The pandemic remains under control at the national level, and the case growth rate remains below recent peaks. Still, the medical news continues to get worse, as this past week has seen case growth continue to rise on a seven-day average basis. While some of this rise may be due to increased testing, most looks to be owing to widening outbreaks in many states. In fact, case growth in many states is starting to approach levels that could threaten the health care systems there, indicating this is a growing problem.

The pandemic remains under control at the national level, and the case growth rate remains below recent peaks. Still, the medical news continues to get worse, as this past week has seen case growth continue to rise on a seven-day average basis. While some of this rise may be due to increased testing, most looks to be owing to widening outbreaks in many states. In fact, case growth in many states is starting to approach levels that could threaten the health care systems there, indicating this is a growing problem.

While the medical risks are rising, the economic recovery continues to move forward. Consumer confidence and spending, an area of concern, have shown better data, which is encouraging. Financial markets have also ticked back up, although recent volatility suggests risks remain. Let’s take a look at the details.

Pandemic Growth Rate Continues to Rise

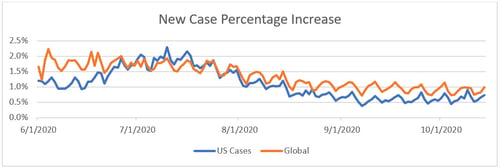

Growth rate. At the national level, as of October 14, the daily spread rate was 0.7 percent per day, the same as the previous week. But during the week, the average growth level was higher. The upward variability in the spread rate suggests that the faster outbreaks in a number of states are showing in the national data, indicating that state-level risks are now becoming material.

Source: Data from worldometer.com

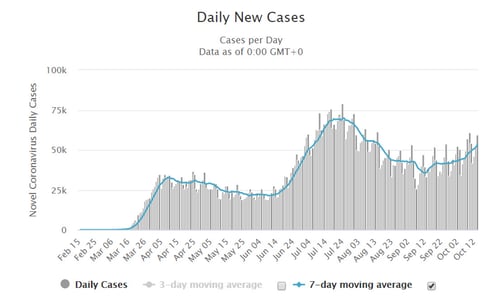

New cases per day. The most obvious metric for tracking the virus is daily new cases. Here, we see more signs that widening state-level outbreaks have continued to increase viral spread. The seven-day average number of new cases per day rose from just over 45,600 per day last week to just over 53,100 per day, a faster increase than the previous week. This is the fourth week in a row we have seen an increase, and the rate of increase is growing. The new case rate is now back to levels seen in mid-August, a reversal of the improvement seen in previous weeks. This is a sign of rising risks and, along with the faster state-level outbreaks, will need to be watched closely.

Source: https://www.worldometers.info/coronavirus/country/us/

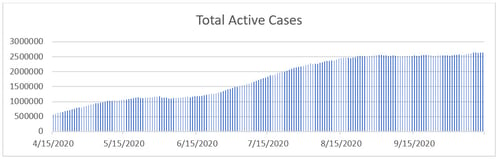

Total active cases. As the number of new cases has continued to rise, the number of active cases has also started to increase again after a period of stability. This is a bad sign, as new infections are now outpacing recoveries for the first time in several weeks. Using the active cases as a base to measure growth also indicates that the acceleration in the daily growth rate is faster—up from 2.1 percent last week to 2.3 percent this week—suggesting that active cases are also at risk.

Source: Data from worldometer.com

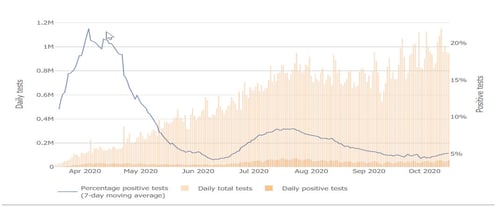

Testing data. The testing news was better, as the number of tests has continued to trend up, although it remains quite variable. As testing levels continue to increase, we look to be getting closer to adequate levels. That said, the positive testing rate has also been increasing. It just ticked back above the recommended maximum of 5 percent for the first time since late September, suggesting that the pace of increasing infections is starting to outrun testing capacity again. While some of the increase in cases may come from better visibility from increased testing, the rising positive rate suggests the growth in cases is more likely due to a widening range of infection growth.

