For the second week in a row, the big picture continues to be very positive. On the medical front, all three major data series—new cases, positive testing rates, and hospitalizations—have continued to trend down, while vaccinations continue to scale up. If current trends continue, we are through the worst of the pandemic and should see continued improvement.

For the second week in a row, the big picture continues to be very positive. On the medical front, all three major data series—new cases, positive testing rates, and hospitalizations—have continued to trend down, while vaccinations continue to scale up. If current trends continue, we are through the worst of the pandemic and should see continued improvement.

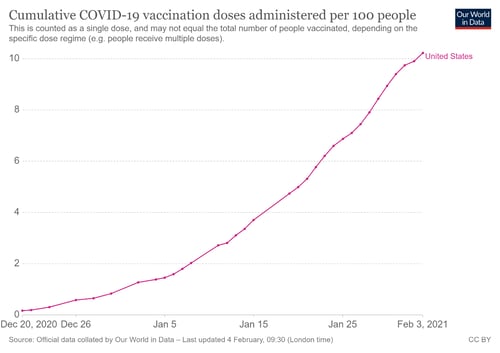

While the trends are positive, the remaining significant risk is that a more contagious variant of the virus could accelerate infection growth, as it has in other countries. Offsetting that will be the progress in vaccinations. We are now at over 10 percent of the population having had at least their first shot, up from just under 8 percent last week, despite a slowdown due to weather. While the risk of a new variant is real, as of right now, we do appear to be through the worst of it, and there is a real possibility of continued rapid improvement.

The economic news is still quite weak, but here too we saw positive signs. The federal stimulus bill has improved both confidence and spending, and medical improvements are allowing reopenings in many states. Given that, the more current jobs and spending data looks stronger and suggests a recovery is under way. Between the medical improvements and the federal stimulus program, the economy also looks likely to be past the worst of the pandemic damage.

Overall, while the current headlines continue to be bad and real risks remain, there are signs of improvement and reasons to believe we may be past the worst of it. That continues to be what markets are thinking, as they have stayed close to all-time highs despite some turbulence. Let’s take a look at the details.

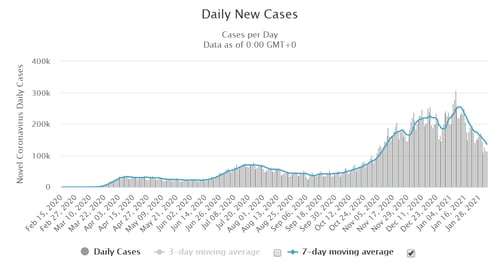

Case Growth Continues to Decline

New cases per day. The most obvious metric for tracking the virus is daily new cases. After holiday surges, we have now seen case growth drop back to levels last seen in November before Thanksgiving. The trend continues to be downward, although there is still a risk that a more infectious variant of the virus could push infection rates up again, as seen in other countries. While we need to keep an eye on that risk, so far at least the trend remains positive. Absent that risk, it looks like we are likely past the crest of the third wave.

Looking at the numbers, the improvement is clear. New daily infection rates were 113,529 on February 3, down from 161,414 a week earlier. The seven-day average number of new cases per day was 136,014, down from 167,963 a week ago. While case growth remains high, the good news is that it is down significantly, and the trend continues to be downward. If this trend holds, we are now past the peak of the third wave.

Source: https://www.worldometers.info/coronavirus/country/us/

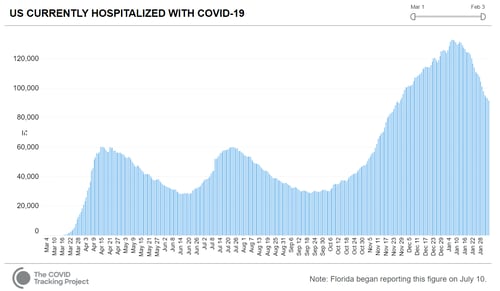

Hospitalizations. We also see the same trend with hospitalizations, which is even more encouraging. While case reporting has weaknesses in how the data is reported, hospitalizations are much better as a real-time indicator. Here, too, we can see a peak and decline. On February 3, there were 91,440 people hospitalized, down from 107,444 a week earlier. As a coincident indicator and as a better indicator of the stress on the health care system, this supports the idea that the trend has turned.

