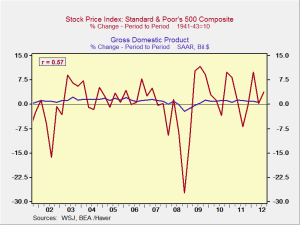

The good news is that GDP growth came in a bit better than expected—at 2 percent versus 1.8 percent, which is up from 1.3 percent in the previous quarter. This was front-page news in the weekend editions of the New York Times (NYT) and the Wall Street Journal (WSJ). For the first time in two years, government spending was a major driver of growth. Consumer spending was also a significant contributor, but it came at the cost of lower saving rates, so it may not be sustainable. Business investment dropped, as did exports, in the face of growing weakness in Europe and China.

The sustainability of the growth is questionable, given that government spending is very likely to decrease going forward; in addition, consumer spending is also likely to slow (at best) as the fiscal cliff tax increases come closer. Nonetheless, a good quarter.