The medical news has continued to worsen since the last update, to the point that a third wave of infections is now underway around the country. Case growth has accelerated and is approaching the July peaks, while the geographic spread of this wave of outbreaks continues to widen. Case growth in many states is nearing levels that could threaten the health care systems there, indicating this is a growing problem.

The medical news has continued to worsen since the last update, to the point that a third wave of infections is now underway around the country. Case growth has accelerated and is approaching the July peaks, while the geographic spread of this wave of outbreaks continues to widen. Case growth in many states is nearing levels that could threaten the health care systems there, indicating this is a growing problem.

While the medical risks are rising, the economic recovery continues to move forward. Consumer confidence and spending, an area of concern, have shown better data, which is encouraging. Financial markets have also ticked back up, although recent volatility suggests risks remain.

Let’s take a look at the details.

Cases Growth Approaching July Peaks

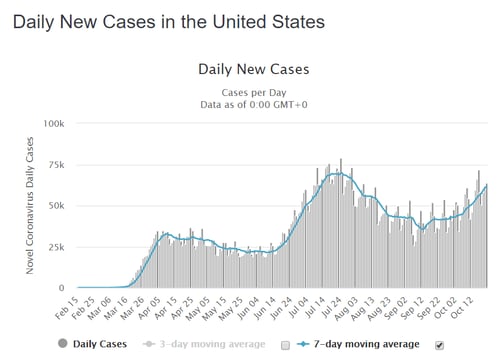

New cases per day. The most obvious metric for tracking the virus is daily new cases. Here, we see that widening state-level outbreaks have continued to increase viral spread, to the point we are now approaching July peak levels. The seven-day average number of new cases per day rose from just over 54,500 per day last week to just over 61,400 per day—a faster increase than the previous week. This is the fifth week in a row we have seen an increase, and the rate of increase has grown every week. The new case rate is now back to levels close to the July highs, almost a full reversal of the improvement seen since then. This is a sign of rising risks, and along with the wider geographic spread, means case counts are likely to keep rising over the next several weeks.

Source: https://www.worldometers.info/coronavirus/country/us/

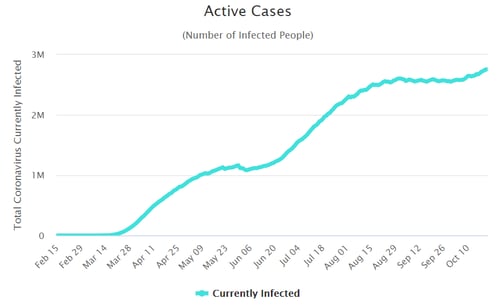

Total active cases. As the number of new cases has continued to rise, the number of active cases has also started to increase again after a period of stability. In recent weeks, the rate of increase has also accelerated. This is a bad sign, as new infections continue to outpace recoveries, which will increase the load on the health care system.

Source: https://www.worldometers.info/coronavirus/country/us/

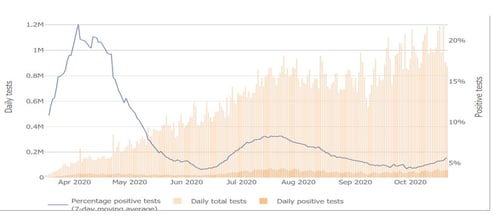

Testing data. The testing news was better. The number of tests has continued to trend up, although it remains quite variable. That said, the positive testing rate has also been increasing and continues to rise above the recommended maximum of 5 percent. This shows that the pace of increasing infections is continuing to outrun testing capacity again. While some of the increase in cases may come from better visibility from increased testing, the rising positive rate suggests the growth in cases is more likely due to a widening range of infection growth.

Source: Johns Hopkins University

The bottom line is that on the medical front, the trends are moving in the wrong direction, and a third wave is now underway. Eighteen states are now seeing the fastest spread of the pandemic thus far; in several of those states, there are outbreak hotspots that are becoming health emergencies. Even in states where the virus remains under control, spread rates are also rising.

Looking forward, the question is whether the situation will continue to worsen. Given the ongoing accelerating infection rates and the fact that many outbreaks are in rural areas with limited local health care resources, that outcome looks likely. With rising positive test results around the country and with the lags between infection and detection, we are also likely to have weeks or more to go before the full effects will be seen. Finally, the history of the first two waves suggests that there may be weeks to run. Overall, the medical risks are likely to keep rising over coming weeks, as the third wave runs its course.

Despite Signs of Slowing, Economic Recovery Continues

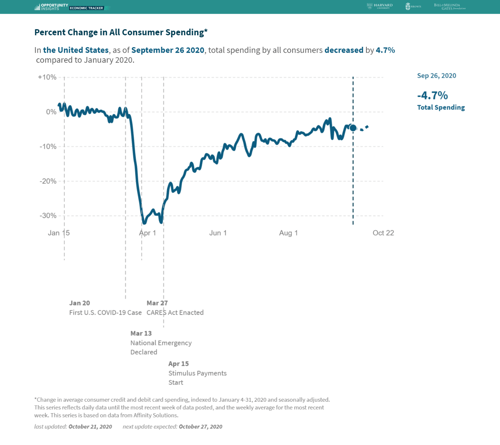

Consumer economy. While the medical risks are rising, the economic recovery continues, despite signs of slowing. The job market continues to show slower improvement, and recent consumer confidence and spending have ticked down somewhat. Consumer confidence has topped in the most recent data, and consumer spending has also softened in the past week. While this metric remains something to watch, growth is continuing despite the recent slowing, suggesting the recovery is more resilient than had been feared.

Source: https://tracktherecovery.org/

Business sector. On top of the signs of continued improvement in the consumer economy, the business sector continues to do well. Business confidence and investment are largely back to pre-pandemic levels, and specific higher-frequency indicators are showing improvement in many cases.

The real question, going forward, is how durable this recovery is. So far, much of the recovery has been based on the spending power generated by federal supplemental income support. But recent data shows that the recovery is continuing even after that support has stopped. The resilience in the face of the medical and stimulus headwinds suggests the recovery will likely be durable.

Big picture? While there are risks out there, especially on the medical side, there are also opportunities. There is a real possibility the economic recovery could accelerate again if the medical risks subside, for example, or if another federal income support program is passed. There are certainly headwinds, but so far at least, confidence and spending are still holding up—and the recovery is still moving forward despite some slowing.

Financial Markets Show More Turbulence

Financial markets rallied for the first two weeks of the month on the better economic news and hopes that the medical risks were under control. But in the past two weeks, they have pulled back on fears that risks were more significant than had been assumed. Given everything that is going on, those fears seem reasonable, which suggests we might see more volatility ahead. That said, the fact that the economic risks remain under control, despite rising medical concerns, should continue to provide some support.

Risks Trending Up

The news this week is that medical risks are rising, especially at the state levels, and that we are now in the midst of a third wave of the virus. With the data so far showing signs of rising risk and with growing outbreaks in multiple states, the risks are clearly trending up. These will need to be watched. Note, however, that we have been through this before, and that it is just a matter of time until we once more bring the pandemic under control.

The economic risks are also real. Despite recent positive news, we do see some slowing in the recovery. That said, there are also opportunities here, and the fact is that the economy continues to outperform expectations. Finally, markets continue to be turbulent as investors process the different risks, and more volatility is quite possible. But as of now, the economic recovery continues, and that should continue to support the markets.

Given all of this, over the next couple of weeks, the most likely case appears to be further deterioration of the medical news as the third wave proceeds and continued slow improvement on the economic front. There are certainly risks coming into focus, and we need to be aware of them. For the moment, however, those risks remain under control.

Print

Print