Last week, I happily returned to yet another tradition that was disrupted by COVID-19: back-to-school shopping. Although I did not miss paying for the rapidly changing school wardrobes of two teenage girls last year, I welcomed the feeling of normalcy the shopping routine brought to my family. COVID-19 and its associated restrictions have had a huge impact on children—educationally, socially, emotionally, and physically. We’ve all seen this. But did you know that, because of the pandemic, children may grow up to be worse off financially than their parents?

Last week, I happily returned to yet another tradition that was disrupted by COVID-19: back-to-school shopping. Although I did not miss paying for the rapidly changing school wardrobes of two teenage girls last year, I welcomed the feeling of normalcy the shopping routine brought to my family. COVID-19 and its associated restrictions have had a huge impact on children—educationally, socially, emotionally, and physically. We’ve all seen this. But did you know that, because of the pandemic, children may grow up to be worse off financially than their parents?

Pandemic-Induced Learning Loss

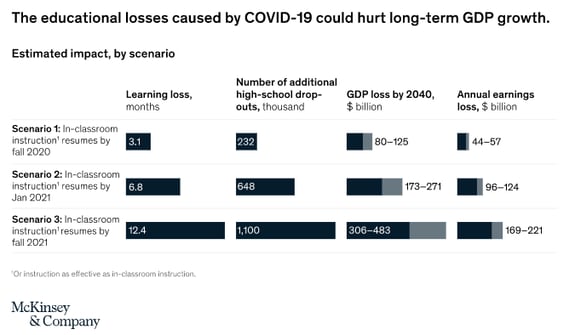

According to a 2020 study by McKinsey, the extended disruption caused by a pandemic lasting one and a half years (and counting) caused devastating effects for the U.S. educational system. Despite the efforts of teachers, administrators, and parents to sustain education, the school closures resulted in a learning loss of varying degrees for children. For lower-income students and students of color—children who have already been affected by existing educational gaps—the learning loss was disproportionately large. The social and emotional disruption caused by the pandemic, as well as the associated anxiety, could also hurt the academic performance of students.

Furthermore, McKinsey estimated that the school shutdowns could potentially increase high-school dropout rates. As reported in that study, following school closures caused by natural disasters such as Hurricane Katrina (2005) and Hurricane Maria (2017), 14 to 20 percent of students did not go back to the classroom. What if that same trend occurs following the COVID-19 pandemic? An additional 2 to 9 percent of high-school students could drop out of school. Finally, the loss of learning may extend beyond the pandemic if tight state and local budgets lead to cuts on education spending.

Assessing the Economic Impact

Learning losses and greater high-school dropouts due to school disruptions are not easily reversible or temporary. On the contrary, they could lead to long-term economic effects on individuals, communities, and countries. Learning disruption leads to fewer skills acquired by the future cohort of workers and, hence, lower earning potential than that of the generations prior. McKinsey estimated that if large-scale in-person learning was pushed out to January 2021, an average K-12 student could lose $61,000 to $82,000 in lifetime earnings.

The impact of this could be far-reaching, given the potential for the U.S. to experience economic harm from the pandemic-induced school closings. According to McKinsey estimates, depending on the length of the disruption, the loss in learning and earnings potential could shave anywhere from 0.3 percent to 2.2 percent of GDP by 2040. Furthermore, if other countries are able to mitigate the impact of lost learning, the long-term economic competitiveness of the U.S. could drop.

Source: McKinsey & Company

How Can We Help?

There is a real possibility that, due to the pandemic, future generations will be financially worse off than our generation (all other things being equal). This scenario calls for urgent action by policymakers, school administrators, teachers, parents, and communities. How can financial professionals help? We can leverage our skills and contribute to the solution to the problem. To this end, we can educate younger generations on how to make the dollar work harder for them.

In other words, we can offer financial literacy as a tool to mitigate the impact of lower potential earnings. If the school and college cohort can start saving and spending wisely early on, that will help them later on. They may be able to better manage debts, build good credit, and make educated investments. If individuals plan well for their financial futures, they will have a greater chance for a fulfilling life. For more information on the importance of good financial practices, this page on National Financial Awareness Day, which we just celebrated on August 14, is a useful source.

This school year, let’s pledge to invest in financial literacy, for our children, and for the children in our communities. As a parent, I strongly believe that if I don’t want to run the Bank of Mom and Dad forever, I need to invest in the financial literacy of my children.

Print

Print