This morning’s news revealed that, as of yesterday, both the S&P 500 and Nasdaq stock indices had hit new highs for the first time in six months or so. Let’s cut right to the chase here. For me, the appropriate response to this news is, “So what?”

This morning’s news revealed that, as of yesterday, both the S&P 500 and Nasdaq stock indices had hit new highs for the first time in six months or so. Let’s cut right to the chase here. For me, the appropriate response to this news is, “So what?”

Headlines (might) matter

Why so what? Let’s look at what the headlines actually mean. For one thing, the indices mentioned are based on prices only. An actual investor in the indices would be getting dividends, which is a better indicator of new highs and actually happened a couple of days ago—to no headlines. Second, in a rising market, you will see new highs on a regular basis once it catches up to the previous high. All this “new high” means is we did just that. From a fundamental perspective, the rise really doesn’t tell us much.

From a psychological perspective, however, it may—which is why the headlines might matter. Confidence is a key driver of stock values. Anything that pushes confidence higher—like headlines announcing a new high—can act to push stocks even higher.

Confidence matters

You can see this relationship in the market action this year, which has been based almost entirely on better confidence rather than on better fundamentals. The recovery in stock prices has been well in excess of the recovery in expected earnings, pushing valuations up from about 15 times forward earnings at the start of the year to about 18 times currently. Higher valuations mean higher investor confidence—and that is what we have seen.

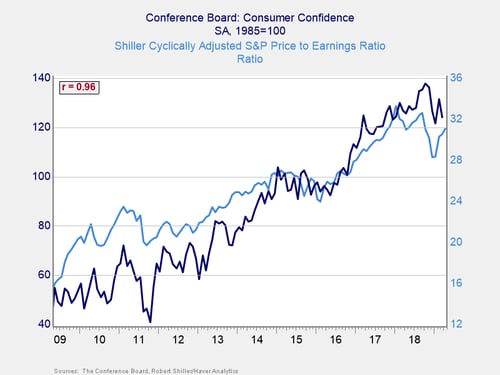

Looked at another way, using the cyclically adjusted (Shiller) valuations, as shown in the chart below, we can see two things. First, a bounce in consumer confidence at the start of this year coincided with the market recovery. Second, we see that correlation not solely in the last quarter. In fact, the correlation between consumer confidence and valuations is almost perfect (at 96 percent) over the past 10 years. Over the past couple of quarters, the pullback and subsequent bounce in confidence were directly reflected in what the market did. In that sense, the markets moving to a new high reflects the rebound in confidence, rather than continued fundamental improvement in corporate profits.

A virtuous circle

This can be a virtuous circle on the way up: higher stock prices boost confidence, which in turn pushes stock prices even higher. That scenario is what we have largely seen over the past couple of years. But it is much more fragile than a fundamentally based rally. As long as confidence is high, things are good. But that can change quickly.

Looking forward, there is a good chance that confidence will remain healthy and keep supporting the market. This strength, combined with earnings coming in better than expected (as they tend to do), is likely to keep the party going. The real takeaway from the headlines is that this high is indeed a positive sign for the future. Markets will likely keep rising for a while.

What will break the circle?

When we look at the reasons why that is, however, we can also see what will break that virtuous circle. Consumer confidence looks to have peaked and has shown it is vulnerable to shocks. Although earnings are beating expectations, those expectations were lowered for a reason. In other words, as good as things are—and they are—the potential to keep getting better is quite possibly eroding. The market can keep rising in the face of that possibility but will eventually react when the possibility turns into reality.

For the moment, however, the news is good. Enjoy it—but not too much.

Print

Print