Source: https://covidtracking.com/data/charts/us-currently-hospitalized

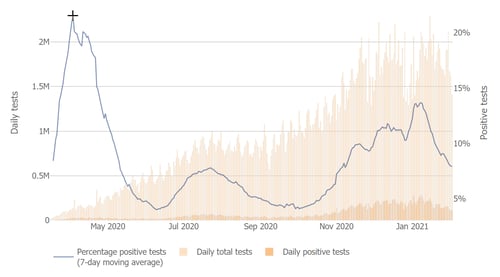

Testing news. We also see that the testing news is showing improvement. Daily testing remains high, and positive rates have substantially declined. This is more supporting evidence for the change in trend and could be a leading indicator of further improvements.

Source: Johns Hopkins University

Vaccinations. Finally, we are now well into the vaccination process. More than 10 percent of the U.S. population has now had at least the first shot of the vaccine, starting with the most vulnerable. This has very likely contributed to the positive change in trend in the other data series. Vaccinations are also likely to accelerate in the coming weeks, which should drive further improvements.

Source: https://ourworldindata.org/covid-vaccinations

The bottom line is that while infection growth is still high and some geographic areas are still at risk, the data suggests that we are through the worst of it. Absent a sudden appearance of a more infectious strain of the virus, we are therefore likely to see more improvement in the next couple of weeks. As vaccine deployment accelerates, the downside risks will drop quickly. While the headlines may well continue to look worrying, the progress is very real and will continue.

Economic Damage Is Moderating

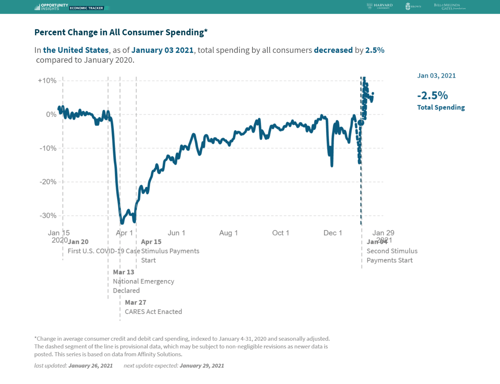

Jobs and consumers. While the backward-looking economic data remains soft, we are seeing improvement in more current indicators as a combination of medical improvement, slow reopening, and the federal stimulus acts to help employment and confidence. While the data is preliminary, the increase in spending as illustrated in the chart below shows that impact has already started. Layoffs have also started to trend down again, for three weeks in a row now. Plus, job growth looks to be improving again, according to the latest ADP figures, as economies reopen. With all of this, the data is showing we are likely through the worst of the economic impact of the pandemic.

Source: https://tracktherecovery.org/

Business sector. This improvement is also what the business sector is expecting. Despite the slowing in the consumer economy, business confidence and investment hit new post-pandemic highs last month and remain above pre-pandemic levels.

With the improvements in hiring, layoffs, and spending, the consumer economy looks to be past the worst of it and set for further improvement in the coming months. The business economy was already solid and looks to be improving even further. As the stress lifts, with the existing and prospective fiscal stimulus package, the medical improvements, and the acceleration in vaccine deployment, the economy now looks like it will keep growing, and we are seeing consumer confidence and spending bounce back, as we saw after previous waves. While the risks are real, we now see most of the economic risks are moving behind us as well.

Financial Markets Hold Gains on Vaccine and Stimulus News

Markets continued to hold near all-time highs again. We did see some volatility, largely attributed to turbulence within the financial markets themselves. But this too represents progress, as the pandemic is no longer the determinative factor. Despite that turbulence, between the ongoing medical and economic improvements, markets continue to expect a much better 2021 and that has supported prices. Analysts’ earnings estimates also continue to be adjusted upwards, with fourth-quarter earnings coming in well ahead of expectations, which suggests this positive trend might continue as well.

Progress Ahead

While risks remain, the data says we are moving beyond the third wave of the pandemic and that medical risks are dropping. Similarly, while the economic damage has been real, with economies reopening and the federal stimulus supporting the most vulnerable parts of the economy, we are moving past the worst of it. The most likely case for the next couple of weeks appears to be continued improvement of the medical news, as well as economic improvement as reopenings take effect. Markets will likely keep bouncing around on new developments, so expect more volatility in the short term.

In the longer term, the good news is that vaccines are now rolling out increasingly quickly. In a couple of months, we should be approaching the end of the pandemic when the economy can normalize and start to really grow again. Despite the real risks that still remain, we are making progress and at an accelerating rate.

Print

Print