In today’s post (the last in this series, for the moment), we’ll look at the U.S. stock market.

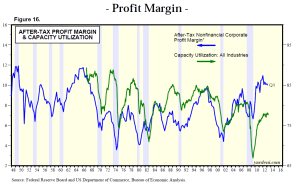

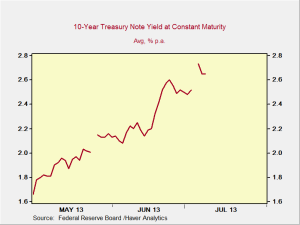

We are in the middle of a very significant bull market—up almost 150 percent since the bottom in 2009—and the question right now is whether the run can continue. I was on a CIO panel at Financial Advisor magazine’s alternative investments conference yesterday, and the views of my fellow panelists—a really impressive group, in which I was flattered to be included—ranged from major declines to consistent, multiyear advances. Even the pros disagree. My own views, as you know, are cautious. Why that is will become clear.