The big news over the weekend was the drone attack on the main oil processing facility in Saudi Arabia. Apparently, the attack significantly affected the nation’s ability to deliver oil, knocking production down by half or more according to some estimates (more than 4 million barrels per day). As I write this, no one knows when the damage will be repaired or when Saudi production will return to normal.

The big news over the weekend was the drone attack on the main oil processing facility in Saudi Arabia. Apparently, the attack significantly affected the nation’s ability to deliver oil, knocking production down by half or more according to some estimates (more than 4 million barrels per day). As I write this, no one knows when the damage will be repaired or when Saudi production will return to normal.

The impact on oil markets was immediate. Monday saw the largest single-day jump in crude oil prices in years, and gasoline futures were up more than 10 percent on the day. Reports are that gas prices are up an average of 28 cents per gallon around the U.S., and air travel prices might well follow. From an economic standpoint, this event could be a big deal if these price increases hold. So, how worried should we be?

What are the risks?

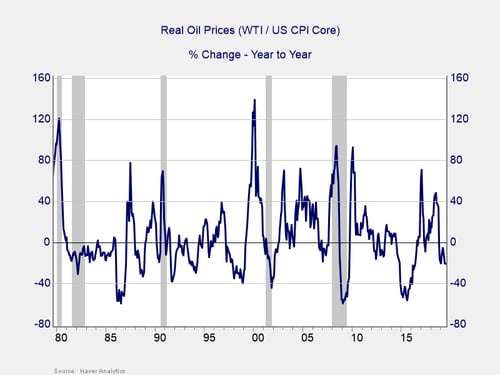

One way to look at the present situation is to compare the price spike with past ones. In the chart below, you can see that real oil prices spike on a fairly regular basis, but they do not often coincide with the start of recessions. We saw spikes a year or so ahead of the 2000 and 2008 recessions, but we also saw spikes in 2011 and 2016 without a subsequent recession. Before the Monday spike, prices were actually down year-on-year. Even with the spike, they remain flat. From an economic standpoint, oil prices remain well outside the risk zone for direct economic effects.

Another possible risk from higher oil prices could come from their effects on confidence. Here again, there doesn’t seem to be immediate reason for concern. When you compare oil prices to consumer confidence, the connection is either nonexistent or weak at best.

A positive for U.S.?

In fact, in some respects, this situation could be a positive for the U.S. As the largest oil producer in the world for 2018, the U.S. is well positioned to expand production if the Saudis can’t. Larger U.S. market share in the short term would be likely, and the U.S. position as a much more secure provider would act to preserve that increase. A larger oil industry here would be stimulative economically. Similarly, despite the short-term damage of higher prices, a larger share of U.S. production could make prices more stable over the medium term, which would also be helpful.

All of this assumes that the disruption to Saudi's oil production will be long lived. We don’t know that yet, and it might not be. If so, any economic effects will be even more limited than we discussed above.

What’s the net effect?

The net effect is that while there will likely be some short-term damage, it is likely to be limited. The U.S. economy is much less exposed to oil than it was in previous oil shocks—oil simply is not as important. That fact, combined with our role as a major producer, means we are in a much better position to ride out a crisis this time, even if the damage proves worse than now understood or if another attack were to happen.

The headlines are valid. Bad things have happened and could continue to happen. What that means for us here, however, is not nearly as bad as the headlines imply. We will certainly be keeping an eye on this story. But for the moment? Once again, remain calm and carry on.

Print

Print