For the first time in several weeks, the big picture on the medical front has gotten worse. Case growth and positive test rates have ticked back up as the economy has reopened. While the change is relatively small so far, it is a reversal of previous improvements and signals that both reopening and the spread of more contagious variants are outpacing the positive effects of vaccinations. Faster spread has therefore moved from a potential risk to an actual one.

For the first time in several weeks, the big picture on the medical front has gotten worse. Case growth and positive test rates have ticked back up as the economy has reopened. While the change is relatively small so far, it is a reversal of previous improvements and signals that both reopening and the spread of more contagious variants are outpacing the positive effects of vaccinations. Faster spread has therefore moved from a potential risk to an actual one.

Despite some adverse headlines, the economic news is better. Reopening in many states has accelerated, pushing layoffs down to a pandemic low in the most recent report. Business spending remains strong. All of this improvement has occurred despite visible effects in the data from severe winter weather in February. Federal stimulus payments have now hit bank accounts and should push March data back up. So, while medical risks are increasing, the economic picture looks positive.

That continues to be what markets are thinking, as they remain close to all-time highs despite some turbulence around rising interest rates. Let’s take a look at the details.

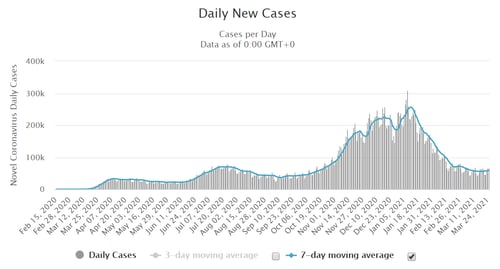

Case Growth Back Up

New cases per day. The most obvious metric for tracking the virus is daily new cases. Case growth has ticked up in the past two weeks, although it remains low by recent standards. This is consistent with what we saw in previous waves, as infection rates rebounded as states reopened, and it suggests another wave remains a possibility. So far, however, conditions remain reasonably favorable despite the recent increase, and future results will depend on how fast vaccinations proceed.

New daily infection rates were 67,046 on March 25, up from 63,552 a week earlier, the second weekly increase in a row. The seven-day average number of new cases per day was 58,866, up from 55,930 a week ago. Case growth remains too high, and while it is down significantly from the peak of the third wave, the trend has changed from improving to deteriorating.

Source: https://www.worldometers.info/coronavirus/country/us/

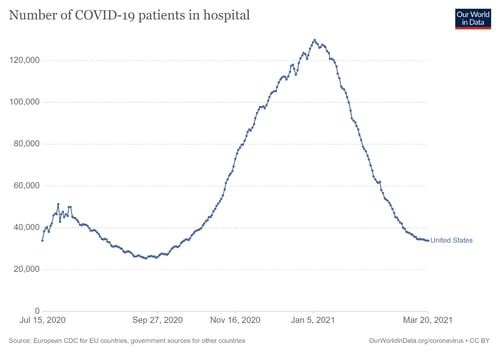

Hospitalizations. We also see the same potential change in trend with hospitalizations, although not as pronounced. While case reporting has weaknesses in how the data is reported, hospitalizations are much better as a real-time indicator. Here, too, we can see a slowdown in the improvement trend. On March 20, there were 33,874 people hospitalized, down from 34,643 a week earlier. This is a lagging data series from case growth, so the slowing improvement is consistent with that data as of a couple of weeks ago. As a coincident indicator and as a better indicator of the stress on the health care system, this supports the idea that the improvement is slowing and may reverse.

Source: https://ourworldindata.org/covid-hospitalizations

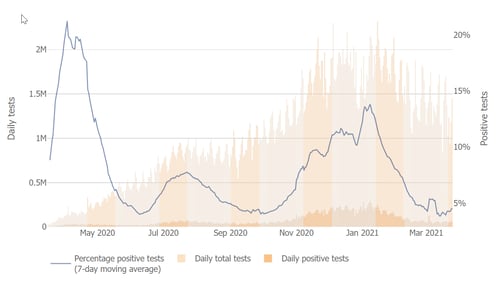

Testing news. The testing news is also getting worse. While the positive rate remains low, it has increased as overall testing numbers have declined. This is a problem, as more infection growth means more testing is needed, not less. As we have less visibility into the potential spread of the virus, this is potentially a risk factor. Nonetheless, the continued low level of positive testing rates is supporting evidence that conditions remain reasonably favorable, and it could be a leading indicator that the medical risks remain contained.

