This weekly update is appearing a couple of days early, due to Thanksgiving. We will go back to the regular Thursday schedule next week. I hope everyone has a terrific holiday. As always, I am grateful for all of you my friends and readers.

This weekly update is appearing a couple of days early, due to Thanksgiving. We will go back to the regular Thursday schedule next week. I hope everyone has a terrific holiday. As always, I am grateful for all of you my friends and readers.

As mentioned last week, the third wave of the pandemic may be peaking. While the medical news continues to get worse, new infections look to have decreased over the past several days, and the rate of increase has slowed substantially. Now that multiple states are implementing anti-COVID measures (e.g., mask mandates and partial lockdowns), infection growth looks to be slowing. While it is too soon to be certain, we seem to be approaching the peak of the third wave. We should know in the next couple of weeks. Case growth in many states remains at levels that threaten health care systems, but peak case growth should reduce that pressure over time.

There is more good news on the medical front. A third vaccine, from AstraZeneca, has been shown to be effective. Plus, Pfizer has applied for emergency FDA approval, meaning actual vaccinations could start within weeks. With three effective vaccines likely and one starting deployment shortly, we can now start to move into the next phase of pandemic management. This shift should help over the next six months or so, although it will still be some time before the vaccines become widely available enough to have a meaningful national effect.

Offsetting the better medical news, the economic reports have softened. Initial claims for unemployment ticked up; perhaps as a consequence, consumer confidence dropped, with retail spending growth also slowing. This slowdown is likely a response to the rising case counts in the past week. While business confidence and investment remain solid, consumer weakness needs to be watched. Despite the slowdown, growth continues, albeit at a slower pace. That growth, combined with the better medical news, continues to push financial markets higher. Let’s take a look at the details.

New Cases May Be Topping

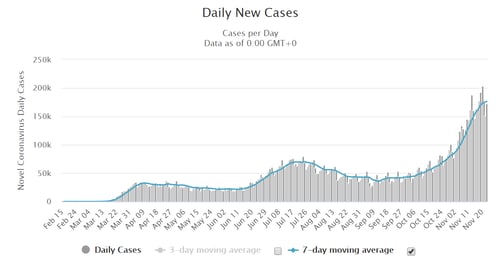

New cases per day. The most obvious metric for tracking the virus is daily new cases. Here, we see two things. First, the number of daily cases is growing at a much slower pace than in previous weeks. Second, on a seven-day average basis, there are signs of a top.

New daily infection rates were 172,300 on November 23, up from almost 163,000 a week earlier—but this is the first week in months where we saw a smaller increase than in previous weeks. The seven-day average number of new cases per day is now up to over 176,000 per day, up from 160,000 a week ago, but the weekly increase is down for the second week in a row. This may indicate that infections will peak in the next couple of weeks and is similar behavior to what we saw in previous waves of the pandemic. So, a peak would be a very positive sign.

Source: https://www.worldometers.info/coronavirus/country/us/

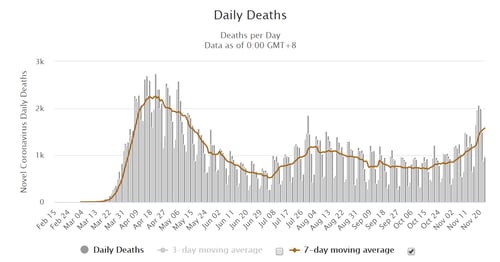

Death rate. The death rate also continues to rise, but at a slower rate. This is a lagging indicator and runs from 6–8 weeks behind case growth. As such, recent increases in the death rate reflect faster infection growth in early October. On a seven-day moving average basis, daily deaths were at 1,577 as of November 23, up from 1,176 in the prior week. As the number of new cases has spiked since early October, we can reasonably expect death rates to increase substantially as well over the coming weeks.

Source: https://www.worldometers.info/coronavirus/country/us/

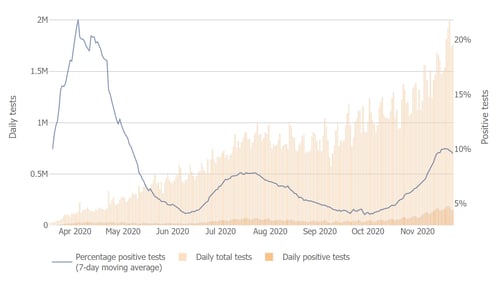

Testing. Finally, the testing news got better. The number of tests has resumed its rise, although it remains quite variable. The positive testing rate has also rolled over as testing gets more widespread. The current level is still well above the recommended maximum of 5 percent. It has started to come down this week, showing that the pace of testing is again catching up with infection growth. Another positive sign is that some of the increase in cases may come from better visibility from increased testing, which would suggest a peak is even more likely.

