Brad here. Today, Rob Swanke, an analyst with Commonwealth’s Investment Management and Research team, takes a look at the benefits and the risks of preferred stock as a source of yield in a portfolio. Over to you, Rob.

Brad here. Today, Rob Swanke, an analyst with Commonwealth’s Investment Management and Research team, takes a look at the benefits and the risks of preferred stock as a source of yield in a portfolio. Over to you, Rob.

Interest rates have been falling since March. As a result, many have started to ask, “Where can I turn to generate income from my portfolio?” The Fed moved short-term rates to nearly zero, so money markets and CDs are producing almost no income. The Fed also implemented an unlimited quantitative easing program that has helped bring 10-year Treasury yields well below 1 percent. For those who rely on their portfolios for income, these low rates will likely leave them short of their goals.

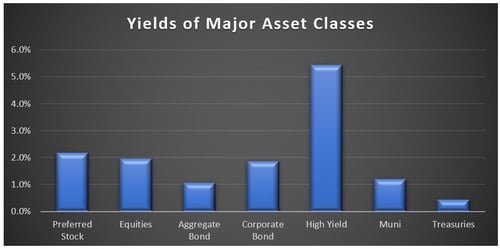

To generate some additional yield, higher-risk securities can be added to a portfolio, in a manner consistent with the investor’s risk tolerance. For many investors, this means investing in corporate bonds; however, most investment-grade corporate bonds are producing yields less than 2 percent. Moving into high-yield investments will certainly provide a yield boost, but the risk associated with these investments increases significantly compared with investment-grade bonds.

Preferred stock as an alternative yield source

Preferred stocks are a hybrid between bonds and equities and can be an alternative to high-yield securities. While preferred stocks are still a higher-risk investment than traditional investment-grade corporate bonds, adding a small amount of preferred stock to a portfolio can diversify the investments and increase the portfolio’s yield.

As you can see in the chart below, as of July 31, preferred stock is the second-highest-yielding asset class. While it may not seem like a big jump from corporate bonds, many investment grade-rated preferred stocks are still yielding in excess of 3 percent, with some above 4 percent. Some preferred stocks pay qualified dividends too, providing a benefit over traditional fixed income for taxable investors.

Source: ICE, Bloomberg (as of July 31, 2020), Bloomberg Barclays, J.P. Morgan, ICE BofA Data Indices, LLC, FactSet, and LCD, an offering of S&P Global Maret Intelligence. Representative indices: preferred stock (ICE BofA Fixed Rate Preferred Index); equities (S&P 500); aggregate bond (Bloomberg Barclays U.S. Aggregate Bond Index); corporate bond (Bloomberg Barclays U.S. Corporate Investment Grade Index); high-yield (ICE BofA U.S. High Yield Index); muni (Bloomberg Barclays Municipal Bond Index); Treasuries (Bloomberg Barclays U.S. Treasury Index).

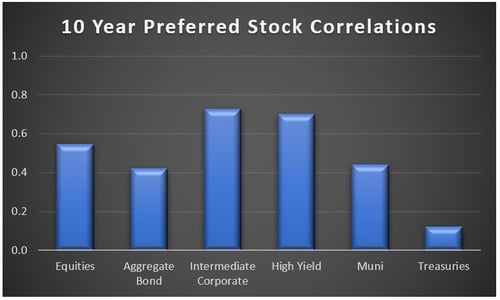

Another benefit of preferred stocks is that they have somewhat low correlations with a number of traditional investments (see chart below), which can help improve the risk/return profile of a portfolio. The lower the correlation, the higher the diversification benefits (with 1 being the highest correlation and anything below 1 providing some diversification benefit).

Source: Morningstar Direct (as of July 31, 2020). Representative indices: equities (S&P 500); aggregate bond (Bloomberg Barclays U.S. Aggregate Bond Index); intermediate corporate (Bloomberg Barclays Intermediate Corporate Index); high yield (Bloomberg Barclays U.S. Corporate High Yield Index); muni (Bloomberg Barclays Municipal Bond Index); Treasuries (Bloomberg Barclays U.S. Treasury 7-10 Year Index); Preferred stock (ICE BofA Fixed Rate Preferred Index).

What are the risks?

While preferred stocks are typically less risky than high-yield securities, they do come with some additional risks compared with investment-grade corporate bonds. The biggest risk for any corporate bond holder is a bankruptcy. The same holds true for preferred stock. While most companies that issue preferred stock are rated investment grade and go bankrupt at the same relatively low rate, when there is a bankruptcy, holders of preferred stock will lose much more of their principal and possibly all of their investment.

The second major risk with preferred stocks, just as with most traditional bonds, is rising interest rates. Preferred stocks are especially sensitive to rising interest rates due to their long maturities. On the other hand, when interest rates fall, most traditional bonds rise in price, but preferred stock may not benefit much. This is because preferred stock issuers can call away the bond at a certain price and refinance its debt, similar to a mortgage holder refinancing when rates move lower.

This may seem like a “heads I win, tails you lose” scenario. But if interest rates stay close to where they are, preferred stocks will be earning a much higher interest rate than similar securities. This can be very beneficial in a scenario where interest rates may remain low for some time. Also, if rates do rise because of an improving economy, the lower risk of a bankruptcy may offset some of the pain from rising rates. Some preferred stocks may even pay a variable interest rate, so the interest rate a preferred stock is paying could rise if rates are rising in general.

Adding preferred stock to a portfolio

When adding preferred stock to a portfolio, there are a couple of key decisions that must be made. Preferred stock can be purchased directly, through an ETF, or through an actively managed mutual fund. Each option has some benefits and drawbacks.

A passive ETF will provide diversification across the asset class; however, since the companies that issue preferred stock are mainly banks, utilities, and REITs, the investor would still be holding a concentrated investment. Buying preferred stock directly can help tailor a portfolio to an individual’s risk tolerance by choosing higher-rated issues or those with variable interest rates, although there will be less diversification. Actively managed mutual funds can use their expertise to analyze and attempt to lower the risk of a bankruptcy or changes in interest rates, but this will require paying a higher fee than the other two options.

A boost to yield

In the end, preferred stocks have several risks and may not be right for every investor. But a small investment in preferred stock can help boost the yield of a portfolio in a low-interest-rate environment while also providing some diversification.

Print

Print