Tensions between Russia and Ukraine are showing no signs of abating. The geopolitical implications of further escalation could be quite dire and complicated. Although the deadlock may be resolved through diplomacy, we are watching for the impact on asset prices if the conflict escalates. Energy and commodity markets could be in the immediate line of fire, but repercussions may also be felt in the region’s equity and fixed income markets. Finally, if the situation worsens, the ripple effects could be more broad-based and have an impact on global inflation expectations and monetary policy.

Tensions between Russia and Ukraine are showing no signs of abating. The geopolitical implications of further escalation could be quite dire and complicated. Although the deadlock may be resolved through diplomacy, we are watching for the impact on asset prices if the conflict escalates. Energy and commodity markets could be in the immediate line of fire, but repercussions may also be felt in the region’s equity and fixed income markets. Finally, if the situation worsens, the ripple effects could be more broad-based and have an impact on global inflation expectations and monetary policy.

First, Some History

Before declaring independence in 1991, Ukraine was part of the former Soviet Union. After breaking away, Ukraine began developing stronger ties with the West, much to the dislike of Russia. Former Ukrainian President Viktor Yanukovych attempted to revert to old allegiances with the Kremlin, but his actions led to an uprising and he was removed from power in 2014. In response, Russia annexed Crimea and supported a separatist uprising in Ukraine’s southeastern region. The 2015 Minsk protocol was signed as a peace deal between the two countries. Nonetheless, low-level fighting has continued over the years as both sides have accused the other of violating the agreement. Agitated by NATO and the West’s support of Ukraine, Russia is continuously looking for ways to assert control over Ukraine and reclaim its sphere of influence. Amid brewing tensions, Russia has deployed more than 100,000 Russian forces at the Ukrainian border. The U.S. and a few other allies are strategizing sanctions or other diplomatic approaches to de-escalate the situation.

A Conflict with Broad Implications

Russia is the world’s largest exporter of natural gas and second-largest exporter of crude oil and petroleum products. It supplies about a third of Europe’s energy and is a major producer of grains, ammonia, aluminum, nickel, palladium, and platinum. At a time when the world is dealing with rising energy prices and supply-demand imbalances in several metals and commodity markets, a steady supply of commodities from Russia is crucial. Hence, talks of steep sanctions on Russia have so far remained largely speculative.

On the other hand, the ruble and Russian equity and fixed income markets are already pricing in increased risk of economic damage to Russia from the ratcheting up of war rhetoric and potential for sanctions. Russia’s defense spending will rise even as its export revenues might fall. Its international financial linkages might be frozen, at a time when its economy is recovering from the Covid-19 shock.

Given this environment, there are two broad categories of outcomes of the current standoff between Russia and Ukraine: escalation and resolution.

Potential Impact of Escalation

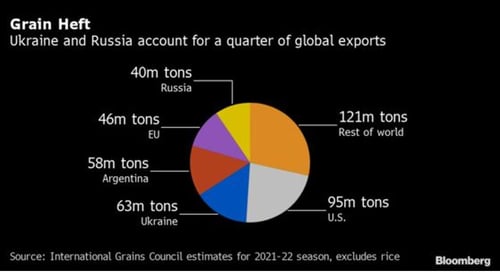

If the situation worsens, Ukraine may be invaded by Russia or subject to aggressions in other forms. If this happens, the markets could get edgy. If Russian energy supplies are disrupted, energy prices could spike higher, especially in European markets. This pressure would keep eurozone inflation elevated, squeezing household incomes and spending, and make the European Central Bank’s job even harder. Food prices could be the next major casualty. As shown in the chart below, Russian/Ukrainian grains exports (wheat, barley, corn) represent 24 percent of the global total, 50 percent of sunflower products (seeds, meal, and oil), and 21 percent of rapeseed products, according to Rabobank. If a resolution is not reached by the spring planting season, prices of some grains will likely rise and may even double. In addition, Russia is one of the world’s largest exporter of key metals. Any disruptions to these exports could exacerbate the already stressed supply chains and amplify inflation across the globe.

In the case of escalation, sanctions might be imposed on Russia, which may include barring Russia from transacting on the SWIFT payment system, which routes most international money and security transfers. This would be detrimental to Russia’s economy and strengthen its resolve to lean east to build alliances for a new world order. Russian economy could suffer in the near term, and the shaky global recovery could also be affected.

What Resolution Might Look Like

If an outright resolution is achieved (which is highly unlikely) or some forms of concessions are made (which is much more likely), the markets will react positively. Even in the case of stalemate, the markets might shrug off fears of a worse outcome. European gas prices could fall after the winter spike in demand, and diplomatic discussions might lead to other positive economic outcomes. Russian asset prices would likely rebound strongly, supported by an otherwise strong economy.

Be Aware, But Not Impulsive

If we could be on the brink of a war, should we de-risk our portfolios? History tells us that geopolitical issues are simmering all the time. Barring exceptional circumstances, however, such conflicts do not have a lasting impact on the markets. As an example, during the Crimean crisis in 2014, Russian equities sold off sharply but they recovered very quickly (see the chart below). Eurozone and aggregate global equities kept marching higher. Besides, escalation of the current situation to an actual war is not the most probable outcome at this time.

Investors should be aware of escalation of the Ukrainian crisis as a tail risk—an event that has a small probability of causing long-term harm to the markets. In the near term, some opportunities could arise in the energy and commodity markets. On balance, given Europe’s greater vulnerabilities and linkages, it could be disproportionately affected. Over the longer term, it is the macroeconomics and fundamentals of countries and companies that will drive asset prices. In other words, keep calm and carry on.

Print

Print