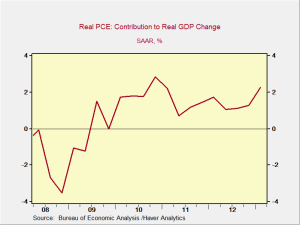

I saw an interesting chart the other day, in a piece by the analyst Jim Paulsen, that showed how the U.S. economy had performed net of the government sector—which, to spare you the suspense, was actually quite well. We’re also seeing increasing debate over federal spending cuts: Are they needed in the short term in the U.S., or are they doing more harm than good?

The austerity debate is also well underway in Europe, and it is starting to be resolved in favor of more spending—at least on a political level. That’s a different discussion, though. Here in the U.S., it is both easier and harder to justify less austerity. Easier, in that we can better afford it; harder in that we need it far less.