone and not just those who are obviously sick. The World Health Organization recommends a target of 5 percent or lower; the lower this number gets, the wider the testing is getting. Here, we can see that the positive level has remained above that target, although we have seen some recent improvement.

Source: Data from the COVID Tracking Project

New cases per day. The most obvious metric for tracking the virus is daily new cases. With increased control measures in place, especially in the outbreak states, the seven-day average number of new cases per day has dropped from just under 45,000 per day down two weeks ago to around 42,000 per day. While this is an improvement, it is much slower than what we saw in previous weeks.

Source: Data from worldometer.com

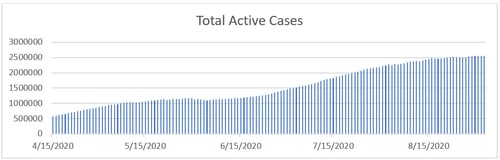

Total active cases. Another positive development is that as the number of new cases has slowed, the number of active cases has stabilized over the past two weeks. If case growth continues to decline, new infections will start to lag recoveries, and the number of active cases would actually decline, which would be a very positive sign.

Source: Data from worldometer.com

Overall, the pandemic is under control at the national level and continues to improve, although at a slower rate. At the state level, the health emergencies have largely passed, although concerns remain in some states. The good news here is that policy and behavioral changes have taken effect, as they did in the first wave, and that we have largely contained the virus as we did then.

Looking forward, the question is whether the improvement will continue into the fall. The trends are positive. But given the slowing of the pace of improvement, combined with the pending reopening of school districts and universities, the risks remain material. These will be something we need to watch.

Economic Recovery Stable

Jobs market. The economic news is also good, with the recovery continuing. The most recent initial jobless claims reports showed further drops, indicating fewer layoffs. The continuing unemployment claims have also improved, showing that many people are returning to work. Stabilization in the jobs market remains a relative bright spot as businesses continue to figure out how to operate under the constraints of the pandemic.

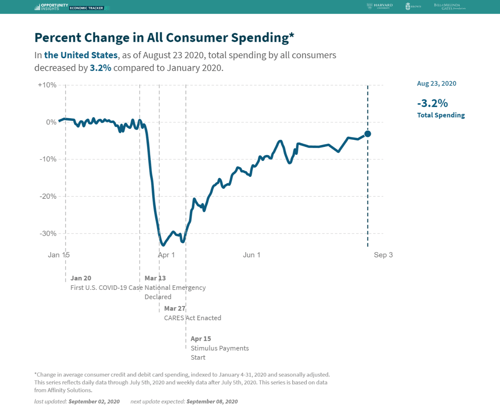

Consumer spending. Consumer spending has also rallied after a pause in the face of the second wave. In the past two weeks, spending has risen to a post-pandemic high, as consumer confidence has shown signs of bottoming and the jobs data has continued to improve. While there are risks, principally around the expiration of federal income support payments, the weakness seems to have passed. This metric remains something to watch, however.

Source: https://tracktherecovery.org/

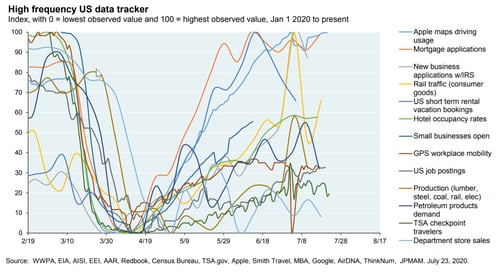

Finally, we can see similar signs of improvement in many areas, despite a slowdown in some others, in this composite of many indicators from J. P. Morgan.

Source: J. P. Morgan

The big picture is that the recovery is still on track. The medical risks have improved significantly, and the economic risks, while still real, are fading.

Financial Market Hit New Highs

Today's selloff notwithstanding, the financial markets have appreciated steadily over the past two weeks in response to the positive news and have hit new highs. On the medical front, markets have responded to the improvement in the new case count and encouraging news on vaccine development. On the economic front, better job and confidence news combined with stronger business confidence have helped drive markets higher.

What’s Ahead?

The real takeaway for this update is that the second wave has been brought under control, just as the first wave was. The medical risks are now contained, although further future improvement is likely to be slower. The economic risks, while real, also seem to be getting better at this point. Markets have responded enthusiastically to the better news.

Given current trends, over the next couple of weeks, the most likely case appears to be continued improvement on both the medical and economic fronts. There are certainly risks, and we need to watch them. But for the moment, the news remains good.

Print

Print