Brad here. Today's look at inflation and your portfolio is brought to you by Rob Swanke, a fixed income analyst on our Investment Management and Research team. Take it away, Rob.

Brad here. Today's look at inflation and your portfolio is brought to you by Rob Swanke, a fixed income analyst on our Investment Management and Research team. Take it away, Rob.

I love golf—it’s a great game of risk and reward. You choose the risk you take on each hole, whether you want to go for the green or take the safe route. But, sometimes, there’s a pond right in front of you and your focus turns to avoiding it. The result? You forget to see the rest of the hole. You play it safe and avoid the water only to get stuck behind a tree, not able to reach the green.

In today’s market, many people understand the risk of recession, especially after more than 10 years of growth. Indeed, a recession is one of the biggest risks to your portfolio. But there’s also the risk that inflation will devalue your portfolio if it’s built around the recession risk. Typically during a recession, high-quality, long-duration fixed income will have the best performance. In an inflationary environment, however, those same assets will perform quite poorly. Consequently, it’s important to not only think about the value of your portfolio but also to think about what the purchasing power of that portfolio is now and what it will be throughout your investment horizon.

Where has inflation been?

Since the recession, we’ve seen inflation greater than 2 percent only for brief periods. So, why should we be concerned? To answer this question, we need to assess why inflation has been low, as well as the factors that could generate higher inflation going forward.

Labor force participation. During the recession, many people left the workforce and were no longer counted as unemployed in the headline unemployment number. So, although headline unemployment has dropped significantly since the recession, many people were left on the sidelines, ready to work again once jobs became available. This scenario kept wages down and is reflected in the large increase in the participation rate among prime-age people (i.e., those who are 25–54 years) reentering the workforce as the economy recovered.

Still, we have not reached the level of prime-age participation that we saw prior to the crisis. In fact, there may be people who continue to wait on the sidelines.

The price of goods. It’s also important to keep in mind that the recession was a global event. Although the U.S. has mostly recovered, many other areas of the world haven’t caught up. Since other countries’ wages have remained low due to high unemployment, the prices of goods that are exported to the U.S. have remained low, helping keep a lid on prices in the U.S.

Another anchor to prices has been technological developments, including the Amazon effect. These days, consumers can find the lowest price from a variety of manufacturers at the push of a button. As a result, it is hard for one producer to raise prices when it’s very easy for consumers to make the switch to a lower-cost product.

Consumer expectations. Finally, inflation expectations have dropped among consumers. This drop can lead to low inflation as people are reticent to pay increased prices when they expect them to remain low.

Could inflation return?

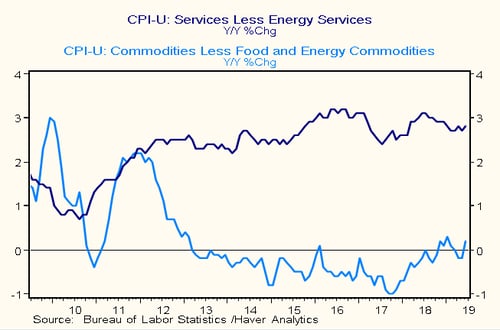

As we move further from the recession, many of these factors could reverse and new factors could come into play. Not only are we nearing pre-recession prime-age participation rates, but many boomers will also be entering retirement. These shifts will reduce the overall workforce and put pressure on rising wages. These same boomers will be looking to spend the assets they’ve built up. In many cases, those entering retirement will find that many of the greatest expenses are service related, such as health care, leisure activities, and the cost of eating out. As wages rise, the cost of those services may also rise. You can see in the chart below how services inflation has outpaced goods inflation over the past 10 years.

Another factor that could cause inflation to rise is the Fed’s determination to ensure that we don’t enter a deflationary environment where people have an incentive to stop spending. The Fed cut rates at its latest meeting to show its commitment to boosting inflation while many other economic indicators remained strong. The Fed has also been discussing its willingness to let inflation run hotter to make up for consistently low inflation. At the same time, it has indicated that policy may be less effective in holding down inflation in the future.

Don’t miss the green!

Although a recession will inevitably come at some point, don’t just plan to avoid the water. Rather, set up your next shot to reach your end goal. Including high-quality fixed income in your portfolio is important in the event of a recession—but ignoring the risk of inflation will have you missing the green.

Print

Print