My colleague Sam Millette, manager, fixed income on Commonwealth’s Investment Management and Research team, has helped me put together this month’s Market Risk Update. Thanks for the assist, Sam!

My colleague Sam Millette, manager, fixed income on Commonwealth’s Investment Management and Research team, has helped me put together this month’s Market Risk Update. Thanks for the assist, Sam!

November was a mixed month for markets, as rising investor concerns surrounding the pandemic led to a late-month sell-off that largely wiped out earlier gains. The S&P 500 declined by 0.69 percent, while the Dow Jones Industrial Average (DJIA) experienced a 3.50 percent decline. The Nasdaq Composite held up the best and managed to record a 0.33 percent gain during the month. The story was much the same internationally, as both the MSCI EAFE and MSCI Emerging Market indices suffered drops between 4 percent and 5 percent. The late-month market turbulence serves as a reminder that the pandemic continues to present a very real risk for markets that should be monitored.

Recession Risk

Recessions are strongly associated with market drawdowns; in fact, 8 of 10 bear markets have occurred during recessions. The National Bureau of Economic Research, which declared that a recession started last February when markets plunged, recently announced that it ended shortly thereafter. Despite that and the ongoing expansion, economic risks remain. The primary risk is a slowing recovery, as evidenced by a slowdown in job growth and a drop in consumer confidence in November.

On the whole, the economic recovery continued in November, although uncertainty about the path of the recovery increased during the month. Given the remaining risks, we have kept the economic risk level at a yellow light for now. Although the most likely path forward is continued recovery, the slowdown in job growth in November is a reminder that the pace of the recovery remains uncertain and that we may see minor setbacks along the way.

Economic Shock Risk

One major systemic factor is the price of money, otherwise known as interest rates. They drive the economy and financial markets—and, historically, have been able to derail them. Rates have been causal factors in previous bear markets and deserve close attention.

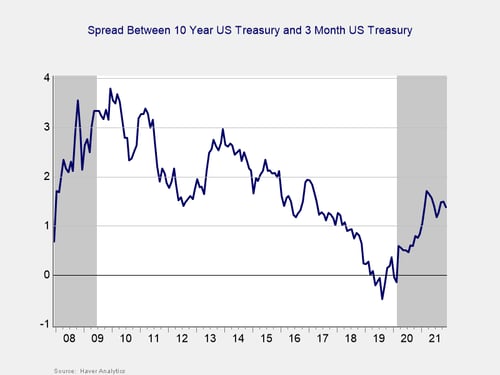

Risk factor #1: The yield curve (10-year minus 3-month Treasury rates). We cover interest rates in the economic update, but they warrant a look here as well.

The yield curve flattened in November, breaking a three-month widening streak. This result was due to falling long-term interest rates, as the 10-year Treasury yield fell from 1.55 percent at the end of October to 1.43 percent at the end of November. The three-month Treasury yield ended the month unchanged at 0.05 percent.

The drop in long-term Treasury yields was primarily due to rising investor concerns near month-end about the Omicron variant and the potential impact on the global economic recovery. Despite the decline during the month, long-term yields remain well above the pandemic-era lows that we saw last year.

Given that long-term yields remain above 2020 lows and that the spread between 10-year and 3-month Treasury yields remains well outside of the historical danger zone, we have upgraded this signal to a green light for now.

Signal: Green light

Market Risk

Beyond the economy, we can also learn quite a bit by examining the market itself. For our purposes, two things are important:

- To recognize which factors signal high risk

- To try to determine when those factors signal that the risk has become an immediate—rather than theoretical—concern

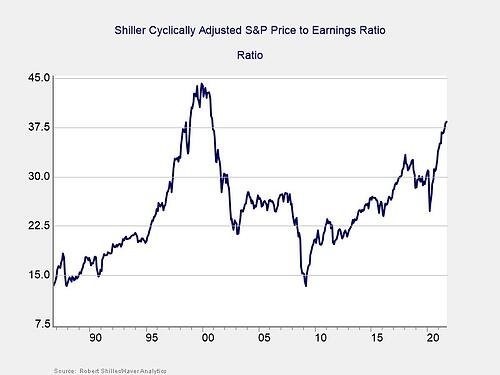

Risk factor #1: Valuation levels. When assessing valuations, we find longer-term metrics (particularly the cyclically adjusted Shiller P/E or price-to-earnings ratio, which looks at average earnings over the past 10 years) to be the most useful in determining overall risk.

