Over the past week, the news on the medical front has been mixed. The pandemic remains under control, and the case growth rate remains low. But case growth has started to slowly increase again, as post-Labor Day infections begin to register and as schools and universities reopen.

Over the past week, the news on the medical front has been mixed. The pandemic remains under control, and the case growth rate remains low. But case growth has started to slowly increase again, as post-Labor Day infections begin to register and as schools and universities reopen.

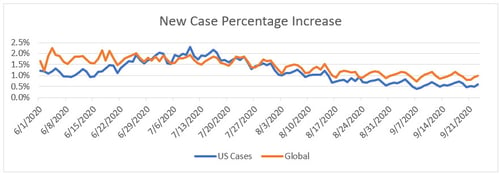

At the national level, as of September 23, the daily spread rate is 0.6 percent per day, the same as the previous week. The seven-day average of the daily number of new cases was up to just over 41,000, from just over 39,000 last week. While case growth remains well below July and August levels, the continued improvement has paused, and we are back at the levels of early September. The increase is still fairly small, but it is a clear sign that risks remain over the next couple of weeks.

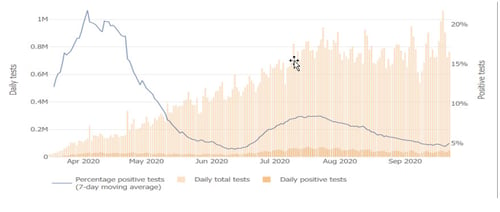

The testing news was better. The number of tests has started to trend up again, although it remains quite variable. If testing levels continue to increase, we should get closer to adequate levels soon. Even at current levels—with the drop in new and active cases and the fact that the positive testing rate has continued to decline and is now around the recommended 5 percent—it seems we are getting close to the testing level sufficient at the moment to keep the virus under control.

Beyond the headline numbers, state-level data is generally good, although concerns remain about a number of states where infection rates are rising. Overall, the national risks remain under control.

With the medical risks contained, the economic recovery also remains on track, albeit with some areas of concern. One worth watching is consumer confidence and spending. Financial markets continue to show turbulence, as investors process the headlines. Let’s take a look at the details.

Pandemic Growth Rate Remains Low

Growth rate. The daily case growth rate stayed steady last week, ending the reporting period at 0.6 percent per day, the same as the previous week. The stability in the spread rate suggests that the medical effects of the Labor Day gatherings, as well as school and university reopenings, may be smaller than had been feared. Even with those effects, this is still very close to the lowest growth rate so far in the pandemic and leaves the infection curve flat at a national level, with low risk to health care systems.

Source: Data from worldometer.com

Positive test results. As the case growth rate has stayed steady, testing has started to trend up again, although it remains variable. The positive rate on tests remains around 5 percent, which is close to an acceptable level. If we look at the percentage of each day’s tests that are positive, lower numbers are better, as we want to be testing everyone and not just those who are obviously sick. The World Health Organization recommends a target of 5 percent or lower, which we are getting close to achieving again. If the case growth rate remains low, the pandemic spread may be approaching the level where current testing is adequate.

Source: Johns Hopkins University

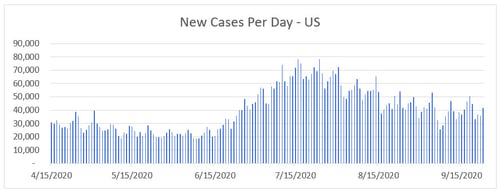

New cases per day. The most obvious metric for tracking the virus is daily new cases. Here, we see more signs that Labor Day gatherings, as well as school and university reopenings, may have increased viral spread, but only slightly. The seven-day average number of new cases per day rose from just over 39,000 per day last week to just over 41,000 per day. This is a reversal of the improvement seen in previous weeks and will need to be watched. But it is well below August levels and has been steady for the past week.

Source: Data from worldometer.com

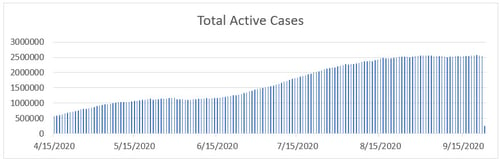

Total active cases. A positive development is that as the number of new cases has slowed, the number of active cases has stabilized and even shown signs of declining. If case growth remains stable, new infections will continue to lag recoveries and the number of active cases would continue to decline, which would be a very positive sign.

