In the past 24 hours, I’ve had several discussions that centered on the question “What do we do now?” During one, on Fox Business News yesterday afternoon, the anchor pointed out that, even as I was cautious on equities, the market had climbed a wall of worry all year—and looked likely to continue to do so. Does that make caution on equities wrong? Similarly, I was talking with a Wall Street Journal reporter this morning about where the market was going, and we got into the continuing government confrontation, earnings, and the real economy—all without coming to any real conclusions.

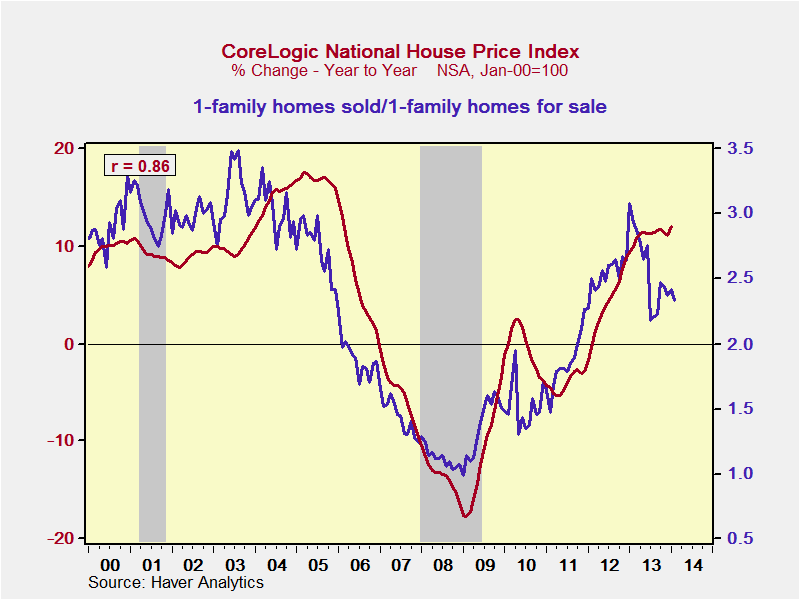

First things first: The fact that the market keeps going up doesn’t mean everything is all right. Under that standard, the housing market was perfectly fine in 2007, so I don’t think the fact that the market is rising means caution is inappropriate.