We are getting close to the decision point on whether large parts of the government will shut down again. Much of our discussion on the first shutdown still applies—the direct economic damage will be real but limited. As we look seriously at a repeat, though, we need to spend some time thinking about the indirect damage. If shutdowns become a regular feature of government, then the effect will be linear but could also rise substantially.

We are getting close to the decision point on whether large parts of the government will shut down again. Much of our discussion on the first shutdown still applies—the direct economic damage will be real but limited. As we look seriously at a repeat, though, we need to spend some time thinking about the indirect damage. If shutdowns become a regular feature of government, then the effect will be linear but could also rise substantially.

No common ground

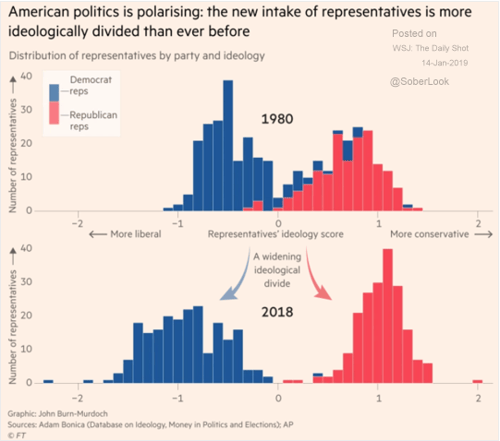

Indeed, there is reason to believe that shutdowns will become more common. The chart below shows that, ideologically, Congress has become significantly disconnected. In 1980, there was a strong central overlap between parties, which provided common ground to cut a deal. Now, there is little or no overlap. The parties simply don’t have any common ground to work from, which makes it harder to come to meaningful compromises—as we have seen.

Tick, tock

If Congress can’t come to an agreement, we will see more frequent and longer shutdowns. It also raises the risks substantially when issues arise where a deal needs to be made. This scenario will occur at the end of next month, on March 29, when the debt ceiling takes effect. At that point, the U.S. government will essentially run out of money, again. A deal will be needed to keep the entire structure operating, including things like paying social security, the military, and bond interest. The problem won’t be immediate. But the clock will start ticking.

If the government shuts down again, of course, this will complicate the debt ceiling negotiations. Beyond that, an inability to cut a deal over the border wall will certainly signal bigger problems ahead. If we get another shutdown, that will be a very bad sign for more trouble in the immediate future.

Indirect effects

Even if we do get a deal, this political disruption is already having significant indirect economic effects, most visibly in consumer confidence.

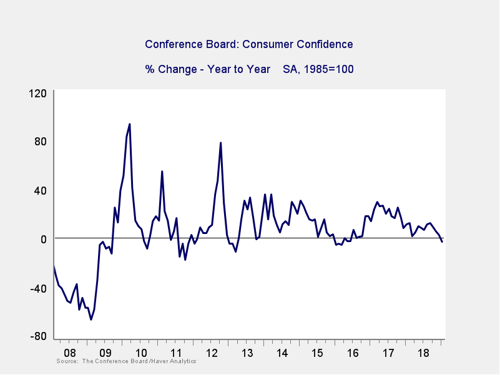

Consumer confidence. Confidence has dropped substantially over the past couple of months. This decline is due at least in part to the shutdown, although the stock market drop no doubt played a part as well. If we get another shutdown, assuming the market recovery continues, we will find out just how big a role the shutdown played.

What seems to be the case right now is that confidence was damaged—and that damage is likely to persist. This matters for several reasons. First, when confidence declines by 20 points year-on-year, it is usually a signal of a recession. The recent decline took us closer to that point than we have been in years. We will need to watch whether it recovers over the next couple of months or whether another shutdown takes it down further into the risk zone.

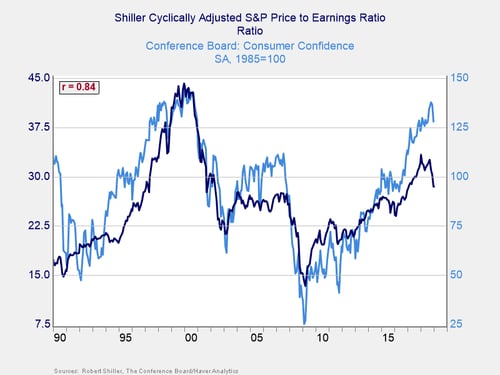

Stock market valuations. More significant for investors, lower consumer confidence has also been strongly correlated with stock market valuations. As you can see in the chart below, the correlation is 0.84, which is quite high for economic data, and the visual correlation is strong as well. With the recent downturn in confidence, the risks to stock prices have clearly risen.

What to watch for

When we look at the prospect of another shutdown, then, we need to focus less on the direct economic damage (which is real but relatively minor) and more on the indirect consequences (which could be much more material) both to the economy as a whole and to our investments. What I will be watching is whether Congress can cut a deal and whether the White House will sign it. That will be a key indicator as to how much we need to worry about the pending debt ceiling. If that debate can’t be settled, then the risks to our investments will rise materially.

Print

Print