This coronavirus update will be shorter than those I have done previously for a couple of reasons. First, there is not much new news. While case growth at the national level appears to have rolled over, other national data is mixed. The case slowdown is by no means certain. Second, the national case data is significantly misleading for many areas, which continue to suffer much higher infection rates than the rest of the country. So, while it is worth taking a look at where we are, the medical situation remains uncertain.

This coronavirus update will be shorter than those I have done previously for a couple of reasons. First, there is not much new news. While case growth at the national level appears to have rolled over, other national data is mixed. The case slowdown is by no means certain. Second, the national case data is significantly misleading for many areas, which continue to suffer much higher infection rates than the rest of the country. So, while it is worth taking a look at where we are, the medical situation remains uncertain.

The same situation applies to the economic data. Some good news—yesterday’s unexpectedly strong retail sales numbers—is offset by weak job growth and lower consumer confidence. There is no clarity in the data, and that has left markets drifting lower.

Overall, the situation remains uncertain. Prospects are still positive, however. Case growth is trending down, and consumers are still spending. Nonetheless, we are in a wait-and-see mode. Let’s take a look at the details.

Case Growth Tops Out?

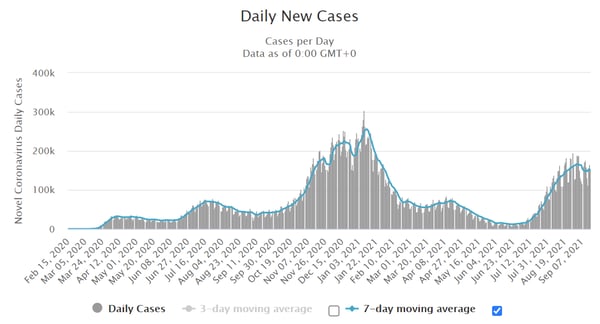

New cases per day. The most obvious metric for tracking the virus is daily new cases. The seven-day average of new cases per day was 150,061 on September 16, down from 166,381 two weeks earlier. That represents a decrease of about 10 percent from the peak of the most recent wave. But this drop included the Labor Day holiday. After that, we saw cases tick back up, and we may see this again. For the moment, however, the news is good.

Source: https://www.worldometers.info/coronavirus/country/us/

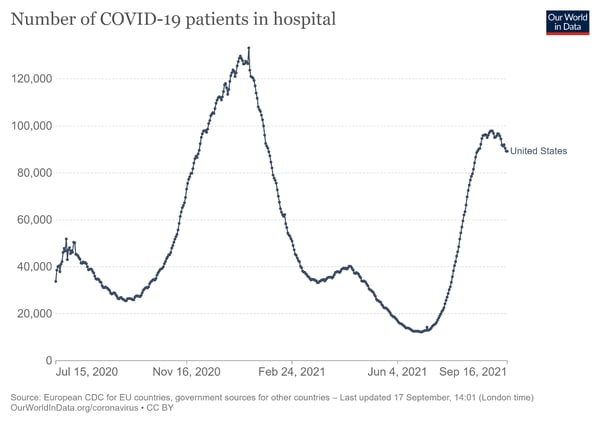

Hospitalizations. We have also seen improvement in the hospitalization data—a more consistent improvement than in new cases. On September 16, there were 89,181 people hospitalized, down from 97,751 two weeks earlier. This represents a decrease of about 9 percent. Hospitalizations typically lag case data, so a further decrease in hospitalizations is likely.

Source: https://ourworldindata.org/covid-hospitalizations

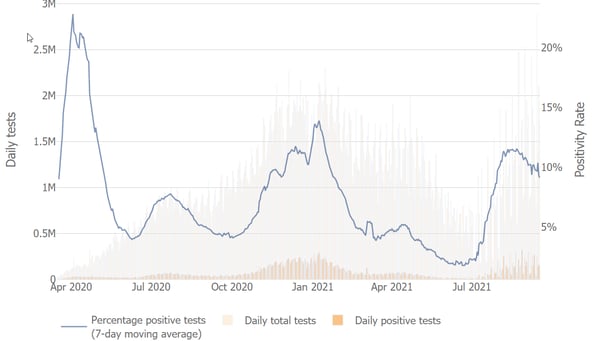

Testing news. The testing news is also slowly getting better, although here too we see volatility in the daily numbers. Overall, testing numbers have spiked back up, which is reasonable given the increase in the number of cases. The positive test rate remains elevated, although it has come down a bit to around 10 percent. This level signals widespread infection exposure. So, the positive test rate indicates that the viral spread continues to grow, although perhaps at a slower rate than before.

Source: The Johns Hopkins University https://coronavirus.jhu.edu/testing/individual-states/usa

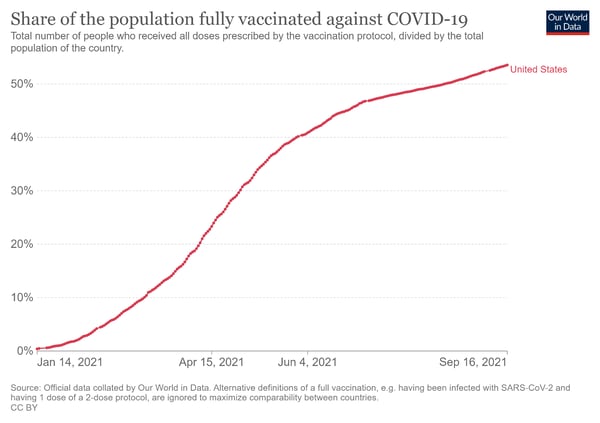

Vaccinations. The deterioration in the medical news has been at least partially due to a slowdown in vaccinations. Still, there is good news. Vaccination progress has accelerated again, although it remains below earlier levels. As of September 16, 62.75 percent of the U.S. population has had at least one dose of the vaccine, and 53.55 percent are fully vaccinated. This is another positive factor going forward.

Source: https://ourworldindata.org/covid-vaccinations

Confidence and Job Growth Weaker on Uncertain Medical Risks

Although the medical risks may be starting to moderate, more signs of economic damage have appeared. Job growth dropped significantly last month, as did consumer confidence. Beyond the pandemic, the expiration of federal subsidy and protection programs is also weighing on consumer sentiment. That said, retail spending continues to be strong, and business confidence remains high. Overall, the economy remains open, and growth continues. Still, the economic risks—especially on the consumer side—are rising.

Financial Markets Stalling on Medical and Economic Concerns

The rising risks are being reflected in financial markets, which have pulled back a bit since the last update. Again, however, the underlying momentum remains strong. The markets are still supported by low interest rates and expectations for strong earnings growth. Whether this environment will continue is one of the key indicators to watch in coming weeks.

Economic Fundamentals Remain Favorable

Over the past several weeks, as infection growth has moderated, we have seen the potential for medical risks to top out. Despite the prospects for improvement, however, the economy has started to react to the recent uptick in case growth. In particular, we can see this trend on the consumer side. As a result, the economic risks have risen, putting the markets on the defensive. So far, though, the country remains open and the economy is growing. So, although risks are rising, economic growth is likely to continue unless medical conditions get much worse. Even though the markets are cautious, economic fundamentals remain favorable. Overall, while volatility is very possible, there may well be more upside ahead.

Print

Print