Brad here. What is the next crisis? We get this question a lot. To keep up on such trends, we have to watch many things, such as countries getting into trouble. Turkey, which is currently struggling with the financial markets, is one of those countries we are watching—but not, as Anu Gaggar shows, all that worried about. This is a good case study of how we keep an eye on emerging risks. Thanks, Anu!

Brad here. What is the next crisis? We get this question a lot. To keep up on such trends, we have to watch many things, such as countries getting into trouble. Turkey, which is currently struggling with the financial markets, is one of those countries we are watching—but not, as Anu Gaggar shows, all that worried about. This is a good case study of how we keep an eye on emerging risks. Thanks, Anu!

Inflation is a hot-button issue around the world. Countries everywhere are dealing with reopening and release of pent-up demand in the midst of supply shortages. All the stimulus pumped into global economies contained the economic damage, but inflation has been mounting. Transitory or not, inflation trends are being closely monitored by central bankers, who are ready to act when needed.

The Turkish central bank has been quite busy lately, but its monetary policy actions have been unorthodox, to say the least. Even as most central banks are starting to look more hawkish, the Turkish central bank has cut interest rates—by 4 percent since September alone. Although the impact on Turkish capital markets is undeniable, there is very limited contagion risk for global investors.

Genesis of Erdoğan's Monetary Policy

Conventional economic theory states that when inflation rises, central banks fight it by raising interest rates. A rise in inflation means prices are also rising, as too much money is chasing too few goods. The solution to this problem is to tamp down on the supply of money—in other words, make money more expensive. Central bankers do this by raising interest rates. Turkish President Recep Tayyip Erdoğan’s views on economic policy are anything but conventional, and the veil of central bank independence is nonexistent in Turkey. As a result, the Turkish central bank was forced to cut its key policy rate even as the annual inflation measure reached nearly 20 percent.

Erdoğan’s view on the interaction of interest rates and inflation has its underpinnings in a school of thought that has been called neo-Fisherism. This theory is based on the work of the American economist Irving Fisher. It suggests that, in certain circumstances (as was the case in developed markets following the great financial crisis), central banks are not able to create inflation by cutting interest rates. In that vein, central banks should be able to decrease inflation by cutting interest rate targets instead of increasing them as orthodox monetarism would dictate.

Erdoğan, who was a businessman before his political career took off, has witnessed the downsides of high or volatile borrowing costs. He believes that when companies have to pay more to borrow money for operating expenses, they pass on the higher costs to consumers, with higher inflation as the result.

Dangers of Unorthodoxy

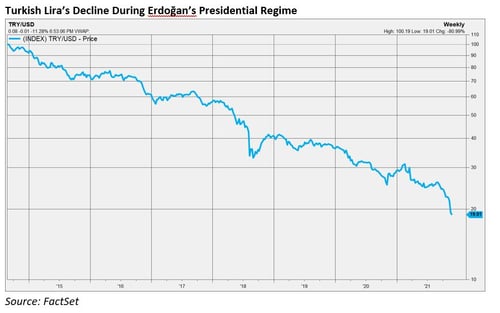

Unfortunately for Erdoğan and Turkey, what is applicable in developed markets is not necessarily applicable in developing economies such as Turkey. Developing economies don’t always have the credibility to keep interest rates low in the face of rising inflation. When they do limit interest rates, they risk losing the confidence of investors and their currencies bear the brunt of the damage. Since Erdoğan became president of Turkey in 2014, the lira has lost nearly 80 percent of its value, including 35 percent in this year alone (see the chart below). That’s thanks to a combination of geopolitical tensions with the West, current account deficits, shrinking currency reserves, mounting debt, and, most importantly, a refusal to allow central bankers to act independently.

A Crisis of Its Own Making

Turkey’s irrational experiment with monetary policy is making it harder for the country to service its foreign-denominated debt. According to Fitch Ratings, in August, 57 percent of Turkey’s central government debt was linked to or denominated in foreign currency. As the country loses credibility and the lira continues its free fall, paying this debt becomes more painful. Rolling the debt over or finding lenders becomes very difficult. Although a return of tourism brought Turkey’s account into a slight surplus, higher commodity prices will challenge the country’s economy. As 74 percent of Turkey’s energy needs are imported, a decimated currency makes its energy bill go through the roof. With dwindling foreign exchange reserves, there is a real risk of a balance of payments crisis. A fall in the Turkish government’s credibility could also lead to a run on the banks. High inflation and tight financial conditions make a tenuous post-pandemic recovery even more untenable.

Limited Contagion Risks

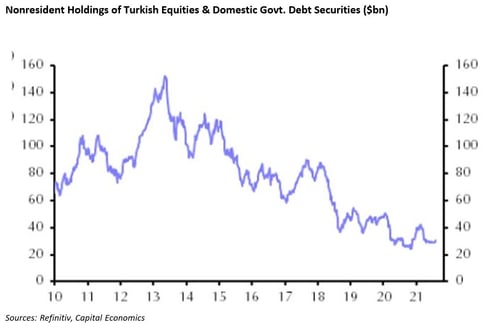

If Turkey’s crisis were to worsen, we might see sentiment sour in the near term for a few other vulnerable emerging market currencies. External vulnerabilities by way of big current account deficits or external financing needs are low or have been reduced for most emerging markets countries, however. Contagion risks for other countries are also low due to far fewer cross-country trade and financial exposures. Taking cues from the several years of policy mistakes, foreign investors have already pared back their exposure to Turkey.

According to Capital Economics data (as shown in the chart below), nonresidents’ holdings of Turkish equities and domestic government bonds are, in dollar terms, only one-third of the size recorded on the eve of Turkey’s 2018 crisis. Exposure of foreign institutions to Turkish bank and nonbank borrowers is also minimal, with the exception of a few European banks. As a result, absolute losses for holders of Turkish assets would probably be lower and forced selling of other emerging market assets might be smaller.

Consequences of Erdonomics

To conclude, thanks to Erdonomics, Turkey is indeed being served for the holiday season this year. The rug has been completely pulled out from under the currency and investors’ confidence. With the central bank’s commitment to deliver another rate cut by the end of the year, things might only get worse in the near term. For investors, Turkish assets are selling at flea-market prices. Still, it is hard to build a fundamental case for holding them as long as the central bank is forced to work under the shadows of Turkey’s president. Overall, however, the contagion risks of a Turkish meltdown to other emerging and developed markets are low due to the low number of trade and financial linkages with Turkey.

Print

Print