On the economic front, the headline news is that the Fed raised rates another quarter point, as expected. So far, so what? But the details paint a more interesting and useful picture about what the Fed is likely to do with interest rates next year—and what that means for you as an investor.

On the economic front, the headline news is that the Fed raised rates another quarter point, as expected. So far, so what? But the details paint a more interesting and useful picture about what the Fed is likely to do with interest rates next year—and what that means for you as an investor.

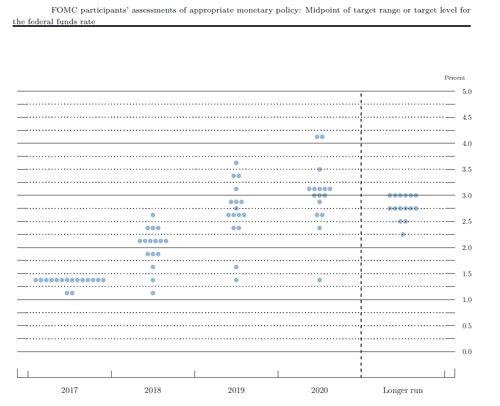

The dot plot

As we dig into the details, the first thing worth looking at is what's known as the dot plot. This plot shows individual committee members’ expectations for where interest rates will be.

As you can see from the chart, the 2017 plot reflects the meeting that just passed, where all members but two voted to raise rates. Looking at the 2018 plot, a majority of members expect three or more rate increases. And in 2019, almost all expect rates to rise further. This suggests two things:

- The upward pressure on interest rates is likely to continue.

- The Fed feels pretty good about the economy.

The tax reform bill

The economic projections confirm that, but with an interesting twist. Growth expectations were revised upward significantly from the last meeting, from 2.1 percent to 2.5 percent for 2018. While no reasoning was given, there is a clear possible cause: the likely passage of the tax reform bill, which would result in fiscal stimulus and a faster-growing economy. That growth boost, however, is expected to subside substantially after next year, as the projections are revised up much less in subsequent years—from 2 percent to 2.1 percent in 2019 and from 1.8 percent to 2 percent in 2020. The Fed does see a benefit from the tax bill, but it will be a short-lived one. Even there, it does not expect growth for 2018 to move above that of 2017.

If we put all of the pieces together, my takeaway is that the Fed anticipates the current slow growth path will continue and expects to keep raising rates anyway. The tax bill, it thinks, will extend fast growth for a couple of quarters but not do much beyond that.

What about inflation?

Inflation, the other piece of the puzzle, was left largely unchanged. In the past, the Fed has appeared worried that inflation was too low and believed that rates should be left low until it perked up. With the latest release, we see a small upward revision, from 1.6 percent to 1.7 percent, to 2017 inflation rates. But the 2018 and 2019 numbers remain the same. Whatever worries there are, they do not seem to be enough to prevent rate increases over the next year.

This set of expectations significantly lowers the bar for future rate increases. Until fairly recently, there seemed to be a real debate at the Fed over whether the economic risks were greater in raising rates or in keeping them low. This set of projections comes down firmly on the side of raising rates even at current growth and inflation rates. The economic risks appear to be contained, allowing the Fed to normalize its policy—and reload the ammunition of rate cuts for the next recession.

The Fed’s new chair

On top of the economic and institutional factors that we see, we also have to consider that Jay Powell will be taking over as Fed chair early next year. Historically, new chairs have acted swiftly to establish their anti-inflation bona fides. As a Republican nominee, Chair Powell may also be considered more hawkish in general, and new Fed nominees are likely to be so as well.

Slow but steady

After years of false starts on rate increases, the stage seems to be set for real this time. Signs of rising inflation, continued slow but steady growth, and a political slant are all aligned in the same direction. Expect slow but steady rate increases through 2018, with the very real possibility of more than the market expects.

Print

Print