April was a good month. While it started with what looked like another wave of infections, by month-end, we were back at recent lows for both case growth and positive test rates. Vaccinations have now hit a substantial part of the population, and that looks to have controlled the virus. The medical risks are still real, but they are now about whether and when we hit herd immunity, rather than whether we have a fourth wave. This is significant progress and means the medical risks are low and likely to decline further over the next month.

April was a good month. While it started with what looked like another wave of infections, by month-end, we were back at recent lows for both case growth and positive test rates. Vaccinations have now hit a substantial part of the population, and that looks to have controlled the virus. The medical risks are still real, but they are now about whether and when we hit herd immunity, rather than whether we have a fourth wave. This is significant progress and means the medical risks are low and likely to decline further over the next month.

The economic news is even better. April showed further normalization of the economy. Reopening across the country has kept job growth high, and we finally saw layoffs drop substantially. As a result, consumer confidence bounced to a pandemic high and is just about back to pre-pandemic levels. Business confidence also stayed close to all-time highs, and the only problems appearing are those of success, as demand is straining supply chains. Despite a terrible February due to winter storms, first-quarter growth was strong, and signs are the second quarter will be even stronger.

For both medical and economic risks, we are now at the most positive point since the start of the pandemic, and the trends are for even more improvement. Markets are clearly on board with the news, as they hit all-time highs. And with corporate earnings blowing away expectations, there may well be more upside ahead. Let’s take a look at the details.

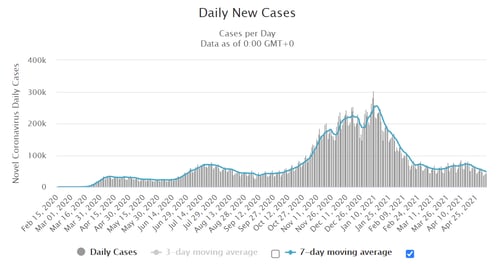

Case Growth Dropping Again

New cases per day. The most obvious metric for tracking the virus is daily new cases. Case growth has declined sharply in the past month, despite reopening and more contagious variants. At this point, another infection wave looks unlikely, and the risks are dropping by the day.

New daily infection rates were 46,129 on May 5, down from 75,370 four weeks earlier, a decline of almost 40 percent. The seven-day average number of new cases per day was 47,945, down from 66,252 four weeks ago, a decline of more than one-quarter. Case growth is now at levels we last saw last fall, and it is still going down. If this drop continues, we could be at pandemic-low case growth rates in a matter of weeks.

Source: https://www.worldometers.info/coronavirus/country/us/

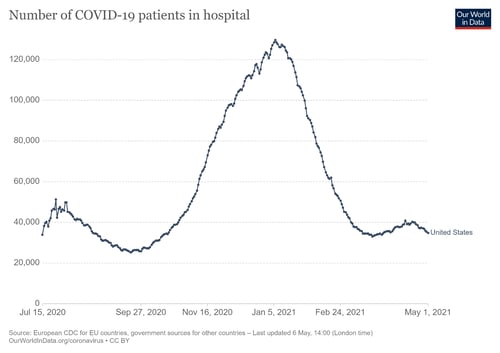

Hospitalizations. We also see improvement with hospitalizations. On May 1, there were 34,905 people hospitalized, down from a peak of 40,890 on April 14. This is a lagging data series from case growth, so the smaller decrease in hospitalizations is consistent with that data as of a couple of weeks ago. Looking at a longer time period, hospitalizations are moving back to recent lows.

Source: https://ourworldindata.org/covid-hospitalizations

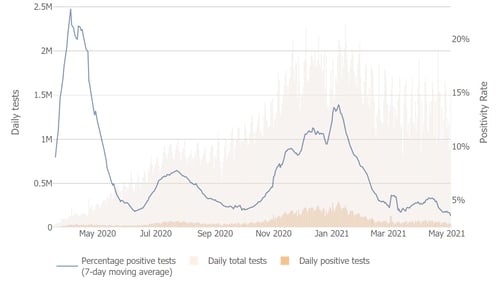

Testing news. The testing news is also much better. Overall testing numbers have stayed at roughly the same levels for the past several weeks, but the positive test rate has dropped sharply and is now at the lowest level of the pandemic, at 3.6 percent. While we would benefit from more testing, the decline and low level of positive testing rates are supporting evidence that the improvement in the other data is real and could be a leading indicator that the medical risks remain contained.

Source: Johns Hopkins University

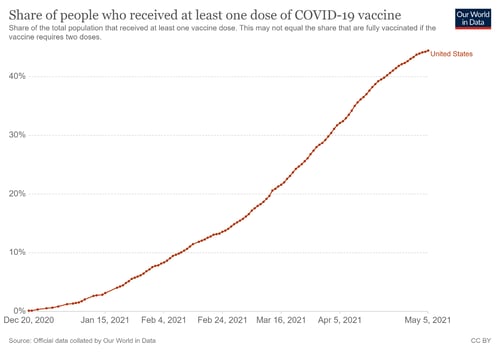

Vaccinations. All of these improvements are due to the success of the vaccination rollout. Almost one-third of the U.S. population is now fully vaccinated, and 44 percent have had at least one shot. This has very likely helped contain the number of new infections and has certainly helped keep hospitalizations low. One emerging area of concern is that the vaccination rate is slowing. If that trend continues, it will delay the onset of herd immunity. As of now, it is very possible that we could be at herd immunity by the end of the summer, but that is now at risk.

Source: https://ourworldindata.org/covid-vaccinations

The bottom line is that infection growth now looks to be controlled and is likely to decline further. At the same time, with vaccinations slowing, further improvements are at risk, and herd immunity may well be delayed or prevented if the slowing trend continues. While we need to keep an eye on this, the trends remain very positive, and we will likely see further improvement over the next month.

Economy Improves Further in April

The economic data continues to get better overall. March job growth came in much stronger than expected, with 916,000 jobs added, and layoffs dropped sharply in April. Consumer confidence bounced to a pandemic high and is now close to pre-pandemic levels. Per the chart below, retail sales have spiked this year, reflecting better employment and confidence. Business confidence remains close to decade-plus highs last month. As the economy continues to reopen, we should see even more acceleration ahead, and we are very likely through the worst of the economic impact of the pandemic.

Financial Markets Hit New Highs as Recovery Accelerates

Markets saw more new all-time highs last month, supported by the good news on the medical and economic fronts. More than that, first-quarter corporate earnings surprised sharply to the upside, with seven of eight companies beating expectations substantially. The magnitude of the beats, in fact, has analysts revising future quarters upwards, suggesting there may be more upside ahead.

Beginning of the End?

Conditions continued to improve in April, with medical risks rolling over and the economy accelerating further. We are through the worst of the risks of the pandemic, and normal may well be only a couple of months ahead.

Markets continue to do well as conditions improve, and they may have some more upside ahead as earnings continue to beat expectations. Future gains will depend on further improvement that, while likely, is not guaranteed, especially in the short term. Expect more volatility.

In the longer term, the major risks have changed from the severe and immediate (a fourth wave or a collapse in job creation) to the more distant and hypothetical (slowing vaccinations and how quickly we get back to full employment). This shift is good news, as it means the difference between whether we recover and get back to normal, and how quickly. Right now, the good news is that whether we recover seems to be resolved—we will. The better news is that this recovery still looks to be within the next several months. This is a much better place than we were in only a couple of months ago, and it very likely marks the beginning of the end of the pandemic.

Print

Print