It’s time for our monthly look at market risk factors. Just as with the economy, there are several key factors that matter for the market in determining both the risk level and the immediacy of the risk. Although stocks have largely recovered from their recent pullback, given valuations and recent market behavior, it is useful to keep an eye on these factors.

It’s time for our monthly look at market risk factors. Just as with the economy, there are several key factors that matter for the market in determining both the risk level and the immediacy of the risk. Although stocks have largely recovered from their recent pullback, given valuations and recent market behavior, it is useful to keep an eye on these factors.

Recession risk

Recessions are strongly associated with market drawdowns. Indeed, 8 of 10 bear markets have occurred during recessions. As I discussed in this month’s Economic Risk Factor Update, right now the conditions that historically have signaled a potential recession are not in place. There are, however, growing signs of weakness, with consumer confidence going to yellow and a recent but brief yield curve inversion. On an absolute basis, all the major signals are not in a high-risk zone. But trends are growing more negative, and two of the signals have now moved to yellow. As such, I have taken economic factors down to a yellow light for April.

Economic shock risk

There are two major systemic factors—the price of oil and the price of money (better known as interest rates)—that drive the economy and the financial markets, and they have a proven ability to derail them. Both have been causal factors in previous bear markets and warrant close attention.

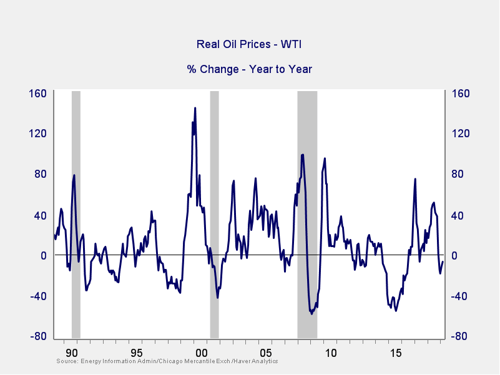

The price of oil. Typically, oil prices cause disruption when they spike. This is a warning sign of both a recession and a bear market.

A quick price spike like we saw in both 2017 and 2018 is not necessarily an indicator of trouble, especially as the subsequent declines took this indicator well out of the trouble zone. With the recent drop in oil prices, they are actually down over the past year, suggesting no risk from this factor. Therefore, this indicator remains at a green light.

Signal: Green light

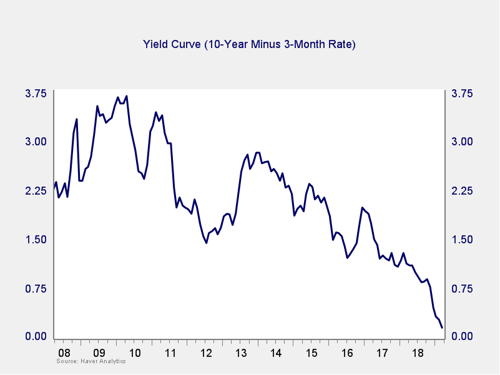

The price of money. I cover interest rates in the economic update, but they warrant a look here as well.

The yield curve spread briefly inverted in March, as longer-term rates pulled back on a notably dovish Fed press conference. Since then, however, the spread between the 10-year and 3-month Treasuries has turned positive again, while other spreads never went negative. As such, the inversion may not be as bad of a sign as it looks.

While the immediate risk remains low, recent policy moves and market action suggest risks are rising. Given that, along with other signs of weakness, the indicator remains something to watch. So, I am keeping this measure at a yellow light this month.

Signal: Yellow light

Market risk

Beyond the economy, we can also learn quite a bit by examining the market itself. For our purposes, two things are important:

- To recognize what factors signal high risk

- To try to determine when those factors signal that risk has become an immediate, rather than theoretical, concern

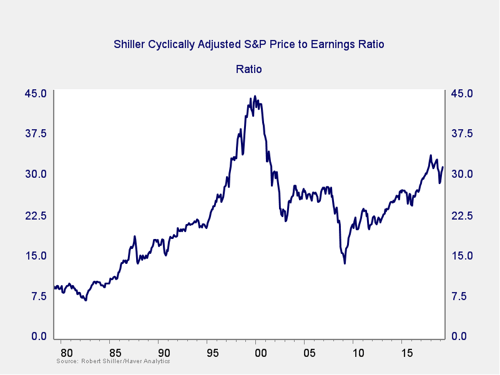

Risk factor #1: Valuation levels. When it comes to assessing valuations, I find longer-term metrics—particularly the cyclically adjusted Shiller P/E ratio, which looks at average earnings over the past 10 years—to be the most useful in determining overall risk.

The major takeaway from this chart is that despite the recent decline, valuations remain extremely high. They are still above the levels of the mid-2000s, although down from recent highs. Also worth noting, however, is the very limited effect on valuations of the recent pullback in stock prices. Despite the drop, stocks remain quite expensive based on history. High valuations are associated with higher market risk—and longer-term metrics have more predictive power. So, this is definitely a sign of high risk levels.

