Since I thought I had covered the most likely outcome of the jobs report in yesterday’s post, I had not planned on writing about it again this morning. Looking at the actual data, though, there are some worthwhile takeaways that deserve a closer look. So, here we are.

Since I thought I had covered the most likely outcome of the jobs report in yesterday’s post, I had not planned on writing about it again this morning. Looking at the actual data, though, there are some worthwhile takeaways that deserve a closer look. So, here we are.

The bad news

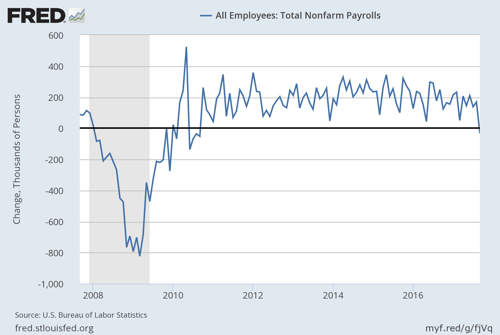

Starting with the headline figure, where the number of jobs actually fell by 33,000, you might be concerned. After all, expectations were for a gain of around 81,000, and this is a big shortfall. Not only that, but the last time we saw a monthly decline in employment was back in September 2010, seven years ago. That sounds bad.

Indeed, this is all true. But the fact of the matter is that those expectations were based on nothing more than hand waving. No one really had a good idea of how much disruption would come from the hurricanes, just that it would be substantial. In fact, the timing—Irma hit Florida during the survey week—may have made it look somewhat worse than it is. Nevertheless, the headline figure could potentially be a concern, if viewed in isolation.

The not-so-bad news

When you look at the other data from the report, however, that weak headline number looks even more like a temporary hit, as the rest of the data is surprisingly strong. The drop in jobs came in large part from restaurants, down 115,000, which is entirely consistent with the storms as a cause. Other areas did much better, with manufacturing down by only 1,000 and private payrolls as a whole down only 40,000. If you remove restaurants from the picture, which are quite volatile anyway, the jobs report does not look bad at all.

The good news

Bigger picture, the news looks even better. The average workweek stayed steady at 34.4 hours, so labor demand held up in areas outside of the storm states. Average hourly earnings rose by 0.5 percent on the month (the highest level since November 2008 and, before that, September 2007) and were up 2.9 percent for the year (the highest since June 2009). Part of this might be from lower-paid workers being more affected by the hurricanes, but this is still a big bump. The unemployment rate dropped to 4.2 percent from 4.4 percent, the lowest level since February 2001. Plus, the underemployment rate dropped from 8.6 percent to 8.3 percent, the lowest level since June 2007. All of the bigger picture news is good—and surprisingly so. Despite the hurricanes, the broad trends are quite strong.

Keeping an eye on underlying trends

Of course, it’s important to keep in mind that one month of data is just one month. The provision that the hurricanes are distorting the data applies just as strongly to good news as to bad. So, let’s not cheer too loudly. At the same time, we would have expected all of these data points to move the other way from the hurricanes. The fact that they were all pretty good, rather than bad, could well be a significant indicator that labor market strength continues.

As we approach the end of the cycle, job creation is a key indicator, and one we have to watch closely. One of the reasons I am paying so much attention to this report is not the headline, which is due to the storms and nothing to worry about, but the underlying trends, which tell a different story than expected. That difference, which is positive, suggests that we could conceivably see more acceleration in the economy.

Print

Print