Last month, I reported that business confidence had pulled back in July and that job growth had weakened. But the data bounced back in the most recent report, for August, suggesting that July was an outlier and the positive trends remain in place. While the question of whether the tariffs are finally starting to have an effect remains open, the current data indicates that, if so, the effect is minor.

With the bounce back in hiring and business sentiment, a rise in consumer confidence to an almost 18-year high, and a stimulative fiscal and monetary policy, the tailwinds behind the economy continue to push it forward. While risks may be rising, they are not here yet.

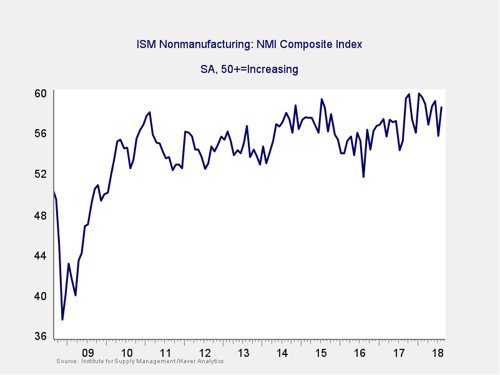

The Service Sector

Signal: Green light

After July's drop in business confidence, which took it to the lowest level of the year, we saw a recovery last month. That recovery—from 55.7 in July to 58.5 for August—took us back close to the June level of 59.1 and was well above expectations. This is a diffusion index, where values above 50 indicate expansion. So, the bounce back suggests that growth is likely to continue in 2018. But the possible topping out of the long-term trend line (as you can see in the chart above) suggests that business confidence may be past its peak. This indicator stays at a green light, as it remains expansionary, but it will warrant close attention in the event of further declines.

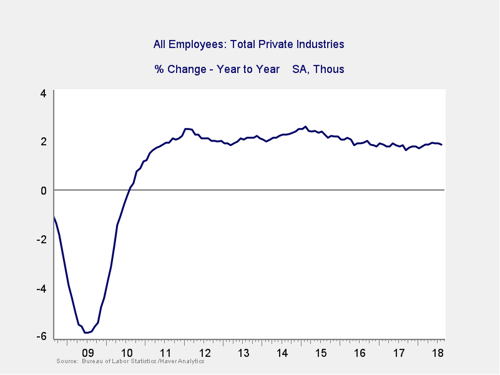

Private Employment: Annual Change

Signal: Green light

August job growth came in at 201,000. This result was above the expected 190,000 and well above July’s 147,000, which was revised down from the initial 157,000 estimate. These numbers suggest that job growth continues to be healthy. But the flattening of the year-on-year trend, as shown in the chart above, suggests that job growth may have started to decelerate.

Overall job growth continues to be strong, however, and the deceleration still leaves us at a healthy level for, likely, the foreseeable future. Nonetheless, the fact that the longer-term trend has flattened suggests that job growth may be at risk over time. As such, this indicator remains a green light but could be weakening.

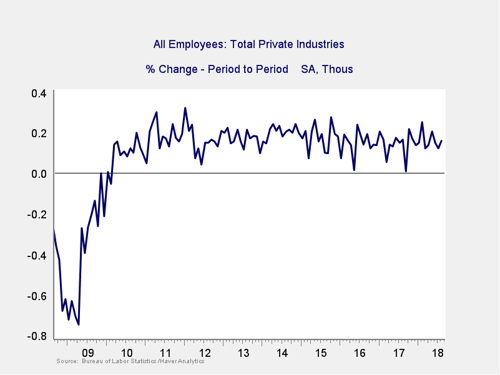

Private Employment: Monthly Change

Signal: Green light

These are the same numbers as in the previous chart but on a month-to-month basis, which can provide a better short-term signal.

As noted above, August’s healthy results offset the weak level of job creation in July, and job growth remains solid. One weak month happens occasionally (as shown in the chart), and that is likely the case here. As with the other signals, and given the continued healthy long-term trends, this indicator remains a green light.

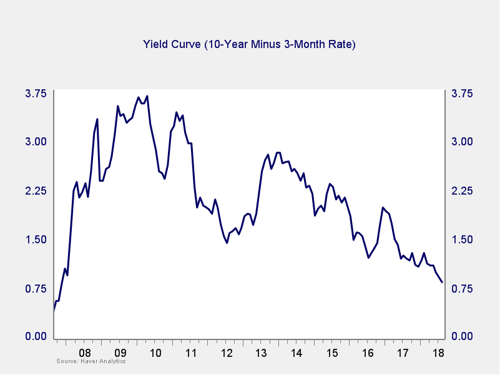

Yield Curve (10-Year Minus 3-Month Treasury Rates)

Signal: Green light

The spread between the 10-year and 3-month rates dropped slightly last month. While the range continues to narrow, we are still above the trouble zone and outside the immediate risk levels. As such, we are leaving this indicator at a green light. Future rate hikes by the Fed might narrow the spread even more, which will be a key area of concern as we move into the end of 2018 and will need to be watched.

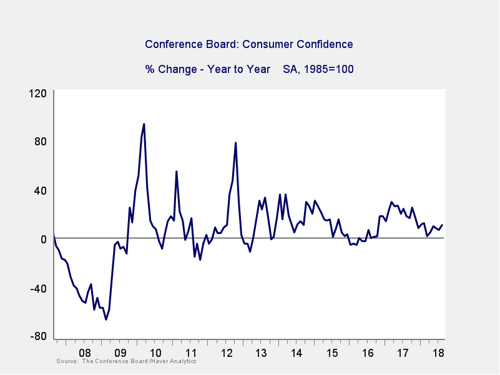

Consumer Confidence: Annual Change

Signal: Green light

Consumer confidence rose again in August, from 127.4 to 133.4. This rise brought it to the highest level since November 2000. On an annual basis, the rise was enough to push the annual rate of change back up, continuing a trend seen this year. With confidence very high on an absolute basis, and with the annual change both positive and well outside the trouble zone, there are no signs of risk here. We will leave this indicator at a green light.

Conclusion: Economy growing, positive trends may have peaked

All four indicators remained positive on an absolute basis, and the data remains strong. While some areas may have peaked and the longer-term trends may be rolling over, present conditions remain favorable overall.

The economy gets a green light for September.

Print

Print