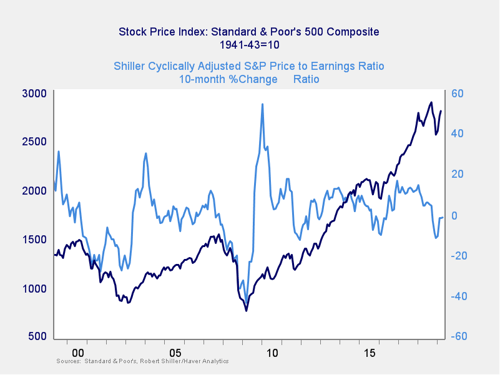

Even as the Shiller P/E ratio is a good risk indicator, however, it is a terrible timing indicator. To get a better sense of immediate risk, we can turn to the 10-month change in valuations. Looking at changes, rather than absolute levels, gives a sense of the immediate risk level, as turning points often coincide with changes in market trends.

Here, you can see that when valuations roll over, with the change dropping below zero over a 10-month or 200-day period, the market itself typically drops shortly thereafter. After the decline at the end of last year took the market into the risk zone, recovery in the past couple of months has taken us back close to even. Given the recent recovery in equity prices and the fact that we remain above the levels of 2011 and 2015–2016, I am keeping this indicator at yellow, as we have seen similar declines before without further damage. Further, the continuation of the recovery suggests risks are moderating.

Signal: Yellow light

Risk factor #2: Margin debt. Another indicator of potential trouble is margin debt.

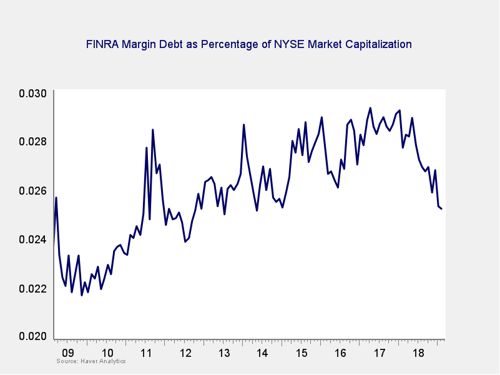

Debt levels as a percentage of market capitalization ticked back down in response to the market recovery. Although margin debt is at the low end of recent history, it remains high by historical standards. The overall high levels of debt are concerning; however, as noted above, high risk is not immediate risk.

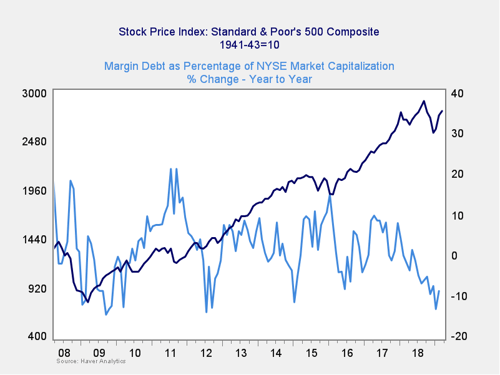

For immediate risk, changes in margin debt over a longer period are a better indicator than the level of that debt. Consistent with this, if we look at the change over time, spikes in debt levels typically precede a drawdown.

As you can see in the chart above, the annual change in debt as a percentage of market capitalization has continued to drop to well below zero over the past couple of months. This indicator is not signaling immediate risk and, in fact, is showing decreasing risk. Still, the overall debt level remains very high. As such, it is worth watching, so we are keeping this indicator at a yellow light, although there are real signs of improvement.

Signal: Yellow light

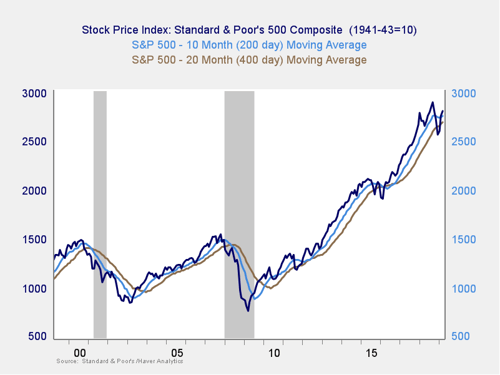

Risk factor #3: Technical factors. A good way to track overall market trends is to review the current level versus recent performance. Two metrics I follow are the 200- and 400-day moving averages. I start to pay attention when a market breaks through its 200-day average, and a break through the 400-day often signals further trouble ahead.

Last year’s declines took all three major U.S. indices below the 400-day trend lines, a significant support level. The subsequent recovery has since brought them back above both that level and the 200-day level, which takes the market back into an uptrend. This switch from downtrend to uptrend is a significant change. Although the risk of the trend turning back to negative remains, investor psychology appears to have shifted. The probability that the markets continue to rebound is therefore more solid; given that, this indicator remains at yellow after a brief drop to red.

Signal: Yellow light

Conclusion: Market risks moderating, but economic risks rising

Market risks have been at the yellow light level for the past 12 months and recently dropped even further with the addition of some red lights. But market conditions have improved over the past couple of months, with the continuation of the rebound from the decline at the end of last year. On the other hand, economic risks have risen as the incoming data remains weak, and there have been a couple of potentially significant breakdowns. On balance, this leaves us solidly in the yellow zone of increased risks.

The continued market recovery is encouraging, the overall economic environment remains supportive overall, and neither of the likely shock factors is necessarily indicating immediate risk. But the rising signs of economic weakness, combined with the fact that several of the market indicators continue to point to an elevated level of risk, suggest that volatility may return.

As such, we are keeping the overall market indicator at a yellow light. This is not a sign that risks have passed. Instead, it is a recognition that despite the recent market turmoil, basic conditions remain supportive and that while risks are real, the most probable course is more appreciation—even though further volatility is quite likely.

Print

Print