Source: Data from worldometer.com

Overall, the pandemic is under control at the national level. But improvement has paused, and there are some signs of increased viral spread. At the state level, the health emergencies have largely passed, although concerns remain in a growing number of states. The good news here is that policy and behavioral changes have taken effect, as they did in the first wave, and that while risks are rising, we still largely have the virus under control.

Looking forward, the question is whether the improvement will continue into the fall. As noted above, the recent Labor Day gatherings, combined with the ongoing reopening of school districts and universities, may well have increased the infection rate based on the most recent data. Given the lags between infection and detection, we still have several weeks to go before the full effect will be seen, so the risks remain material. These will be something we need to watch.

Economic Recovery May Be Slowing

Jobs market. The economic news is also showing signs of weakness. While the recovery continues, there are signs of slowing. These signs include the fact that the most recent initial jobless claims reports did not decline from the prior week and that the improvement in the continuing unemployment claims has slowed. Improvement in the jobs market has been a relative bright spot, so these are negative developments.

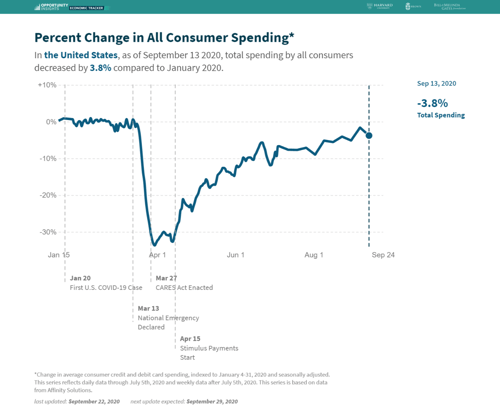

Consumer spending. On the positive side, consumer spending has continued to trend upward, although there was a pullback in the past week. The positive trend also appears to be slowing, which would be consistent with the weaker employment data and consumer confidence. Much of the decline in both confidence and spending appears to come from lower-income workers, where the jobs recovery has been particularly weak and who are most affected by the expiration of federal income support payments. This metric remains something to watch.

Source: https://tracktherecovery.org/

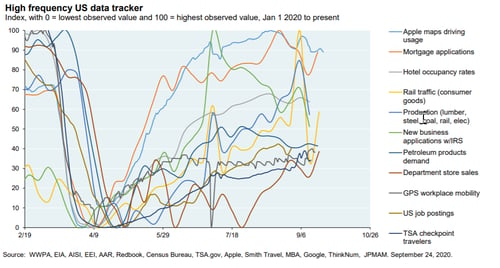

Business sector. Even as there are signs of weakness in the consumer economy, the business sector continues to do well. Business confidence and investment are largely back to pre-pandemic levels, and specific higher-frequency indicators are also showing improvement in many cases, as we can see in this composite of many indicators from J. P. Morgan.

Source: J. P. Morgan

The big picture is that the recovery is still on track but that consumer spending, at more than two-thirds of the economy, may be weakening. While this weakness is offset by strong business sentiment, it will bear watching.

Financial Markets Show More Turbulence

Financial markets continued to bounce around last week, with more turbulence on growing worries about rising medical risks, as well as just how durable the economic recovery was. Given the data we reviewed above, those doubts seem reasonable, which suggests we might see more volatility ahead. That said, the fact that both the medical and economic risks are still relatively low should continue to provide support.

Keep an Eye on the Data

The real news this week is that the pandemic remains under control, although medical risks are starting to rise again. The effects of the Labor Day exposures and school reopenings are starting to appear in the data, and we have a couple of more weeks to go until the full effects will be apparent. While the data so far is encouraging, it will need to be watched.

The economic risks are also real, and we do see some slowing in the recovery. That will also need to be watched, especially if the medical risks rise. At the moment the recovery continues, and there is a real possibility it accelerates again if the medical risks remain constrained or, especially, if another federal income support program is passed. The risks are real, but so are the opportunities.

Finally, markets continue to be turbulent as investors process the different risks, and more volatility is quite possible. But the fact that, as of now, the medical risks remain contained and that the economic recovery continues should provide support.

Given all of this, over the next couple of weeks the most likely case appears to be some deterioration of the medical news, although likely to a limited degree, and continued slow improvement on the economic front. There are certainly risks coming into focus, and we need to be aware of them. But for the moment, the news remains good.

Print

Print