Brad here. As we talk about inflation (and we will have more to say next week), the real question for us, as investors, is what we should do with our portfolios. No one is more qualified to answer that question than Pete Essele, who runs our Preferred Portfolio Services® Select asset management program. Here are his thoughts—have a great weekend!

Brad here. As we talk about inflation (and we will have more to say next week), the real question for us, as investors, is what we should do with our portfolios. No one is more qualified to answer that question than Pete Essele, who runs our Preferred Portfolio Services® Select asset management program. Here are his thoughts—have a great weekend!

The recent inflationary environment has investors asking, how do I protect portfolios against a rise in inflation? More specifically, they’re wondering how to preserve the real value and purchasing power of their investments. It’s a valid question, so let’s dig into how one can protect portfolios in practice.

Diversification Is the Name of the Game

One of the best ways to hedge inflation is through a properly diversified portfolio, which includes growth and value equities, especially the latter. An asset class that has been shunned by many investors in recent years, value equities are experiencing a resurgence in demand. The renewed interest in the asset class is due to equity areas within that help protect in rising rate and inflationary environments. Financials, for instance, generally do well in a rising rate environment, and many value-oriented indices are heavily allocated to the sector. In addition, the value asset class is where you’ll find inflation-sensitive sectors like energy.

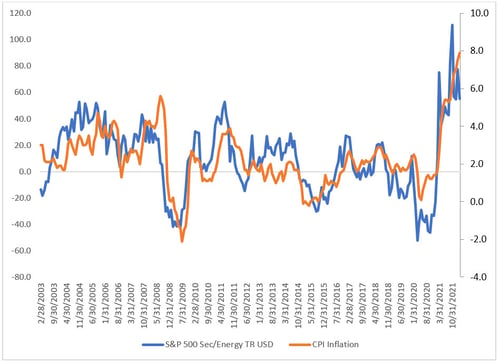

The chart below shows the rolling one-year returns of the S&P 500 equity sector alongside year-over-year changes in inflation. It’s evident that there’s a very high correlation between energy equities and price changes in the economy over time. In fact, the energy sector has a higher correlation to inflation than any other S&P 500 sector, which makes it an attractive option for preserving the real value of portfolios! If you own a diversified portfolio of equities that largely mimics the sector breakdown of the S&P 500, you’ll generally have around 5 percent to 10 percent in energy names. Therefore, in most cases, there’s really no need to start adding additional positions to help insulate against inflation because those exposures are already embedded in portfolios.

Rolling One-Year Return S&P 500 Energy Sector and Year-Over-Year Inflation

Source: Haver/Commonwealth Financial Network

Commodities as an Inflation Hedge?

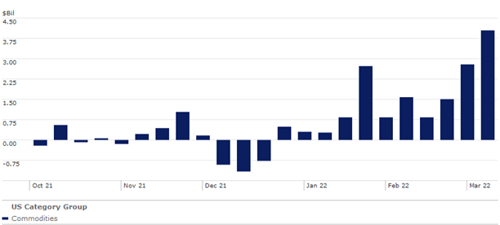

When many investors hear inflation, the first asset class that comes to mind is commodities. Commodities can be an effective inflation hedge over time, so it seems like a natural fit in this inflationary environment. The problem, however, is that everyone knows that’s the case, and monies have piled into the space at an alarming rate as of late. The chart below shows the weekly investment flows into commodity-related strategies according to Morningstar, with the week ending March 9 seeing over $4 billion in flows, a substantial amount for any asset class.

Investment Flows into Commodity-Related Funds

Source: Morningstar

The rush of interest and acceleration of demand have caused a distortion in prices, with some commodity-related ETFs trading at premiums relative to their net asset value (NAV). Prices quickly reverted in subsequent trading periods, and the premium was erased. ETFs have mostly traded near their NAV until recent periods, where strong demand is greatly outpacing available supply.

If you elect to introduce direct commodity exposure in this environment, it’s important to understand the associated costs and risks, both explicit (premiums to NAV) and implicit (valuation). Many of the common commodity ETFs out there are heavily allocated to oil, a commodity that is currently trading around all-time highs. It’s also an out-of-benchmark exposure (if managing portfolios to common equity benchmarks), which could introduce tracking error. If inflation subsides in the coming quarters, as is the Fed’s intention with monetary tightening, there’s a very real risk that commodities and related areas will come under pressure.

Maintain the Course

With portfolio construction, one of the best things you can do to protect yourself is to properly diversify and allocate to a broad array of portfolio exposures. While certainly not the most exciting approach, it can be an effective method for portfolio allocators who produce sustainable, long-term value over time (although past performance is no guarantee of future results). Unfortunately, far too often, investors chase performance and start overconcentrating portfolios, which can leave them exposed when the tide turns against them. In recent years, many investors have shed their value exposures in favor of growth names, concentrating away from an asset class that generally does well in rising rate and modest inflationary environments.

As the late, great American economist Paul Samuelson once said, “Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.” I couldn’t agree more.

Exchange-traded funds (ETFs) are subject to market volatility, including the risks of their underlying investments. They are not individually redeemable from the fund and are bought and sold at the current market price, which may be above or below their net asset value.

Print

Print