Please note: Because of data limitations, this is the same chart that was used in last month’s update.

Valuations continued to rise in September, as the Shiller CAPE ratio rose from 38.09 in August to 38.34 in September. This marks four consecutive months with rising equity market valuations, and it left the ratio at its highest level since late 2000.

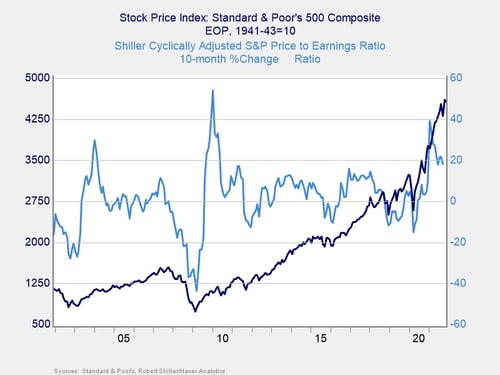

Even though the Shiller CAPE ratio is a good risk indicator, it’s a terrible timing indicator. To get a better sense of immediate risk, let’s turn to the 10-month change in valuations. Looking at changes rather than absolute levels gives a sense of the immediate risk level, because turning points often coincide with changes in market trends.

Above, you can see that when valuations roll over—with the change dropping below zero over a 10-month or 200-day period—the market itself typically drops shortly thereafter. This relationship held at the start of the pandemic, as valuations and the index rolled over before rebounding. On a 10-month basis, valuations rose 18.1 percent in September, down from the 21.8 percent increase we saw in August. Given the historically high valuation levels, we have kept this indicator as a yellow light for now, despite the fact that valuation changes have remained outside the danger zone since May 2020.

Signal: Yellow light

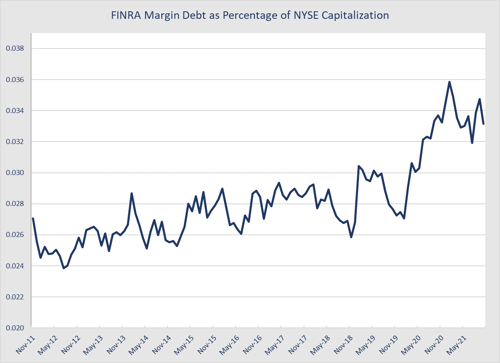

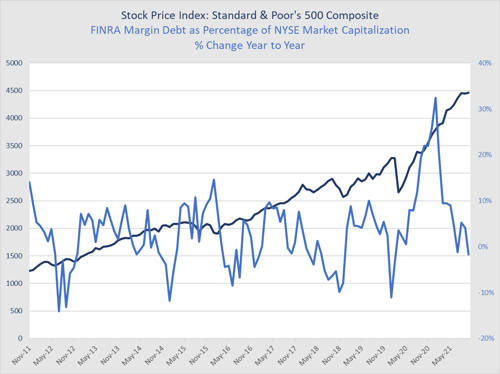

Risk factor #2: Margin debt. Another indicator of potential trouble is margin debt.

Debt levels as a percentage of market capitalization increased notably at the start of the pandemic and throughout 2020. Since then, we have seen margin debt largely decline from the recent highs that we saw late last year. Margin debt declined in October following increases in August and September; however, the overall level of margin debt remains high on a historical basis. The high level of debt associated with the market is a risk factor on its own but not necessarily an immediate one.

For immediate risk, changes in margin debt over a longer period are a better indicator than the level of that debt. Consistent with this, if we look at the change over time, spikes in debt levels typically precede a drawdown.

As you can see in the chart above, margin debt as a percentage of market capitalization declined by 1.67 percent in October after a 4.15 percent increase in September. This marks the second decline in monthly year-over-year margin debt as a percentage of market capitalization this year, echoing July’s 1.22 percent decline.

Although the margin debt as a percentage of market capitalization declined on a year-over-year basis in October, the high absolute level of margin debt as a percentage of market capitalization is worth monitoring. We have kept this indicator at a yellow light for now.

