Brad here. Today, I’m pleased to introduce a post by Andrew Kitchings, a portfolio manager with Commonwealth’s Investment Management and Research team. Enjoy!

Brad here. Today, I’m pleased to introduce a post by Andrew Kitchings, a portfolio manager with Commonwealth’s Investment Management and Research team. Enjoy!

When analysts talk about the economy, the focus is often on consumer sentiment—to what degree people feel good enough about their financial prospects to keep spending. As consumer spending drives two-thirds of the U.S. economy, looking at consumer sentiment as a key indicator makes sense. Or does it?

Consumers don’t lead, they react

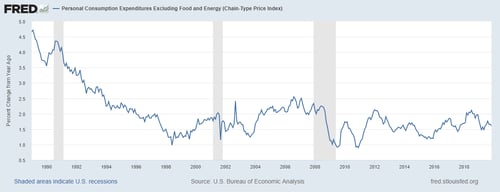

As the chart below indicates, during the past three recessions, U.S. consumers kept spending during the downturn and only stepped back once the bottom fell out of the economy. From this data, we can see that consumer spending does a poor job as a leading economic indicator. Consumers merely react to the economy, rather than lead it.

Business is better

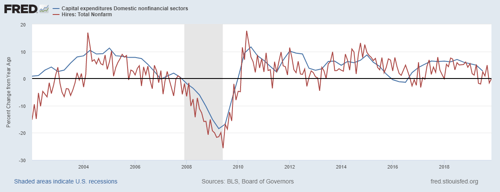

Businesses, on the other hand, can quickly adjust to economic challenges by changing the amount of funds allocated to capital expenditures and personnel hires. As demonstrated by the chart below, these levers for business development can be managed relatively quickly, based on the outlook for the overall economy. Accordingly, business is a better leading indicator for the health of the economy than the consumer. (Insights such as this are discussed regularly in our Economic Risk Factor Update.)

Look to the CFOs

We should also look beyond the headlines and consider the actions of the corporate leaders writing the checks—the CFOs—to track shifts in business sentiment. As a harbinger of economic trends, these shifts give us valuable insight into factors that could soon be influencing the broader economy. Here, we are fortunate to have the Duke CFO Global Business Outlook, which is a joint enterprise of Duke University and CFO Magazine.

The Duke CFO Global Business Outlook, completed on a quarterly basis since July 1996, is a global survey of CFOs from both public and private companies. The survey asks about corporate spending, employment trends, and optimism regarding the economy. To drill down into the optimism component, questions get into specific details regarding sentiment about the respondent’s own company, the U.S. economy, and the broader economy. By capturing the CFO’s expectations for the next 12 months, the survey can shed light on future growth trends.

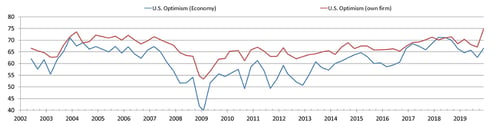

CFOs, in general, are currently optimistic about how their firms are positioned for the next 12 months. As for their optimism about the general economy, their thoughts have changed over time. Looking back, CFOs were less optimistic about the U.S. economy at the end of 2007 and in early 2008. During the long bull market that followed the financial crisis, both firm-specific optimism and broad economic optimism moved higher. Then, in 2019, as concerns regarding global trade flared, CFO sentiment once again started to shift downward. The chart below captures these changes in sentiment.

CFO views on the aggregate economy can be understood by looking at their approvals for capital expenditures and R&D projects. During periods of subdued or declining optimism about the economy, CFOs expect that their firms will cut back on capital and R&D spending. This trend was evident in the September 2019 survey, which captured the peak of global trade uncertainty that was driven by daily announcements regarding the U.S. and China trade policy. Subsequently, the negative expectations on corporate spending were reversed in the responses to the December survey. At that point, the trade rhetoric quieted down and the phase one deal had been signed.

Monitoring the health of the economy

Toward the end of 2019, business sentiment clearly indicated that the general health of the economy was inching into the trouble zone. This risk gave investors cause for concern. Recently, however, sentiment has bounced higher, which could lead to an uptick in business spending. In turn, higher spending could serve as a tailwind for the U.S. economy for the next couple of quarters. The situation will bear watching, however, as business sentiment could quickly turn and become a headwind for the economy. Thus, it’s only one of several indicators that we must actively monitor to understand the current and future health of the economy.

Print

Print