Source: Johns Hopkins University

The bottom line is that on the medical front, the trends are moving in the wrong direction. At the state level, there are outbreak hotspots that are now starting to look like health emergencies as we saw at the height of the previous two waves, and concerns are growing in other states. While we still largely have the virus under control at the national level, the state-level outbreaks are now driving the national statistics, and national risk levels are now at the highest level since July.

Looking forward, the question is whether current conditions will continue into the fall. Some of the current increases are likely due to the reopening of school districts and universities. Given the lags between infection and detection, we may still have a couple of weeks to go before the full effect will be seen, but we might then see it fade. That outcome is far from certain though. Similarly, some of the increase is likely due to more testing—but not all of it. Overall, the risk of a third wave is rising and will be something we need to watch.

Positive Signs in the Economic Recovery

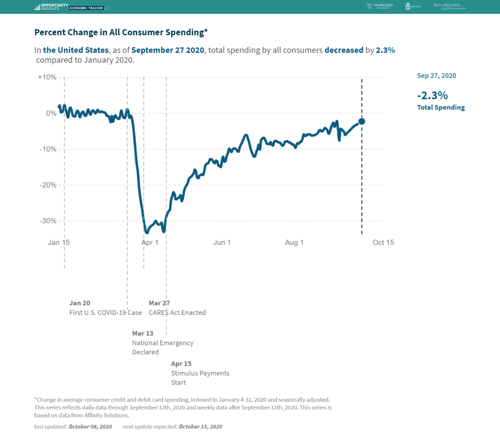

Consumer economy. While the medical risks are rising, the economic news has shown signs of improvement. The job market continues to show slower improvement, but the effects on consumer confidence and spending are becoming less apparent. Consumer confidence has bounced off of post-pandemic lows, and consumer spending has returned to a positive trend, after signs of a reversal. While this metric remains something to watch, it does suggest the effect of the expiration of expanded federal unemployment benefits may not slow the recovery as much as feared. It also suggests the economy is more resilient to the slowing job market than had been feared.

Source: https://tracktherecovery.org/

Business sector. On top of the signs of improvement in the consumer economy, the business sector continues to do well. Business confidence and investment are largely back to pre-pandemic levels, and specific higher-frequency indicators are also showing improvement in many cases.

The real question, going forward, is how durable this recovery is. Much of the recovery so far has been based on the spending power generated by the federal supplemental income support. But recent data shows that the recovery is continuing even after that has stopped. The resilience in the face of the medical and stimulus headwinds suggests the recovery will likely be durable.

Big picture, there are risks out there, especially on the medical side. But there are also opportunities. There is a real possibility the economic recovery could accelerate again if the medical risks subside, for example, or if another federal income support program is passed. While there are certainly headwinds, so far at least, confidence and spending are still holding up, and the recovery is still moving forward.

More Turbulence for Financial Markets

Financial markets rallied for the first two weeks of the month on the better economic news and hopes that the medical risks were under control. In the past week, however, those hopes have pulled back on fears that risks were more significant than had been assumed. Given everything that is going on, those fears seem reasonable, which suggests we might see more volatility ahead. That said, the fact that the economic risks remain under control, despite the rising medical concerns, should continue to provide some support.

Risks Trending Up

The news this week is that medical risks are rising, especially at the state levels. Although the pandemic remains under control at a national level, that status is increasingly under threat. With the data so far showing signs of rising risk and with growing outbreaks in multiple states, the risks are clearly trending up. These risks will need to be watched.

The economic risks are also real. Despite recent positive news, we do see some slowing in the recovery. That said, there are also opportunities here, and the fact is that the economy continues to outperform expectations. Finally, markets continue to be turbulent as investors process the different risks, and more volatility is quite possible. But, as of now, the economic recovery continues, and that should continue to support the markets.

Given all of this, over the next couple of weeks the most likely case appears to be further deterioration of the medical news, as well as continued slow improvement on the economic front. There are certainly risks coming into focus, and we need to be aware of them. But for the moment, those risks remain under control.

Print

Print