“If you are driving in a fog, you slow down.” — Fed Chairman Jerome Powell, October 29, 2025

“If you are driving in a fog, you slow down.” — Fed Chairman Jerome Powell, October 29, 2025

Investors entered the week expecting the Federal Open Market Committee (FOMC) to once again reduce rates by 25 bps—and that’s exactly what happened. The target for the federal funds rate stands at 3.75 percent to 4 percent. The FOMC also announced it would end its balance sheet runoff as of December 1. This is viewed as a restrictive form of monetary policy, reducing the amount of liquidity from the market; ending it is seen as a form of easing by investors. All of that is good news for markets.

Although the lack of government data due to the shutdown (now on its 30th day) didn’t affect this meeting’s decision, it could set up a debate about the path ahead. For the third straight meeting, there were dissenters to the policy decision. As he did in September, Governor Stephen Miran dissented in favor of a 50 bp reduction. Perhaps more interestingly, Kansas City Fed President Jeffrey Schmid dissented in favor of no change to interest rates.

So, will there be more rate cuts ahead? Investors are left to read the tea leaves and listen to upcoming comments from Fed officials to determine whether rates will be reduced at the Fed’s next meeting in December.

What the Fed Knows

The lack of official government data means the Fed doesn’t have all the tools it normally has to make decisions. But Chairman Powell made it clear that the Fed would know if there had been a dramatic change in the economic outlook and that it has not seen any indication of that. The Fed continues to believe the employment market is cooling slowly, mentioning that nongovernment data indicates that scenario remains true. The chairman cited jobless claims and jobless openings as remaining fairly stable. All this seems to indicate that the Fed believes the employment outlook is similar to what it was in September and, therefore, another risk management interest rate cut was warranted.

On the inflation side of the Fed’s dual mandate, Powell stated that if the impact of tariffs were removed, the rate of inflation would be close to the Fed’s target of 2 percent. But the reality of the situation is that tariffs are having an impact, which can be seen in goods pricing. There is, however, some good news. Housing inflation is moderating. This is certainly a positive for the Fed in achieving its longer-term goal once the impact from tariffs cycles through the data.

What Could Happen in December

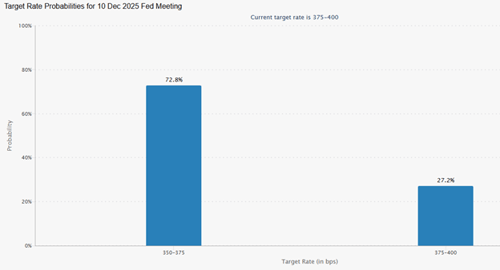

The biggest takeaway from Chairman Powell’s post-meeting press conference was his confirmation that there are sharp differences within the committee when it comes to what to do in December. He also mentioned that a rate cut was not a foregone conclusion. This ran counter to market expectations leading up to Wednesday’s decision. At that point, market participants pegged the probability of a third 25 bp rate cut in December at over 90 percent. But these expectations quickly adjusted downward.

Source: CME FedWatch (as of 10/30/2025)

The chart above shows there is a roughly 70 percent chance that rates will be cut in December. This suggests that market participants consider the possibility of a pause in December to be at least on the table for the time being. There are multiple reasons this could happen. First, there may be a continued lack of clarity about the economic outlook if government data remains delayed, which is what prompted Chairman Powell’s quote at the beginning of this article. A pause could also result if there is an indication that the jobs market has stopped slowing or the impact of tariffs on inflation accelerates.

What It Means for Investors

Powell’s confirmation that there is no guarantee of another rate cut in December caused the market sell-off after the meeting. Granted, markets were at all-time highs earlier in the day. So, a muted reaction to the meeting wouldn’t have been a surprise, no matter what the Fed had to say.

But not long after the Fed meeting ended, investors turned their attention back to fundamentals. Earnings reports, highlighted by Alphabet, Meta Platforms, and Microsoft, gave investors something to think about, with pluses and minuses to consider. We believe corporate earnings continue to be a positive story for investors and should be supportive for markets moving forward.

Broadly speaking, S&P 500 third-quarter earnings continue to beat analyst expectations, as was true in the first quarter and the second quarter. This performance should cause full-year 2025 and 2026 estimates to tick higher, providing a solid fundamental backdrop for market participants.

While the sentiment of an easing Fed is certainly welcomed by investors, October is currently on pace to be the sixth straight month of positive returns for the market. With uncertainty around Fed policy going forward and the ongoing government shutdown, there is the potential for volatility ahead. But companies across a large swath of the economy continue to report solid earnings. On top of that, we’ve seen good news on trade policy, particularly with China. These should provide decent tailwinds for investors over the intermediate term.

Print

Print