As expected, we saw a pullback in many coronavirus indicators over the Christmas holidays. But also as expected, the data has bounced back, indicating that the drop was due to slower reporting rather than an actual decline in cases. Looking forward, we still have another couple of weeks where infections due to holiday travel will show up in the data, and there are signs that is starting to occur. The next two weeks are likely to show continued case growth. While some sections of the country are showing improvements, we are not through this wave yet.

As expected, we saw a pullback in many coronavirus indicators over the Christmas holidays. But also as expected, the data has bounced back, indicating that the drop was due to slower reporting rather than an actual decline in cases. Looking forward, we still have another couple of weeks where infections due to holiday travel will show up in the data, and there are signs that is starting to occur. The next two weeks are likely to show continued case growth. While some sections of the country are showing improvements, we are not through this wave yet.

That said, there are signs of improvement. Vaccinations have now started. Although the headlines are about how slow the process has been, the situation will improve over the next couple of weeks. As the vaccinated population grows along with the population of people who have been exposed to the virus, that should also help reduce infection rates. We are getting close to the worst of it. After that point, more improvement should come steadily.

The economic news also continued to deteriorate, but here too we saw positive signs. Confidence and spending were down as lockdowns widened around the country. On the positive side, the federal government has now passed a stimulus program that should help support the economy over the next couple of months. And with the new administration, more stimulus is likely.

While the current headlines continue to be bad, there are signs of improvement and reasons to believe we are close to the bottom. That seems to be what markets are thinking, as a combination of slowly decreasing medical risks and economic resiliency has kept them close to all-time highs in the past weeks. Let’s take a look at the details.

Christmas Travel Cases Showing Up in the Data

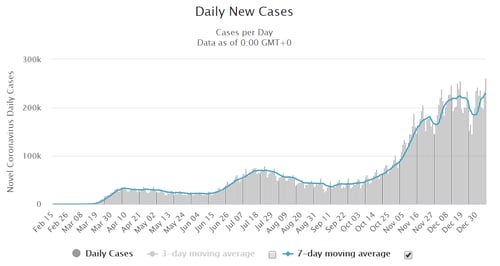

New cases per day. The most obvious metric for tracking the virus is daily new cases. We saw a data distortion lull in the aftermath of the Christmas holiday, as we did with Thanksgiving, with the drop due to slower data reporting. Now, however, case growth has moved back up to new highs as the holiday travel surge shows up, and this trend is likely to continue over the next couple of weeks. While the lockdowns in many states are working, at a national level, the third wave continues.

New daily infection rates were 260,973 on January 6, up from 235,131 a week earlier. The seven-day average number of new cases per day was 228,891, up from 185,419 a week ago, reflecting the drop in reported cases over Christmas. While case growth remains high, the good news is that the rate of increase may have slowed. If this trend continues, we could see the third wave peak in the next couple of weeks, once the post-holiday surge fades.

Source: https://www.worldometers.info/coronavirus/country/us/

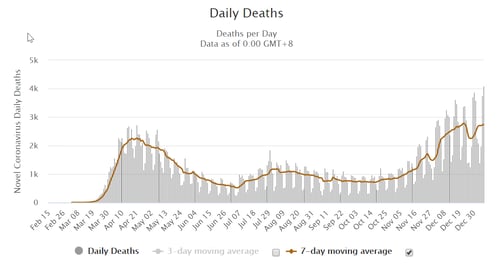

Death rate. The death rate reporting is also showing the same trends. This is a lagging indicator and runs six to eight weeks behind case growth. As such, recent increases in the death rate reflect infection growth in late November. On a seven-day moving average basis, daily deaths were at 2,702 as of January 6, up from 2,365 in the prior week. As the number of new cases has spiked since Christmas, we can reasonably expect death rates to increase substantially over the coming weeks.

Source: https://www.worldometers.info/coronavirus/country/us/

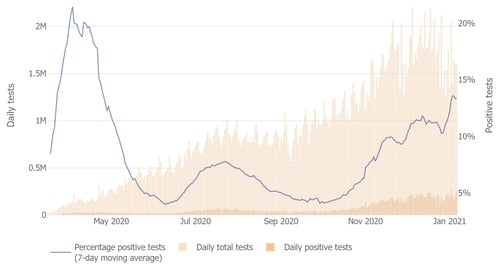

Testing. Finally, we see that the testing news is also indicating we are not through the worst of it yet, with testing down over the holiday and positive rates back up. The good news is that even though the number of tests remains down, the positive rate may be peaking. This could be a leading indicator of improvements.

