Earlier this week, my colleague Rob Swanke wrote about the relevance of the 60/40 portfolio in light of the current market environment. He asked whether this investment model, which seeks to balance the growth potential of equities with the volatility mitigation potential of fixed income, should be abandoned. Spoiler alert! Rob suggests we need to look forward, not backward, when making portfolio decisions, even though market conditions have changed. While short-term adjustments may help boost performance, the 60/40 portfolio can still be an attractive choice for the moderately aggressive investor.

Earlier this week, my colleague Rob Swanke wrote about the relevance of the 60/40 portfolio in light of the current market environment. He asked whether this investment model, which seeks to balance the growth potential of equities with the volatility mitigation potential of fixed income, should be abandoned. Spoiler alert! Rob suggests we need to look forward, not backward, when making portfolio decisions, even though market conditions have changed. While short-term adjustments may help boost performance, the 60/40 portfolio can still be an attractive choice for the moderately aggressive investor.

Is the Unknown the New Normal?

Rob’s thoughts on “normal” market conditions, paired with the potential benefits of a 60/40 portfolio, were intriguing to me. Lately, it seems that every few years we’re faced with once-in-a-generation or once-in-a-lifetime events. Over the past 20 years or so, we’ve seen a tech meltdown followed by the great financial crisis, a downgrade of America’s credit rating, and the collapse and resurgence of oil prices. A pandemic shut down the world, inflation rose to levels we haven’t seen in decades, and, most recently, Russia initiated a war against Ukraine. We’ve been through a lot, as have our portfolios, and there’s surely more to come.

Should we start trying to prepare for the unknown? But if we don’t know what’s coming, how can we protect our portfolios from it? Let's take a look at how alternative investments are used as a strategic allocation in a well-balanced portfolio.

Alternatives and Modern Portfolio Theory (MPT)

The use of alternative investments comes down to the building blocks of portfolio allocation and, more specifically, to MPT. Here’s a simple take on MPT: When presented with two portfolios that have the same return but different risk profiles, investors will take the less risky one. Why? Investors are risk-averse. And, according to MPT, the most effective way to reduce risk is to diversify a portfolio across different investments and asset classes.

Alternatives are the “alternative” to traditional asset classes, such as stocks, bonds, and cash. Theoretically, by incorporating alternatives into a portfolio, we can increase diversification and potentially deliver similar or better returns with less risk than when using a traditional allocation like the 60/40 portfolio.

Alternative Building Blocks

Alternative investments can be broken down into the following building blocks, each providing distinct characteristics:

- Gold has offered returns similar to those of equities. From January 1971 to December 2019, gold had average annual returns of 10.6 percent, while, over the same period, global stocks returned 11.3 percent, according to statista.com. And, because gold tends to hold its value during market downturns, it can help provide a portfolio with defense against volatility and protection from inflation. Gold is seen as an effective way to diversify a portfolio, because its prices don’t typically follow the same trends as those of other asset classes. Overall, gold can serve as a store of value or safe haven during periods of economic or geopolitical distress.

- Hedge funds are a class of pooled investment funds that invest more aggressively than most mutual funds. For this reason, they’re generally accessible only to accredited investors. Because hedge funds use a wide range of complex strategies, they offer diversification opportunities investors don't find through traditional investments. As hedge fund managers trade actively, their returns are driven by the manager’s skill rather than by broad market movements.

- Infrastructure investments, meaning investments in the physical systems of a business, region, or nation, are generally meant to be held for the long term. These assets offer relatively stable cash flows and revenues that are linked to inflation. Through diversification and inflation protection, infrastructure investments can provide more defense against market volatility than securities traded in the broader markets.

- Private credit investments are considered illiquid in that they cannot be easily or quickly sold or exchanged for cash. As a result, their returns are driven by the so-called “illiquidity premium,” the additional compensation or yield necessary to make the investment attractive. Private credit is a broad category, but it is largely made up of direct lending where an investment firm is taking the place of a traditional bank and negotiating and lending money to private businesses. Due to the tailored nature of these positions, and because underlying positions don’t trade on a public exchange, the space tends to provide diversification that is outside the realm of traditional credit.

- Private equity primarily focuses on investing in private companies—that is, those not traded on an exchange such as the New York Stock Exchange. Portfolio managers use hands-on influence to create changes at the company level with the hope of unlocking a company’s value. Portfolio managers will ultimately sell the company to realize the value created. Because the companies are private and subject to infrequent valuations (typically quarterly), their prices don’t generally move in sync with those of stocks offered on the public equity markets.

- Real estate prices typically rise and fall some time after the rest of the economy (which means this asset is a lagging economic indicator). Still, investment opportunities in real estate are typically robust, including various property types and locations that follow unique market cycles. As a result, broader market influences have less impact on real estate assets.

Can Incorporated Alternatives Work?

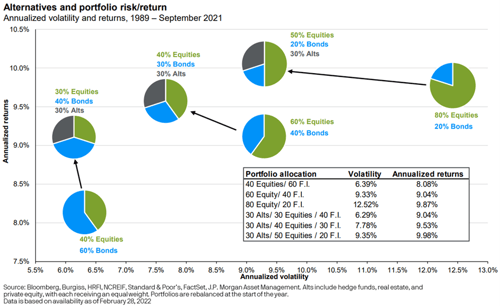

As the chart below shows, the use of alternatives can deliver healthier absolute and risk-adjusted performance relative to that of a traditional portfolio. Please note that past performance is no guarantee of future results.

Caveats to Keep in Mind

Despite the potential offered by alternative investments, they are not appropriate for everyone. As with any investment, alternatives have their strengths and weaknesses, which investors should fully understand before adding them to a portfolio. The above discussion is intended as a starting point for understanding how alternatives can be used in today’s market environment. Alternative investments are complex and relatively costly and come with unique risks. These risks include the risks associated with leveraging the investment, utilizing complex financial derivatives, adverse market forces, regulatory and tax code changes, and illiquidity. Additionally, alternative investments may not be available to all investors, and there is no assurance that any investment objective will be obtained. Investors should do thorough research, consider their risk level, and talk to an advisor before investing in them.

Investments are subject to risk, including the loss of principal. Some investments are not appropriate for all investors. Diversification does not assure a profit or protect against loss in declining markets, and diversification cannot guarantee that any objective or goal will be achieved.

Print

Print