Brad here. Today's post on why the stable value fund is becoming a more common investment option in retirement plan menus comes from Michael Geraci of Commonwealth's Retirement Consulting Services team. Take it away, Michael.

Brad here. Today's post on why the stable value fund is becoming a more common investment option in retirement plan menus comes from Michael Geraci of Commonwealth's Retirement Consulting Services team. Take it away, Michael.

In today’s uncertain economic environment, interest rates have declined, and the Fed has expressed its commitment to keeping them low. This environment has put pressure on money market funds yielding close to 0.1 percent, which has affected those retirement plan participants seeking preservation of capital. Many of these same participants are close to retirement and cannot afford to lose a significant portion of their retirement portfolios, but they’re also seeking returns to keep pace with inflation.

Now, inflation is not necessarily a near-term risk for the U.S.; however, more market volatility may be on the horizon, with the growing uncertainty surrounding the potential second wave of COVID-19 case growth. Given this risk, retirement plan investors may be seeking more conservative investments within their plan’s menu.

Aside from money market funds, the stable value fund is becoming a more common investment option in retirement plans. A stable value fund is a capital preservation investment option that has been around for more than 40 years, and it is exclusive to defined contribution plans or to what we know as 401(k) plans. Let’s take a closer look.

Stable value versus money markets

Stable value funds are designed to preserve capital and earn returns similar to those of short-duration bond funds with risk similar to that of money market funds. Both stable value and money market funds have the same objective, but there are certainly some key differences.

- Money market funds are restricted to lower-risk, shorter-duration, and highly liquid instruments.

- Stable value funds are investments that offer steady returns and can provide both principal protection and accumulated interest.

Both stable value funds and money market funds are conservative investments. But generally speaking, stable value solutions offer more competitive yields, have limited volatility, and have historically outperformed money market funds.

Stable value restrictions

Stable value investments do have restrictions to be aware of. For example, the “90-day equity wash provision” can require the investor to move to an equity fund or a fixed income fund with a higher duration for 90 days. Another restriction called a “put period” is when an employer initiates a withdrawal or termination at the plan level, which could restrict liquidity to plan participants. Of course, it’s important to always look at all investment restrictions when evaluating the capital preservation space. In cases where liquidity is preferred, money markets should be considered. But if an investor within a retirement plan portfolio is looking to stabilize returns and minimize volatility, then stable value could make sense.

Consistency is key

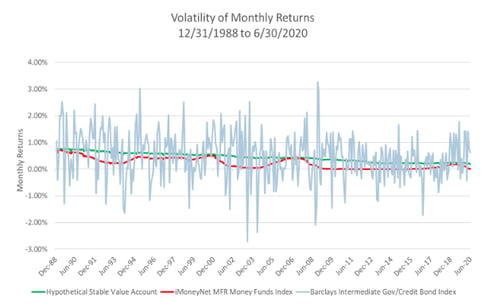

A stable value fund’s objective is not only to preserve capital but also to provide a positive rate of return with limited rate fluctuations relative to other investment options. This being said, it is important for investors to also look at the volatility of returns on an investment. As shown in the chart below, the volatility of the stable value model portfolio’s monthly returns is similar to that of the money market index and far less volatile than that of the intermediate-term bond index.

Source: https://www.stablevalue.org/. Stable value is a simulation of book value returns in a hypothetical fund holding intermediate bonds and stable value wrap contracts, with crediting interest rates reset monthly using the industry accepted crediting rate formula. The bond returns incorporated into the simulation are monthly market value returns from the Barclays Intermediate Government/Credit Bond Index, with gains/losses reflected in future crediting rates by amortizing market-vs.-book values over intermediate bond index durations. This simulation incorporates no ongoing cash flows into or out of the fund. Returns illustrated are gross before any fees.

When comparing the stable value fund with other investment options, an investor may find that stable value has provided returns similar to those of short-term bond funds when performance is measured over a full market cycle. If a participant’s risk tolerance is limited, then an investment designed to provide a stable positive rate of return may be very attractive.

2020: A quandary for retirement plan investors

No one would have guessed that in 2020 there would be a worldwide pandemic and GDP growth would decrease at an annual rate of 32.9 percent in the second quarter. The capital markets are clearly reflecting some economic distress and uncertainty. This situation poses a quandary for retirement plan investors. The choices in the current conditions appear to be equity funds at high valuations, money market funds at low yields, and bond funds that are subject to interest rate and default risk.

This environment is where stable value investments can pose a solution for those same retirement plan investors. In times of uncertainty, stable value funds may help protect a portion of an investor’s assets, while earning a competitive rate. This unique capital preservation option may allow investors to ride out any volatility until we have a clearer view of the future economy.

Print

Print