Source: Johns Hopkins University

The bottom line is that on the medical front, despite the fact that infections are still rising, the trends have started to move in the right direction, and signs are the third wave may be cresting. While the risks are still substantial, with a majority of states seeing widespread outbreaks, at least there are signs it may stop getting worse in the near future.

Looking forward, the question is whether the improvement will continue. Given the wider imposition of shutdowns and restrictive policy action, that outcome is probably likely. Against that, though, is that the Thanksgiving holiday may bring another round of infection growth. While the next couple of weeks should show more improvement, mid-December still remains very much at risk.

Economic Recovery Shows Signs of Slowing

Consumer economy. While the medical situation is showing signs of improvement, the economic recovery shows signs of slowing. The job market has started to soften, with layoffs ticking back up again, and consumer confidence has softened as well. Retail spending, while up, grew much more slowly last month.

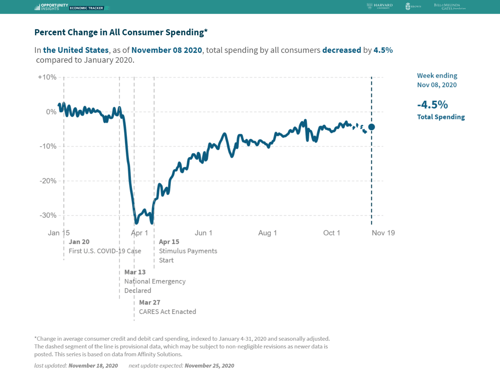

Looking at higher-frequency data (see chart below), there are also signs that consumer spending may have stopped improving. Overall, in the context of the rising medical risks, the data suggests that the consumer is still resilient, but cracks may be starting to show.

Source: https://tracktherecovery.org/

Business sector. While the consumer economy may be weakening, the business sector continues to do well. Business confidence and investment remain at pre-pandemic levels, and specific higher-frequency indicators are showing improvement in many cases.

The real question, going forward, is how durable this recovery is. Much of the data has continued to improve despite the ongoing third wave, suggesting substantial resilience, and there are signs that the economy is adapting to the pandemic. There are growing signs that the positive trends may be weakening, and lockdowns in several states will be a headwind. But given the resilience of the recovery in the face of the medical and stimulus headwinds, it is likely the recovery will be durable, although we may well see some more slowing in coming weeks.

With that durability in the face of risk, we should remember there are also opportunities. The biggest one at the moment is that if the third wave does crest and start to recede, we could see consumer confidence and spending bounce back. Another is the very real prospect of another federal income support program, which would help the economy ride out any weakness. In any event, while there are certainly headwinds, so far at least, confidence and spending are still holding up, and the recovery is still moving forward despite some slowing.

Financial Markets Rally on Vaccine News

Markets continue to rally. Reasons this week are primarily the good news on the vaccine front, with AstraZeneca announcing another successful virus and Pfizer applying for a use permit for its vaccine. The chances of vaccinations starting in the next couple of weeks and of effective vaccines being widely available in the next three to six months or so now look very real.

Between the resilient economy and the potential for multiple vaccines in the near- to medium-term future, markets are largely ignoring the medical risks. Given everything that is going on, that seems a reasonable reaction, but one that also leaves open the possibility of more volatility ahead if medical risks move back into the headlines. We can reasonably expect the current positive trends to have some durability over the next couple of weeks, but the medical news could easily lead to more volatility during that time.

Third Wave May Be Cresting

The news this week is that the third wave may be cresting, even as the vaccine news continues to get better, with more than one vaccine likely to be widely available in the next six months or so. This development, despite signs of slowing economic growth, has markets cheering.

The economic risks are real, and we do see some slowing in the improvement in consumer spending. That said, growth has continued and has been much more resilient than expected. This is a positive signal for the future, and we have more upside risk here as well with the possibility of more federal stimulus. Finally, while markets are rallying on the positive vaccine news, more volatility is quite possible as the medical news moves back into the headlines.

Over the next couple of weeks, the most likely case appears to be slow improvement of the medical news and continued but slow improvement on the economic front. Markets will likely keep bouncing around on new developments, so expect more volatility. This will be a difficult period as we get the pandemic under control again—but get it under control we will. It will just take some time.

Print

Print