The big news this weekend was the dog that did not bark: Larry Summers withdrew his name from consideration for chairman of the Federal Reserve. There are headlines on this in both the New York Times and the Wall Street Journal, among others, and it was a lead question I discussed on CNBC this morning.

Which, of course, makes the average person ask, “So what?” Why do I care that an economics professor and former government official isn’t going to apply for a job? How does this affect my life?

A good question, and the short answer is interest rates. The longer answer is that it affects how much you pay to buy a house or a car, and how many jobs are created, as well as many other aspects of your daily economic life.

Of the candidates for the chairmanship of the Fed, Larry Summers would have injected the most uncertainty into the system. As a former Treasury Secretary and academic superstar, he unquestionably has the firepower to do the job, but there were questions about his ability to work well within the system. As a Federal Reserve outsider, he lacked the connections a long-term internal candidate would have, and it wasn’t clear that he could work effectively with people who disagreed with him.

His policy positions were also a key issue, with his work on Wall Street and positions on deregulation when he was Treasury Secretary prompting key Senate Democrats to announce they wouldn’t vote for him. Ultimately, it seems that opposition by the Democrats was what caused him to withdraw.

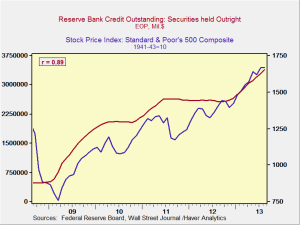

As I write this, stock futures are up and interest rates are down. On the surface, the market seems to be saying it’s glad Summers withdrew, but I don’t think it’s as simple as that. What the market is really saying is that it’s glad uncertainty has been reduced. As an outsider, Summers would have introduced an element of policy uncertainty about raising rates and reducing stimulus that an internal candidate wouldn’t have.

With Summers out, the most probable contender is internal. Janet Yellen, currently vice chairwoman of the Fed and previously the president of the Federal Reserve Bank of San Francisco, is a long-term Fed insider. As one of the Fed members perceived as most “dovish” on inflation—that is, one of the most tolerant of allowing inflation to increase—she’s thought to be most likely to continue the current policies and to leave stimulus measures in place for the longest. With its reaction, the market is saying that Yellen is a safe choice who’s unlikely to rock the boat, and who will continue the current policies, which the market is used to.

I’m not sure that’s the case, longer term, although I think the perception is probably correct in the short run. Yellen is perceived as dovish, and that has been true, but her policy preferences have been based on her prescient views on the weakness of the economy. She was one of the first senior Fed officials to recognize the pending housing crisis and was also way ahead of the curve on the slowness of the current recovery. I think it’s fair to say that her policy prescriptions, thought dovish at the time, have in fact been right on. When the recovery starts to gear up, I suspect she might be equally prescient in recognizing, and responding, to that.

She is not, however, the only candidate. Two other names have been floated: Donald Kohn, a former Federal Reserve vice chairman, and Timothy Geithner. Both have extensive central bank experience and excellent credentials, and both would be good candidates. As with Summers, however, they would introduce more uncertainty into the system merely by virtue of not being there right now, possibly driving rates up again as the market tries to assess what their candidacy would bring.

The interest rate and stock price reaction may be short lived, as other factors are certainly in play, with Syria being a key one. I also believe that the decline in rates is due, at least in part, to the market getting better at price discovery in the face of the impending taper in Federal Reserve stimulus to the bond market. Nonetheless, the fact that something like this can move rates and markets highlights the continuing importance of government actions to the economy.

I hope that the White House acts as quickly as possible to finalize its candidate, to remove at least that section of uncertainty from the market. And, once that candidate assumes the chairmanship, I hope the Fed also acts to remove itself from the economy as quickly as possible.