In January, members of Commonwealth’s Investment Management and Research team traveled to Florida for the Inside ETFs conference, which has become the world’s largest conference on this topic. We met with and heard from industry experts and a number of ETF providers, and we networked with peers from other firms to discuss the latest trends within the ETF industry. Every year, a couple of topics seem to dominate the discussions. This year, without question, the two hottest topics were the emergence of nontransparent actively managed ETFs and the surge in environmental, social, and governance (ESG) investing.

In January, members of Commonwealth’s Investment Management and Research team traveled to Florida for the Inside ETFs conference, which has become the world’s largest conference on this topic. We met with and heard from industry experts and a number of ETF providers, and we networked with peers from other firms to discuss the latest trends within the ETF industry. Every year, a couple of topics seem to dominate the discussions. This year, without question, the two hottest topics were the emergence of nontransparent actively managed ETFs and the surge in environmental, social, and governance (ESG) investing.

SEC approves new ETF structure

In May 2019, the SEC granted approval for the first-ever nontransparent, actively managed ETF product. Then, in December, the SEC approved four additional nontransparent or semitransparent ETF structures, and they have been the talk of the ETF industry ever since.

Why is this news significant?

The holdings of traditional ETFs are disclosed on a daily basis. When you buy an ETF, you know exactly what stocks the fund holds. On the other hand, actively managed mutual funds do not have to disclose their holdings on daily basis. In fact, their holdings are often disclosed on a quarterly or semiannual basis.

Portfolio managers for actively managed funds, especially equity funds, do not want to let the investing world know what stocks they’re buying and selling every day. Their concern is the potential for “front running” or “free riding” on their portfolio decisions by a competitor, so many active managers have been reluctant to launch their strategies within an ETF advisory program. But a fund structure that employs the ETF strategy without having to disclose holdings allows active managers to protect their intellectual property (IP) when launching new ETF products or cloning existing strategies into an ETF.

In general, ETFs have many benefits over mutual funds, including potentially lower costs, intraday liquidity, and greater tax efficiency. These are a few of the reasons so much money has moved into ETFs over the past several years. With the nontransparent ETF structure, active managers now have the ability to deliver their investment strategies to investors in a more efficient vehicle.

How do the new ETFs work?

Currently, five different structures have been approved by the SEC. With a nontransparent structure, a fund discloses its holdings to a single representative who works with market participants or exchanges to place creation and redemption orders for the fund. This protects the manager’s IP because that representative is the only party with knowledge of the investment portfolio holdings.

The other four structures approved by the SEC will disclose their entire holdings once a quarter. They will also publish some information about their portfolios every day, in order to help market participants price their funds. Active managers who license these ETF structures are expected to begin launching new ETF products in 2020.

Will the new ETFs be successful?

Whether or not nontransparent and semitransparent ETFs are successful remains to be seen. Many questions need to be answered. How tax-efficient will the new ETFs be? Will these vehicles be able to attract new assets? Only time will tell, but the prospect of actively managed strategies inside a low-cost, tax-efficient program could be attractive for investors and asset managers alike.

Record flows into ESG investing

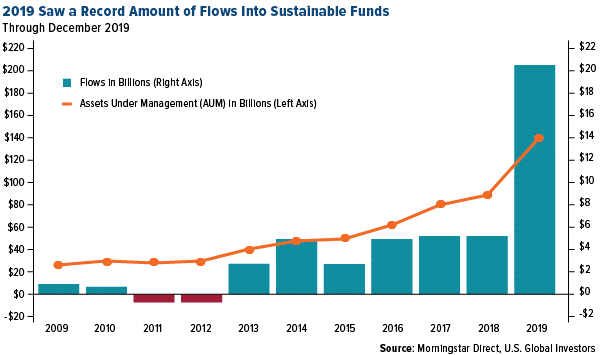

The other hot topic at the Inside ETFs conference was ESG investing. Indeed, the investment world has been talking about ESG investing for several years now, but assets flows into these products had not really taken off until 2019. Last year, as seen in the chart below, a record $20 billion in new assets flowed into this sector.

What are the primary catalysts behind this sudden surge of flows? According to discussions at the Inside ETFs conference, the flows seem to be primarily driven by institutional investors, including foundations and endowments, that are incorporating ESG into their investment policies. Secondly, a number of new ESG products have been launched, especially within the ETF marketplace, even as more and more active managers are incorporating ESG into their investment strategy.

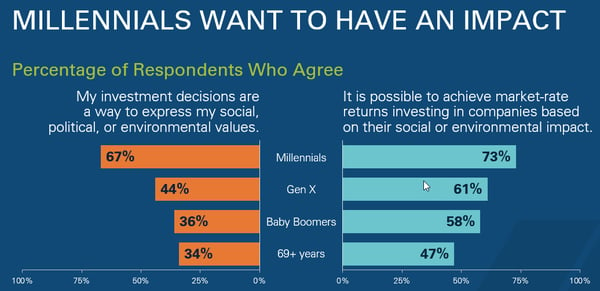

Finally, there is the emergence of the millennial investor. Last year, millennials were expected to overtake the baby boomers as the largest generational cohort in the U.S. The oldest millennials are now about 40 years old, and wealth often comes with age. And, significantly, when it comes to investing, the vast majority of millennials feel that their investment decisions are a way to express their social, political, and environmental values, according to the chart below.

Source: 2014 U.S. Trust Insights on Wealth and Worth; HBR.org

Source: 2014 U.S. Trust Insights on Wealth and Worth; HBR.org

Given these indicators, I suspect that ESG investing is still in the early stages. We may begin to see more and more product development and asset flows into this space.

What lies ahead?

The Inside ETFs conference featured many great sessions on a multitude of topics, all enthusiastically debated by industry experts and asset managers. It was clear, however, that the topics of nontransparent ETFs and ESG investing dominated the conference discussions. Given this level of interest, we’ll continue to monitor these two key investment developments in 2020 and beyond.

Exchange-traded funds (ETFs) are subject to market volatility, including the risks of their underlying investments. They are not individually redeemable from the fund and are bought and sold at the current market price, which may be above or below their net asset value.

Print

Print