Rising home prices have been the focus of countless headlines throughout the past year. Accelerated demand in a tight real estate market has produced some captivating statistics. Recently, the National Association of Realtors (NAR) reported that the third-quarter median sale price for an existing single-family home was 16 percent higher year-over-year. That marks a record since the NAR began capturing the data in 1968.

Rising home prices have been the focus of countless headlines throughout the past year. Accelerated demand in a tight real estate market has produced some captivating statistics. Recently, the National Association of Realtors (NAR) reported that the third-quarter median sale price for an existing single-family home was 16 percent higher year-over-year. That marks a record since the NAR began capturing the data in 1968.

Drivers for Residential Real Estate

In our weekly Monday Update on economic news, we’ve discussed how the lack of U.S. housing inventory has contributed to rising home prices and rent growth nationally. In May of this year, Freddie Mac estimated that the U.S. housing shortage reached 3.8 million units at the end of 2020. That represents an increase of 52 percent from the shortage of 2.5 million units in 2018.

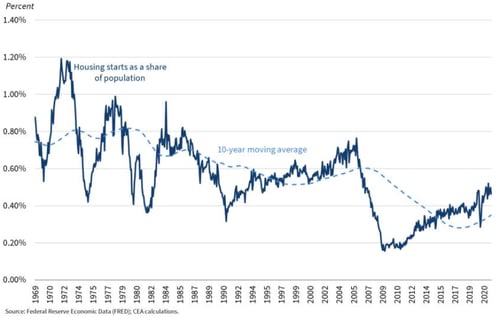

Housing demand. Feeding this deficit are household formations from the largest demographic in the U.S., the millennial generation. Millennials provide a steady stream of housing demand that builders have been unable to keep up with. Today’s high cost of construction materials and labor shortages are among the factors slowing an already lagging development pipeline for new homes. The chart below, produced by the Federal Reserve Bank of St. Louis, shows U.S. housing starts per capita dropping off during the 2007–2009 financial crisis and making a slow recovery.

Housing scarcity. Housing scarcity is most prominent for entry-level homes in many markets across the country. Unable to increase their budgets while carrying the largest share of a $1.6 trillion national student loan debt, many millennials are being forced into crowded rental markets. This trend sets the stage for the double-digit year-over-year rent growth and rock-bottom vacancies we’ve seen in 2021. In fact, rent growth measured by the CoreLogic Single Family Rent Index was 10.2 percent in September 2021. This statistic marks the speediest year-over-year increase in 16 years.

The coming year. Conflicting forces throughout the coming year are projected to result in continued growth for single-family home prices, albeit at a more moderate pace. With more than 45 million millennials in the prime first-time home buying ages of 26 to 35 in 2022, there’s a large pool of unquenched demand creating a support level for home prices. Tightening labor markets may continue upward pressure on wages, thereby providing more funding for home buyers. Higher mortgage rates will put a strain on budgets.

Demand for Real Estate Stocks

On the securities markets, residential real estate company stocks have also seen increased demand, encouraged by the lack of income-generating alternatives. Dividends for these stocks currently average around 3 percent per FactSet as of December 20, 2021. Investors may increase allocations to real estate as a means of meeting portfolio income objectives or as a partial hedge against inflation. Property types with shorter lease durations, like apartment buildings and self-storage centers, provide landlords the opportunity to adjust rents more frequently to compensate for rising inflation. This helps to preserve the real value of income produced by the assets. These supply-and-demand dynamics have supported the growth of residential real estate securities, which have on average outperformed the S&P 500 year to date, according to FactSet as of December 20, 2021.

Menu of Residential Real Estate

For more than a decade, the multifamily apartment building has been a core holding for institutional real estate portfolios. Cap rates, which measure the required rate of return implied by direct real estate transactions, are now at historic lows. This environment implies a high level of investor confidence for this property type. But it’s not just apartment buildings that have the attention of big investors. In the evolving institutional market, asset managers are finding new ways to add diverse exposure to housing demand. They’re expanding their opportunity set to include property types such as single-family rental houses, self-storage facilities, student housing, and manufactured housing.

Single-family rentals. According to Invitation Homes, Inc. (INVH), the largest publicly listed single family rental REIT, as of April 2021 institutional owners only accounted for 1.85 percent of the single-family rental market, but interest is growing. Single-family homes built specifically for renting represented 6 percent of all home construction in 2020, up from 4 percent in 2019. Tenants of single-family rentals stay longer, on average, than apartment tenants. The single-family properties may also provide flexible exit options to the benefit of investors. Asset managers can choose to sell a single house or an entire consolidated portfolio of homes. In contrast, selling an apartment building is generally an all-or-nothing transaction.

Self-storage demand. Self-storage properties share in many of the same factor sensitivities as residential housing. Demand for storage space is projected to increase as baby boomers continue to downsize homes, thus increasing their need for storage space. Generation X is aging into the primary self-storage customer demographic.

Looking Ahead

With interest rate hikes expected in 2022, many investors are wondering how this might affect commercial real estate portfolios and the demand for rental housing. Continued rent growth and persistent demand may provide support to property values. Investors should take caution and moderate return expectations, however. As the cost of debt increases with interest rates, profit margins may slim for leveraged commercial real estate investments. Rising yields on fixed income securities could draw away some investors seeking income at reduced risk, also applying downward pressure on values. As always, investors should take a long-term perspective, consider their investment objective, risk tolerance and investment goals, and speak to a financial advisor before making any financial decisions.

Investments are subject to risk, including the loss of principal. Some investments are not suitable for all investors, and there is no guarantee that any investing goal will be met. Talk to your financial advisor before making any investing decisions.

Real estate investments are subject to a high degree of risk because of general economic or local market conditions; changes in supply or demand; competing properties in an area; changes in interest rates; and changes in tax, real estate, environmental, or zoning laws and regulations. A nontraded real estate investment trust (REIT) is a REIT that is not traded on any public stock exchange. Nontraded REITs are generally illiquid securities for which no public market exists. As such, investors may be unable to liquidate the security at any price. You should consult with your financial advisor and carefully consider your short-term and long-term liquidity needs. Real estate units/shares fluctuate in value and may be redeemed for more or less than the original amount invested. There is no assurance that the investment objective will be attained.

Print

Print