Just as I do with the economy, I review the market each month for warning signs of trouble in the near future. Although valuations are now high—a noted risk factor in past bear markets—markets can stay expensive (or get much more expensive) for years and years, which doesn’t give us much to go on timing-wise.

Just as I do with the economy, I review the market each month for warning signs of trouble in the near future. Although valuations are now high—a noted risk factor in past bear markets—markets can stay expensive (or get much more expensive) for years and years, which doesn’t give us much to go on timing-wise.

Of course, there are other market risk factors beyond valuations. For our purposes, two things are important: (1) to recognize when risk levels are high, and (2) to try and determine when those high risk levels become an immediate, rather than theoretical, concern. This regular update aims to do both.

Risk factor #1: Valuation levels

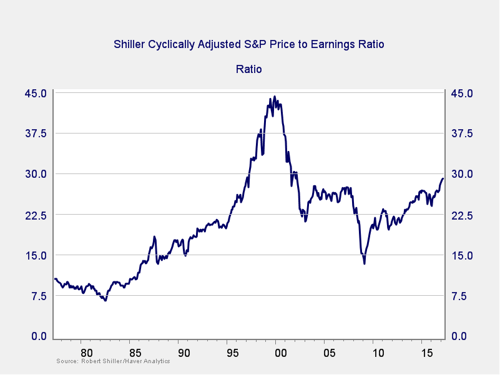

When it comes to assessing valuations, I find longer-term metrics—particularly the cyclically adjusted Shiller P/E ratio, which looks at average earnings over the past 10 years—to be the most useful in determining overall risk.

This chart is interesting for a few reasons. First, we can see that, since the presidential election in November, equity valuations have increased to levels consistent with the early 2000s. Second, gains in March kept valuations high—well above pre-election levels.

Although they are close to their highest level in 15 years, valuations are still below their peak, so you might argue that this metric does not suggest immediate risk. Of course, that also assumes we might be heading back to 2000 bubble conditions, which isn’t exactly reassuring.

Risk factor #2: Changes in valuation levels

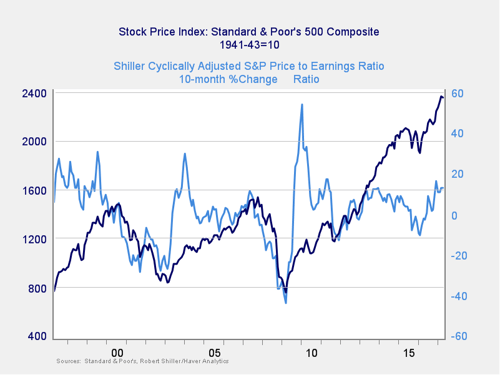

As good as the Shiller P/E ratio is as a risk indicator, it’s a terrible timing indicator. One way to remedy that is to look at changes in valuation levels over time instead of absolute levels.

Here, you can see that when valuations roll over, with the change dropping below zero over a 10-month or 200-day period, the market itself typically drops shortly thereafter. The post-election rally has kept changes in valuations at a good level, so this indicator shows low immediate risk.

Risk factor #3: Margin debt

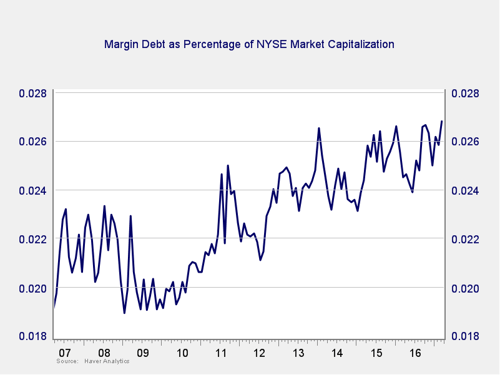

Another indicator of potential trouble is margin debt.

Debt levels as a percentage of market capitalization have moved back to all-time highs in recent months, which raises the risk level considerably. This high level of debt is concerning; however, as noted above, high risk is not necessarily immediate risk.

Risk factor #4: Changes in margin debt

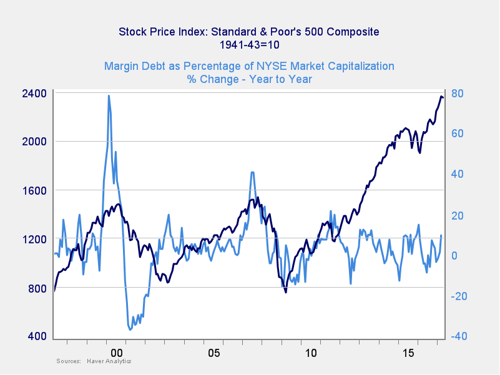

Changes in margin debt are a better indicator of immediate risk than the overall level of debt. Consistent with this, if we look at the change over time, spikes in debt levels typically precede a drawdown.

As you can see in the chart above, the change in debt as a percentage of market capitalization remains low—although it is getting higher and closer to the risk zone. Further, although the absolute level of margin debt is high—and therefore so is the risk level—we do not yet see the kind of spike that signals trouble. Immediate risk, therefore, is moderate but increasing.

Risk factor #5: The Buffett indicator

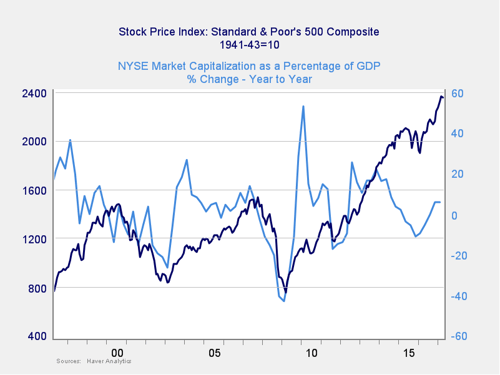

Said to be favored by Warren Buffett, the final indicator is the ratio of the value of all the companies in the market to the national economy as a whole.

On an absolute basis, the Buffett indicator is actually somewhat encouraging. Although it remains high, it has pulled back to less extreme levels. The index has increased since the election, though, so we’ll need to monitor the situation going forward.

Technical metrics are also reasonably encouraging, with all three major U.S. indices well above their 200-day trend lines. Even as markets approach new highs, it’s quite possible that the advance will continue given growth in earnings and positive consumer, business, and investor sentiment. A break into new territory could actually propel the market higher, despite the high valuation risk level.

Immediate risk level is low but increasing

Many of the indicators point to an elevated level of risk, but these high levels, while concerning, don’t signal an immediate problem. Instead, they may be driven largely by the positive sentiment surrounding the post-election rally. What does bear watching is the immediate risk level, which, while low, is starting to increase.

Print

Print