We closed yesterday’s post with the observation that although current conditions remain good on the economic front, there may be clouds on the horizon. As such, it could be time to start thinking about a pending recession. Today, I want to take a deeper dive into that. But let’s start with why things are still good.

We closed yesterday’s post with the observation that although current conditions remain good on the economic front, there may be clouds on the horizon. As such, it could be time to start thinking about a pending recession. Today, I want to take a deeper dive into that. But let’s start with why things are still good.

Exhibit A: Strong job report

Job growth came in at the second-highest level of 2018, at 312,000. Plus, wages moved up to the second-highest level of the past three years. On an annual basis, wage growth is also at the second-highest level since 2009, while job growth is at the highest level since mid-2016. People keep getting jobs, and businesses keep hiring. These are signs of a strong economy—not a weak one.

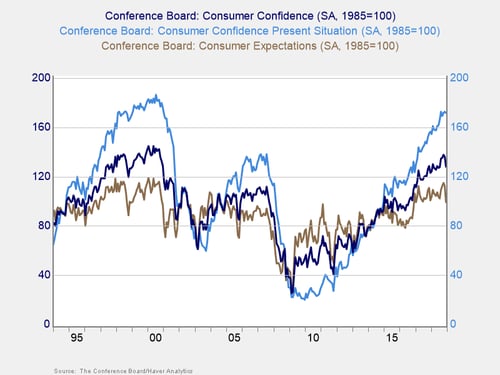

Exhibit B: High level of consumer confidence

Although confidence is down over the past couple of months, it is still above levels from 2017 and before. This level is also consistent with continued strong economic performance. Consumers are certainly doing their part by spending more, which should help keep growth strong for the next couple of quarters.

When you look at the economy today, then, the fundamentals are not only sound but strong. We will take a closer look at this next week in the Economic Risk Factor Update. Right now, it appears we will have nothing but green lights again.

So, why the worry? As solid as the current data is, looking forward things get a bit murkier.

Storm clouds ahead?

Consumer confidence. For example, consumer confidence is measured in two ways—using current conditions and future expectations—and the data is reported as a combination. All good. Except that while the combination remains at high levels, this is due primarily to the fact that conditions are good right now. Future expectations have dropped significantly more.

As you can see in the chart above, the present-conditions survey is at levels we last saw in the dot-com boom. It has been climbing consistently since 2011, before steadying over the past couple of months. Expectations, on the other hand, which have been steady since about 2015, have now dropped to the lower end of that range. People may feel good in the present, but they haven’t expected the future to be much better for the past couple of years. The recent drop also suggests that future expectations may be even more vulnerable going forward.

If that happens and present conditions start to weaken, we might see consumer confidence drop faster than now seems likely. A drop in consumer confidence is a major sign of a pending recession, and that sign could come faster than expected, per this data.

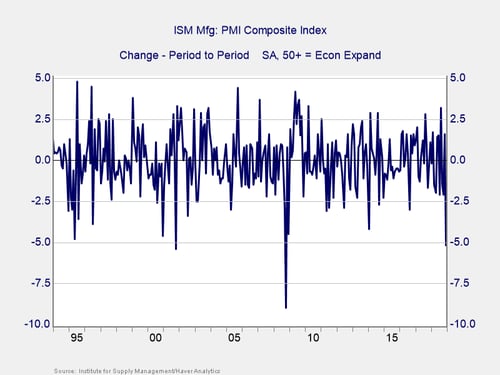

Business confidence. We can see the same signal in business confidence. Manufacturing confidence just registered the biggest monthly drop since 2008 and, before that, since 2001. Although it remains in positive territory, that big shift in sentiment can certainly be a cautionary sign.

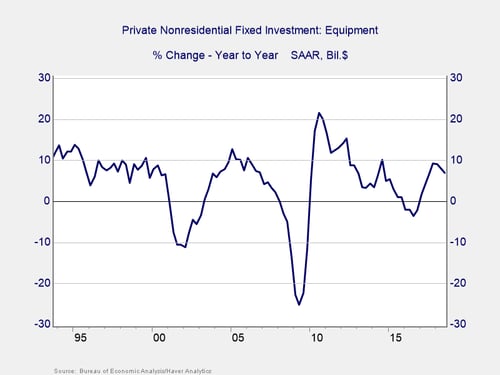

Business investment. That cautionary signal also shows up in business investment. Investment did pick up in 2016 and 2017, especially driven by the tax reform. But it has since rolled over—even as hiring continues to increase. Businesses are confident enough to hire but not to invest more, which suggests a level of caution as workers can be laid off.

International trade is also a growing concern, as the trade deficit has continued to grow and import growth has outpaced exports.

All in all, although conditions remain very positive, the clouds are indeed there and growing. At the same time, much of the reversal in sentiment may be largely due to recent developments—the U.S. government shutdown, the trade war, and so on—that will probably be transient. Present worries do not necessarily signal the end of the recovery, but they do remind us that at some point it will happen.

The big picture

The recovery looks likely to continue for a while and may even pick up again if some of the bad news resolves. Regardless, now is the time to start thinking about the next steps. It may be a while, but the recent data has let us know changes will certainly be coming sooner or later.

Print

Print