It was so good to see the spooky season back in full swing last week. Many of the Halloween events unfortunately canceled in 2020 were back this year. Ghosts, witches, princesses, and others in costume were making the neighborhood rounds, yards were decorated with Halloween props, and many other fall festivities were back.

It was so good to see the spooky season back in full swing last week. Many of the Halloween events unfortunately canceled in 2020 were back this year. Ghosts, witches, princesses, and others in costume were making the neighborhood rounds, yards were decorated with Halloween props, and many other fall festivities were back.

Best Time of the Year

Halloween is understandably a favorite holiday for many. Guess who else loves this time of year? Equity markets! That’s because Halloween marks the beginning of a seasonally strong period for market returns. This phenomenon, which is called the “Halloween effect,” can be described as a market timing strategy proposing that stocks perform better between October 31 and May 1 than they do between early May and the end of October (hence the “sell in May and go away” adage).

Genesis of the Strategy

The Halloween strategy is believed to have originated in the 16th century in London, when the rich and privileged—those who had access to equity markets in that time—would leave the city around May to head to their homes or estates in the countryside. During the summer months, these investors were known for not attending to their portfolios or moving their money into lower-risk assets. In our time, a similar phenomenon is believed to occur in the U.S. when brokers, analysts, and other investors leave their Wall Street firms or the cities and head off to their summer oases.

Nonbelievers Abound

For believers in the efficient markets hypothesis, this seasonal trading strategy is an old wives’ tale. Such a profitable trading strategy should not be able to exist. If it ever did, it should have been arbitraged away by now, rather than be sustained for decades, if not centuries. Many researchers and academics have gone down the rabbit hole of trying to poke holes in this phenomenon or, alternatively, to find a strong plausible reason for it to exist. They have come back empty-handed. Mysteriously, the Halloween effect appears to be alive and kicking not just in the U.S. but in many other major equity markets across the globe.

A Quick Sanity Check

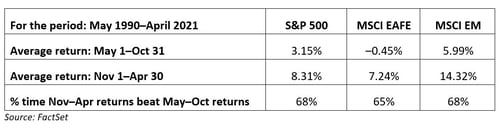

Many academic papers have been written about the Halloween effect, using in-depth analysis proving its statistical significance over long periods of time and across many markets. Still, I decided to do a quick sanity check by looking at the data myself. The table below compares the May to October and November to April returns for the S&P 500, MSCI EAFE, and MSCI Emerging Markets (EM) indices from 1990 to 2021.

According to the data, the Halloween effect appears to exist. Average returns for November to April are much higher than those for May to October for all three indices.

And the Cause?

Many theories have been put forth for the existence of the Halloween effect, but none of them appear conclusive. The belief remains that summer vacations lead to reduced market liquidity and risk appetite. Hence, in theory, returns will be lower in the summer months. But is there any truth here? The existence of electronic trading, which lets anyone trade from anywhere, weakens the argument. Doubts have been raised due to the potential impact of the January effect, given that investors may be buying stocks in January for the new tax year. Still, some researchers have found that, even after controlling for the January effect, the Halloween effect exists.

Believe It or Not, Stay Invested

Data shows that the Halloween effect is not just folklore but a mysterious reality of the stock markets. Without a logical explanation for its occurrence, it’s hard to comprehend the phenomenon. Nevertheless, for investors, the Halloween effect provides yet another reason to stay invested in the equity markets, especially in this seasonally strong period of the year.

Print

Print