One question I get a lot is whether the market is overvalued. Or, to put the concern the way my son would, is the market crazy expensive? All year, even as the market continued to rise, many people called out high valuations. Now that the market has pulled back, at least for the moment, fears are rising that we may see valuations collapse—and the market with them. Should we be worried?

One question I get a lot is whether the market is overvalued. Or, to put the concern the way my son would, is the market crazy expensive? All year, even as the market continued to rise, many people called out high valuations. Now that the market has pulled back, at least for the moment, fears are rising that we may see valuations collapse—and the market with them. Should we be worried?

Context for Market Valuation

First, as always, let’s establish some context. What are stock valuations? One common way to express them is to look at how many years of company earnings the stock’s price represents. For example, if a company earned $10 in a year and the stock price was $100, the P/E ratio would be 100/10, or 10. The higher the P/E ratio, the more expensive the stock is, based on its earnings. We can do the same calculation with the stock market. If we combine all company earnings and divide the total by their combined stock prices, the result is what is typically meant by a market valuation level.

What Average Earnings Tell Us

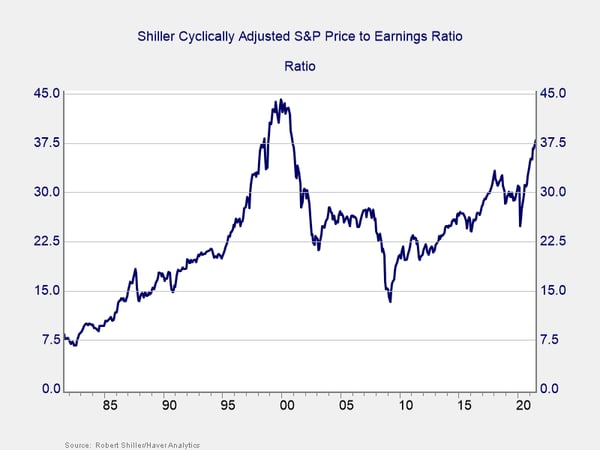

Part of the problem with doing this, though, is that earnings change from year to year. Any one year may not be representative—as, say, 2008 or 2020 was not. A common way to account for this factor is to use average earnings over a period of time. Robert Shiller, a Nobel Prize–winning economist, is famous for running this calculation with a 10-year earnings average, which smooths out the effects of any one abnormal year. The Shiller P/E is shown in the following chart:

This chart gives us the context we need to determine whether current valuations are high. Looking at history, we can see a couple of things. First, stocks are now as expensive as they have ever been—with the exception of the dot-com boom. Stocks are much more expensive than they were before the pandemic and much more expensive than before the Great Financial Crisis. Based on history, there is no question that stocks are extremely expensive.

Case Closed?

Does this mean case closed? Not at all. Because the next thing we can see is that stock valuations have been steadily increasing for the past 40 years. Yes, there have been ups and downs, but the clear trend is up. So, we have to consider the possibility that some factor is driving those valuations up. And there is. Stock prices are usually understood as the discounted value of future earnings. This means that as interest rates decline, those values go up. In other words, if interest rates go down, stock valuations go up. And what we have seen over the past 40 years? There has been a steady drop in interest rates—and a corresponding rise in valuations. This correspondence is not the whole answer to current valuations, but it looks to be a big part of it.

Rational Pricing?

Furthermore, this answer is consistent with what we have seen since the Great Financial Crisis, especially when looking at data since the start of the pandemic. During the recovery from the start of the pandemic, valuations rose to reflect the drop in interest rates. After that, valuations stayed fairly constant, with stock prices fluctuating with earnings expectations. In other words, the interest rates set the range of valuations, and then stocks adjusted within that range to reflect earnings. So, although valuations are high, they do seem to reflect rational behavior on the part of investors.

3 Potential Answers

So, how do we answer the question of whether the market is crazy expensive? We have three ways to get there. Based on history, the answer is yes. Based on current interest rates, the market looks reasonably priced—not cheap, but certainly within a reasonable range. Finally, based on market behavior, we can see rational pricing. As I see it, history does not look to be a good guide to our answer, especially given the multidecade trend of rising valuations. On balance, the right answer seems to be that the market is reasonably priced.

Could this environment change? Of course. If interest rates rise sustainably, we would see valuations adjust down, just as we saw them rise. Any changes in interest rates made by the Fed—remember the potential taper tantrum?—could have the same effect. Earnings fluctuation could hit stock prices, although not necessarily valuations. In other words, even if valuations are reasonable, we might still experience market volatility—even substantial volatility.

But if valuations are reasonable, the downside will (hopefully) be limited. Since 2014, the low in valuations has been around 24x, instead of the much lower valuations we saw in previous downturns. Having the interest rate valuation support doesn’t mean markets can’t fall. But, in the past, this support has provided a cushion for the markets. Understanding that should help cushion market worries.

Print

Print