Normally, I don’t spend my time watching the markets move. But this morning, I did have one chart open: the interest rate on the U.S. Treasury 10-year. In the past couple of days, the rate has risen. The question is, will it actually get to 3 percent? If so, what will that mean?

Normally, I don’t spend my time watching the markets move. But this morning, I did have one chart open: the interest rate on the U.S. Treasury 10-year. In the past couple of days, the rate has risen. The question is, will it actually get to 3 percent? If so, what will that mean?

Well, it did. The rate crept up to 3.001 percent, before dropping back down (as I write this) to 2.986 percent. You might think that the difference—of 0.015 percent (i.e., 15 parts out of 10,000)—is insignificant. In a mathematical sense, you would be right. Markets don’t just run on math, though, so it may matter more than it would seem.

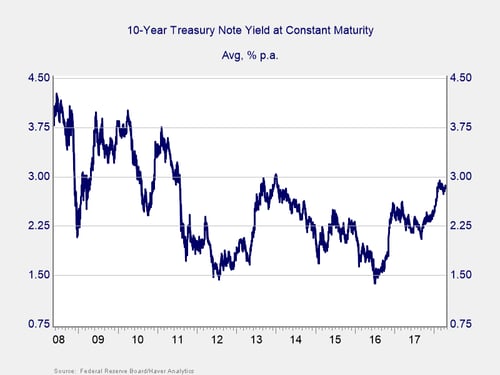

Let’s take a step back and look at the context here. The last time we saw the 10-year crack a yield of 3 percent was in December 2013; as you can see from the chart above, it didn’t last long. The last time we saw rates higher for any length of time was in 2010–2011, but the Greek crisis led to further central bank policy action that took rates back down and kept them there. For rates to move back above 3 percent returns us to a much more restrictive monetary policy environment, one we last saw before the Greek crisis.

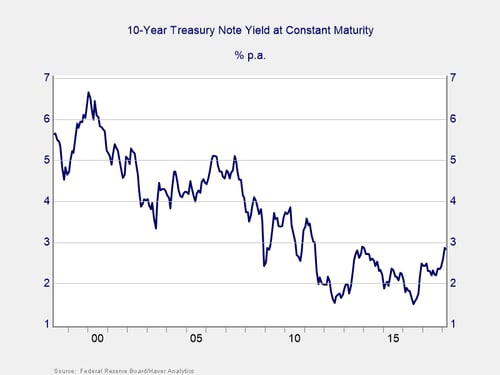

On a longer-term basis, we can also see that moving above 3 percent starts to take us closer to a normal monetary policy. Even after the crisis, rates more or less held to a 3-percent floor. Yes, there were periods when they dropped lower, but they kept bouncing back up. Until 2011, that is, when the European crisis led to even more central bank quantitative easing. Since then, we have been in a central bank-dominated interest rate environment. The question is whether that is really changing. A sustained move back above 3 percent would indicate it is.

As of right now, while the U.S. Federal Reserve is slowly tightening monetary policy, other central banks, including Europe and Japan, are still quite loose. If—and I emphasize if—rates move back up, it will mean that despite that loose policy abroad, rates are still normalizing here. From an economic point of view, that suggests U.S. rates are decoupling from global rates and that here, at least, we are back into a more normal—and more restrictive—interest rate world.

Will rates keep rising?

There are two primary reasons this could, and is likely to, happen. First and foremost is the fact that the Fed is raising rates at the short end, which is likely to continue to and should push rates up for longer terms as well. Second is the massive increase in the U.S. deficit, which will push rates higher as an increased supply of bonds meets stable demand across all time frames. Both are very likely to keep going, meaning rates will keep rising. If the European Central Bank decides at some point to tighten policy, that could accelerate the process. Either way, rates are likely to keep moving higher—although not necessarily immediately.

An economic headwind

Breaking the 3-percent level would be a signal that this is really happening, and happening now. This could change investor perceptions. Low interest rates are a big part of the reason that current stock market valuations make sense, so higher rates would call that into question. Higher rates will also significantly affect company profitability over time, as companies are forced to roll over existing debt at higher rates. With both sides of the equation getting hit, this would be a major headwind for the stock market. At the economic level, higher rates will also hit the U.S. government budget directly, pushing debt service costs up. This will, over time, become the same kind of headwind for the economy as a whole.

Time to pay attention

Whether rates tick above 3 percent or not is, therefore, not a matter of a small number but of many big ones. More important, it is the story that the financial markets tell themselves. In a low-rate environment, the lessons of the past several years continue to hold. If rates are moving up, though, everything will need a fresh look—and will likely be considerably less favorable.

And that’s why I am watching my screen. We are not there yet, but this is one more thing that requires attention.

Print

Print