Signal: Yellow light

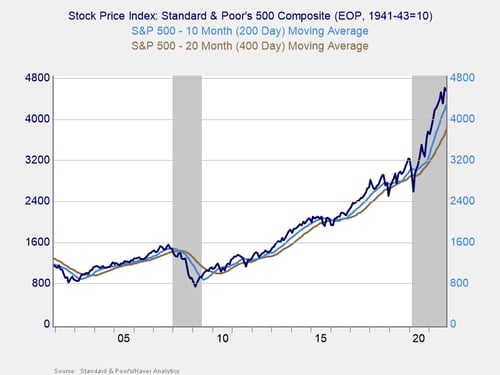

Risk factor #3: Technical factors. A good way to track overall market trends is to review the current level versus recent performance. Two metrics we follow are the 200-day and 400-day moving averages. We start to pay attention when a market breaks through its 200-day average, and a breakthrough of the 400-day average often signals further trouble ahead.

Technical factors remained supportive for equity markets throughout November. The S&P 500, which managed to break above its 200-day moving average at the end of May 2020, has finished above-trend every month since. The DJIA and Nasdaq Composite have seen similar technical support; however, the DJIA did come close to hitting its trend line due to the pullback at the end of the month.

The 200-day trend line is an important technical signal that is widely followed by market participants, as prolonged breaks above or below could indicate a longer-term shift in investor sentiment for an index. The 400-day trend line is also a reliable indicator of a change in trend. The continued technical support for markets, despite volatility during the month, was encouraging, so we have left this signal at a green light.

Signal: Green light

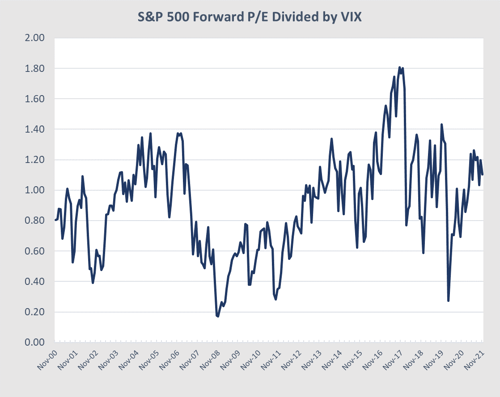

Risk factor #4: Market complacency. This is a recently added risk factor that aims to capture a standardized measure of market complacency across time. Complacency can be an uncertain term, so this chart identifies and combines two common ways to measure complacency: valuations and volatility.

For the valuation component of the index, we are using the forward-looking price-to-earnings ratio for the S&P 500 over the next 12 months. This gives an idea of how much investors are willing to pay for companies based on their anticipated earnings. Typically, when valuations are high, it signals investors are confident and potentially complacent. For volatility, we have used the monthly average level for the VIX, a stock market volatility index. When volatility for the S&P 500 is high, the VIX rises, which would signal less complacency.

By combining the two metrics in the chart below, we see periods where high valuations and low volatility have caused peaks, such as 2000, 2006–2007, and 2017. We saw market drawdowns within roughly one year following each of these peaks.

Source: Haver Analytics, FactSet

Looking at the current chart, market complacency declined in November. The average VIX reading increased from 17.9 in October to 18.5 in November. The forward-looking P/E ratio for the S&P 500, on the other hand, declined from 21.4 to 20.4 during the month. The combination of higher volatility and lower forward-looking valuations caused the market complacency index to fall back to 1.1 after it rose to 1.2 in October.

Readings exceeding 1.2 have historically been a signal that market complacency may be at concerning levels, so the pullback for the index in November is a sign that complacency fell back from the potential danger zone. With that being said, the index has spent the past few months near this historically concerning level, and it’s too early to say that we are out of the woods in terms of market complacency. Therefore, we have left this signal at a yellow light for now.

Signal: Yellow light

Conclusion: November Pullback Highlights Risks

While the economic recovery continued in November, the late-month sell-off reminds us that investors are still closely monitoring the course of the pandemic and that rising medical risks can still cause short-term volatility. We also saw political risks increase during the month, which contributed to the pullback.

We’ve already seen markets partially rebound to start December; however, the risks on the medical, political, and economic fronts still remain and should be monitored. With that being said, the most likely path forward is for continued market appreciation in the months ahead, provided we see continued economic growth.

Ultimately, the path back to a more normal economic environment will likely be long, and we can expect setbacks along the way (as we saw in November). Given that the indicators we track in this update remained at a yellow light or better during the month, we have left the overall market risk level at a yellow light for now. But, the recent rise in medical risks could lead to further volatility and downgrades in the months ahead.

Print

Print