Source: Johns Hopkins University

The bottom line is that the data continues to get worse, driven by holiday travel infections, and that is likely to continue over the next couple of weeks. That said, there are signs of moderation in the growth rate, which suggest that absent the effects of holiday travel, things would look better. Once the effects of holiday travel work their way through the data, we should therefore see more improvement in the next couple of weeks. Along with the deployment of vaccines, we should be approaching the end of the beginning. While the pandemic may well look worse over the next couple of weeks, the medium- and longer-term pictures look brighter.

Pandemic Economic Damage Continues

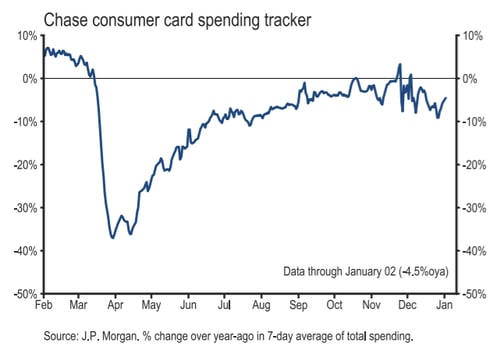

Jobs and consumers. Government-mandated shutdowns in response to the deterioration of the medical situation, along with changes in consumer behavior, have hit the economy hard in recent weeks. Job growth as reported by the ADP went negative for December, and the official figures are likely to confirm that layoffs remain very high. Most affected are the low-wage workers. With the employment market down, consumer confidence has softened further, leading to a sharp drop in retail spending as reported for last month. Overall, the data suggests that the third wave has now hit a point where it will act as a significant drag on the economy until it reverses.

Source: https://markets.jpmorgan.com/research/open/latest/publication/9002054

Business sector. Despite the slowing in the consumer economy, based on what we know so far, the business sector continues to do well. Business confidence and investment remain at pre-pandemic levels, although the risks here are rising as well.

The real question, going forward, is how durable this recovery is. Much of the data has remained solid despite the ongoing third wave, suggesting substantial resilience. The question is whether the accelerating damage will reverse the economic recovery before the vaccines can be widely deployed. Here, the fiscal stimulus package passed by Congress should help bridge that gap. It will provide the kind of boost that supported growth in earlier waves, especially in the low-wage populations most at risk, which should get us through until vaccines start to make a difference. At that point, we should start to see consumer confidence and spending bounce back, as we saw after previous waves. While the risks are real, the federal stimulus will substantially mitigate the worst of them.

Financial Markets Hold Gains on Vaccine and Stimulus News

Markets continued to rally and hit all-time highs again. Reasons this week are both the existing federal stimulus package and the expectation of more federal stimulus shortly. Both medical and economic risks now look to be close to peaking, and it is reasonable to conclude we are at the end of the beginning of the pandemic. Between the short-term cushion from the stimulus and the expectation that vaccines will normalize the medical risks in 2021, markets are clearly looking for a much better 2021—and prices are responding.

We’re Making Progress

The bad news this week is that we are not yet through the third wave and can expect more case growth over the next couple of weeks. As the pandemic continues to get worse, we will also see the economic damage continue to mount. The good news is that with vaccines now starting and signs that policy is starting to succeed in containing the virus—despite the short-term damage done by holiday travel—the medical risks may be within weeks of peaking. Similarly, while the economic news continues to be worrying, the federal government’s stimulus bill should provide enough cushion for the economy to keep growing until the medical risks are more contained. The most likely case for the next couple of weeks appears to be some deterioration of the medical news, as holiday travel effects show up, but then slow improvement. Similarly, the economic data will remain soft in the short term but should then show improvement as the stimulus package takes effect. Markets will likely keep bouncing around on new developments, so expect more volatility in the short term.

In the longer term, the good news is that vaccines are rolling out increasingly quickly. In a few months, we should be approaching the end of the pandemic when the economy can normalize and start to really grow again. The stimulus package should help the economy bridge the gap to that point. Despite the headlines we are seeing today and the real risks, we are making progress. We will get there, but it will just take a bit longer.

Print

Print