Source: Johns Hopkins University

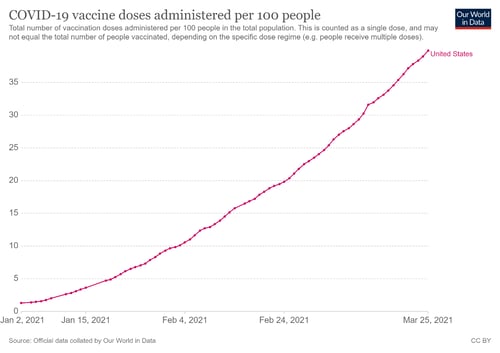

Vaccinations. Finally, the good news is that the vaccination process continues to accelerate. More than one-quarter of the U.S. population has now had at least the first shot of the vaccine, and 14 percent have been fully vaccinated. This has very likely helped contain the number of new infections and has certainly helped keep hospitalizations low. Vaccinations continue at a high rate, and that trend is likely to continue over the next several weeks. As of now, it is very possible that everyone who wants to could be vaccinated by the summer.

Source: https://ourworldindata.org/covid-vaccinations

The major risk continues to be that a more contagious strain of the virus could take root and accelerate infections again before vaccinations get sufficient traction. While we are seeing some signs of this, overall the medical risks are still contained and will decline as vaccinations advance. While this is a declining risk, it is still very real.

The bottom line is that infection growth is still too high and may get worse again. Policy measures are being loosened around the country, which likely has had an effect, and there is a real risk from more infectious strains of the virus. We need to keep an eye on this. Despite that, vaccine deployment continues to moderate the risks. As that accelerates, the downside risks will drop quickly.

Economy Continues to Improve

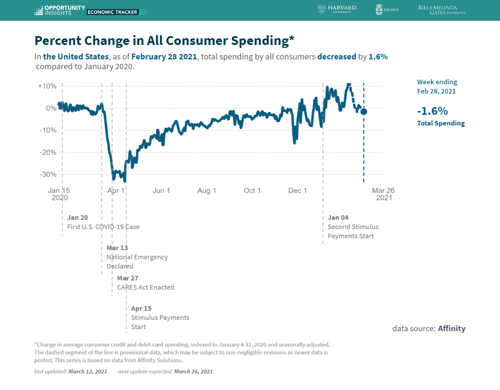

The economic data continues to get better overall. February job growth came in strong, with 379,000 jobs added, focused on the weakest areas of leisure and hospitality. Plus, layoffs hit a pandemic low last week. While consumer spending ticked down over the past two weeks, that was largely due to weather effects, combined with the expiration of the previous round of federal support programs. Better spring weather and the recent passage of more federal stimulus should boost spending again in March, so we are likely through the worst of the economic impact of the pandemic, and growth may well accelerate further. This is also what the business sector is expecting, as business investment continues to rise and is now above pre-pandemic levels.

Source: https://tracktherecovery.org/

As the worst of the economic impact moves into the past, with the existing improvements and current stimulus package, the economy now looks like it will continue to keep growing even if we see a short-term reversal of the medical improvements. While the risks are real, we now see most of the economic risks are moving behind us as well.

Financial Markets Hold Gains Despite Rising Interest Rates

Markets saw some volatility in past weeks, largely attributed to increases in interest rates. But this, too, represents progress, as that increase is based on continued economic improvement. Despite that turbulence, between the ongoing medical and economic improvements, markets continue to expect a much better 2021 and that has supported prices. Fourth-quarter earnings came in well ahead of expectations, and analysts are now adjusting their 2021 earnings estimates upwards, which suggests this positive trend might continue as well.

Still Making Progress

While conditions remain favorable by recent standards, the reversal in medical improvement suggests that medical risks are still very real. We don’t need to panic about it, but we do need to pay attention. Vaccines will likely solve the problem in the next couple of months, but we are not there yet.

Offsetting the medical risks, however, with states reopening and the federal stimulus supporting the most vulnerable parts of the economy, the economic risks look to be largely in the past. We should see continued growth until and past the point the medical risks normalize.

Markets are in an interesting place, as the benefits of the improving medical and economic conditions are increasingly being offset by the likely higher interest rates as a result of those improvements. As higher rates are a headwind for markets, they will likely keep bouncing around on new developments, so expect more volatility in the short term.

In the longer term, the good news is that vaccines are now rolling out quickly. By the summer, we should be approaching the end of the pandemic, when the economy can normalize and start to really grow again. Despite the real risks that still remain and the possibility of a medical setback, we are making progress.

Print

Print