I suspect that many of us are worried about the stock market. I certainly am, but what else is new? That’s why they call me Eeyore. But worrying by itself doesn’t do any good. What is important is to figure out how to worry effectively. That is, by identifying the real signs of trouble, you can focus on those and not worry until there really is something to worry about. I think we could all use a refresher on how to do this.

I suspect that many of us are worried about the stock market. I certainly am, but what else is new? That’s why they call me Eeyore. But worrying by itself doesn’t do any good. What is important is to figure out how to worry effectively. That is, by identifying the real signs of trouble, you can focus on those and not worry until there really is something to worry about. I think we could all use a refresher on how to do this.

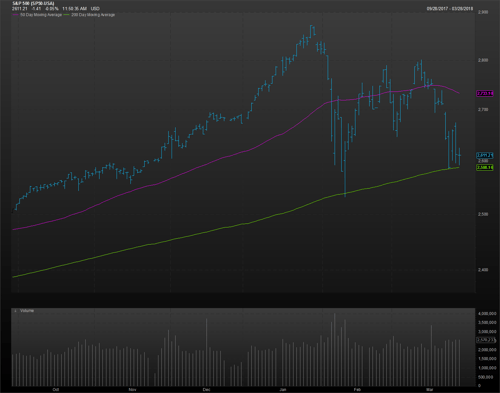

200-day moving average

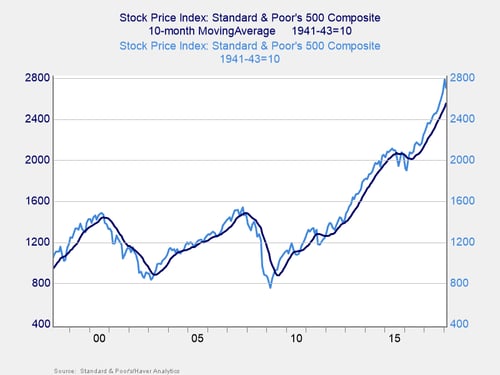

In particular, I want to look at the 200-day moving average as a sign of when to worry. In recent days, there has been some media coverage around how the market is on the verge of breaking through this trend line. Depending on the venue, you’ll get more or less hysteria about what that might mean. Indeed, the 200-day trend line is certainly worth paying attention to. It is not, however, a sign of an impending crash, as we will see.

In the chart above, the light blue line is the S&P 500 and the dark blue line is the 200-day moving average. (The latter is shown as the 10-month moving average, but they are essentially the same thing.) You can see that in 2000 and 2007, the market dropped below the 200-day trend line and much larger drops followed. This is why I keep an eye on it as a place to start paying attention. It is also what the more hysterical media tend to highlight.

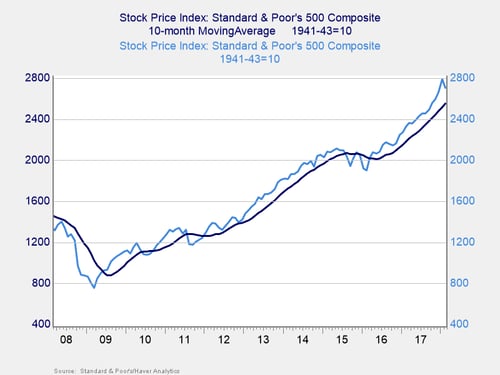

You can also see, however, that in 1998, 2004, and 2015–2016, the market dropped below the trend line, only to bounce back and head higher. Breaking the trend line is a warning sign. But it is nothing more than that, as it is prone to false alarms. That is why I pay attention—but don’t react immediately—when the market drops below that line.

Note also that you can see how the 200-day trend line acts as a support line, with the market bouncing off it repeatedly when it gets close. So, just as it can act as a warning sign, it can also be a source of market support.

In fact, if we look at the most recent data, we can see the S&P 500 bouncing off the 200-day trend line a couple of times in the past weeks, showing just that behavior. For all the worry, the market has not actually broken down.

What do I take away from all of this? The market is at a level where further downturns are quite possible but not yet at a point that suggests a major downturn is underway. Drops below the trend line took place in 2011 and 2015–2016 and lasted for a while, only to recover. We are not there yet.

The strength of the fundamentals

The difference between deeper and longer downturns and those that are shorter is primarily the strength of the fundamentals. Here in the U.S., confidence and employment remain high, while the recent tax cuts and governmental spending increases should help ensure that growth remains healthy. Under such conditions, pullbacks have tended to be short lived.

Still, we are not completely out of the woods. Even if pullbacks are short, they can be sharp. We saw that in early 2016, in 2011, and on multiple other occasions (most notably, 1987). In all of these cases, though, a sharp drop in the markets was followed by a rapid recovery, as the economy remained healthy.

Pay attention, not time to panic

As investors, we are not in the worry zone, although we are getting there. Even when we do move below the trend line (if we do), it will still not be time to panic. Real market troubles tend to come when the economy starts to roll over, in conjunction with market weakness. While we are having some market weakness now—and it might get worse—the economic fundamentals remain solid. That should help limit both the scope and the duration of any pullback.

As always, I will be doing a monthly economic and market risk update. This is just a guide to how we should be thinking about the recent market activity. It is certainly worth paying attention to—but not worth panicking about, yet.

Print

Print