The year 2021 was all about supply shortages—from semiconductor chips to construction materials and everything in between. As supply chain logjams ease in 2022, some goods will get back to a normal balance. Others may swing to an oversupply. Sectors and industries that benefit from economic activity in which supply rises to meet demand may continue to reward investors in the near term. The business cycles for some companies may be at or near peak, however, so investors must watch for potential signs of a downturn.

The year 2021 was all about supply shortages—from semiconductor chips to construction materials and everything in between. As supply chain logjams ease in 2022, some goods will get back to a normal balance. Others may swing to an oversupply. Sectors and industries that benefit from economic activity in which supply rises to meet demand may continue to reward investors in the near term. The business cycles for some companies may be at or near peak, however, so investors must watch for potential signs of a downturn.

Why Did the World Run Out of . . . Everything?

In 2020, COVID-19 significantly hit manufacturing and shipping activities. Then, as lockdowns were relaxed, production came back online and was met by strong consumer demand ready to scoop up all goods produced. Supply chains remained disrupted, however. Goods could not get to warehouses, retailers, and end consumers quickly enough, which led to higher prices, also known as inflation. The robust demand for goods meant that manufacturers were caught short on production, and consumer shortages became more acute.

Where Are We Now?

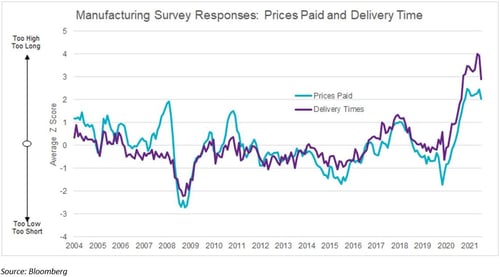

We are not yet in a state of demand-supply equilibrium, although signs of moderation in supply chain stresses have emerged. The most recent Purchasing Managers’ Index (PMI) survey, released on January 3, showed that delivery times, while still high, are easing. As the chart below shows, companies reported that manufacturers’ input costs are coming off the boil. The auto industry, the sector that experienced the most acute bottlenecks, has seen a rebound in activity. GM was able to reopen all its plants as the semiconductor shortage eased.

Are We Set for the "Bullwhip" Effect?

Supply shortages remain acute, but they are no longer getting worse. A surplus of goods and materials is nowhere in sight, but history suggests that this scenario could be forthcoming. The semiconductor industry, with its famously boom-and-bust past, is a prime example. When demand for chips surges, manufacturers ramp up production, and chips fill up warehouses and supply chains. Then sales crash. And then it’s lather, rinse, repeat.

Chipmakers are arguing that this time the environment is different. Chips are omnipresent these days, and their varied uses imply that demand could be a bottomless pit. Still, with more than $1 trillion in semiconductor capital expenditure planned globally, a lot of capacity is being built. Oversupply in the future is certainly possible.

Other industries may be at an even greater risk for future oversupply. Coal usage, for instance, rebounded in 2021 due to a resurgence in demand, especially in China. The coal sector saw futures climb 400 percent in some markets to reach record highs (see chart below), and shares of coal mining companies were also up. China responded by announcing measures to boost coal production, leading to a crash in coal prices and shares of coal mining companies. Lumber prices also had a wild ride in 2021, skyrocketing as much as 600 percent from their pandemic lows, only to fall back down.

Inventory Glut and Shifting Consumer Preferences

With expectation of massive pent-up consumer demand, manufacturers and retailers alike are building up inventories. While companies do not want to be caught off-guard as they were last year, over-producing and over-ordering are real risks. Exacerbating the problem are concerns that actual customer spending will not match up with expectations to spend. A mismatch would leave a glut of inventories in warehouses and shop floors.

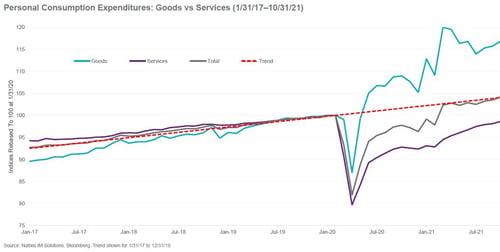

Equally important is the possibility of a more rapid return to post-pandemic normalcy. If that happens, we may see a shift in consumer preferences from goods to experiences. During the past year, spending on goods rebounded to well above pre-pandemic trends, but spending on services is yet to fully recover (see chart below). When spending on experiences and services rises, it could replace consumer demand for goods.

Closer to the End Than the Beginning

The current supply chain crisis means it will take many months for inventory levels of manufacturers, wholesalers, and retailers to get back to a comfortable percentage of sales. A telltale sign of supply glut and a forthcoming sales crash is a rapid rise in inventories in relation to sales. An inventory glut could lead to lower market prices and potential losses for businesses.

In the near term, inventory buildup should continue to support the businesses and equity values of goods and materials producers. Still, unless the demand function shifts materially higher, we might be closer to the end than the beginning of the supply cycle. In other words, stocks of goods and materials producers may have downshifted from third to second gear. A further downshift may be forthcoming.

Print

Print