Today's post is from Anu Gaggar, senior investment research analyst.

Today's post is from Anu Gaggar, senior investment research analyst.

To the surprise of many, MSCI Emerging Markets Index returns in 2020 matched those of the S&P 500. Given this strong performance, are there reasons to be optimistic about emerging markets in 2021? Indeed, there is much to like about their fundamental outlook, and patient investors could benefit from a strong rebound in earnings. That being said, there are near-term risks to be mindful of: the strong snapback in 2020 implies that emerging market equities do not have the wind of extremely cheap valuations behind them. Plus, they continue to face challenges, with potential restrictions arising from the spread of new coronavirus variants and rising U.S. interest rates.

A Look Back at 2020

Early in 2020, investors fled emerging markets for the safe haven of the U.S. dollar and dollar-denominated assets. Their nervousness was understandable. When the COVID-19 pandemic hit, emerging market countries did not have advanced health care infrastructures, they did not have money to spend, and they could not afford to print money like most of the developed world. In other words, they were losing a grip on their future. But many emerging markets did a better-than-expected job of managing the pandemic, and the resilience of their economies was reflected in their stock markets.

Where Will Emerging Markets Go Next?

As we look ahead, there are four key catalysts for emerging market equity returns: improvement in health outcomes, global growth opportunities, the ability to fire on all cylinders, and dollar depreciation.

Improvement in health outcomes. There was a stark divergence in the success rates of emerging market countries in handling the pandemic. China and several other North Asian countries navigated the crisis much better than the rest of the world, while many Latin American countries struggled. Even now, there is wide dispersion in the penetration of the vaccination programs. Thus, economies of some countries have rebounded quicker after the sharp collapse early last year, and others are at the tail end of the crisis. As vaccinations get underway, we could see greater positive convergence among emerging countries, as the North Asian economies sustain positive momentum while others reopen and rebound.

Global growth opportunities. Emerging market countries have a higher beta to global growth. Following the initial lockdown, global manufacturing growth rebounded strongly and remained resilient during the subsequent virus waves. Industrial production volumes are above pre-crisis levels in most emerging markets. Overall, emerging market countries weathered the pandemic better than developed countries and are expected to lead the recovery in the post-pandemic period.

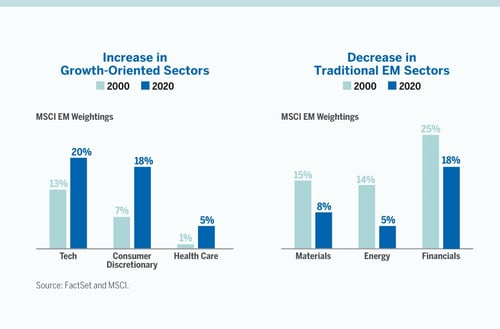

Ability to fire on all cylinders. In the past couple of decades, the emerging market index has pivoted from an overweight in traditional materials, energy, and financials to more growth-oriented sectors like technology, consumer discretionary, and health care (see chart below). Secular trends like digitalization and increased spending on health care, logistics, and premium products should continue as the pandemic crisis moves behind us. The evolution of the sector make-up of the emerging market index is favorable for better earnings growth rates and plays into the long-term emerging market consumer theme.

There is also the prospect for broadening of the emerging market opportunity set. The recent surge in commodity and oil prices has lifted optimism about economic prospects in the large natural resource producers in Latin America and the Middle East. While this may not signal the start of another commodity super cycle, it does boost the near-term outlook for the cyclical regions and sectors of emerging markets.

Dollar depreciation. Emerging market equities tend to do better in a weaker dollar environment. A weaker dollar leads to easier financial conditions and attracts foreign capital into emerging markets. Conversely, as the dollar strengthens, emerging markets experience outflows and weaker returns for U.S. investors. The dollar has been range-bound in the past few months, as longer-dated U.S. rates rose, and there is potential for some strengthening here if the upward pressure in rates remains. But the fundamental factors for a longer-term trend of a weaker dollar continue—massive money printing, a huge fiscal deficit, and broadening global growth. A weaker dollar could lift emerging market equities further.

Evaluating the Near-Term Risk

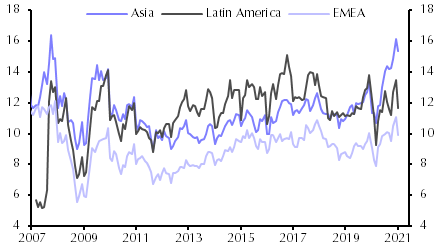

After strong gains in recent months, emerging market equities appear to have come off the boil, driven in part by rising U.S. Treasury yields. Despite the recent declines, valuations in parts of emerging market equities look stretched relative to their history (see chart below). This could prove to be a near-term headwind, especially if U.S. rates continue to rise and the dollar consolidates gains or rises further.

Source: Capital Economics

Earnings Growth Ahead?

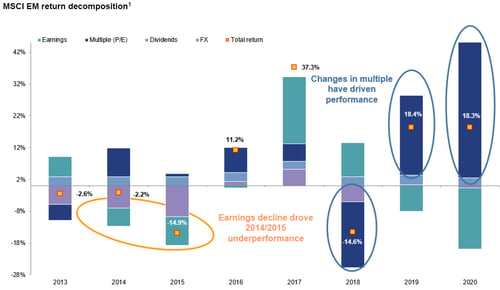

While richer valuations could be a headwind, stronger earnings growth could carry the day (or year) for emerging markets. Valuation changes have been the key driver of emerging market equity returns in the past few years. Even in 2020, when earnings of emerging market companies tanked as countries went into lockdown, investor sentiment and, hence, valuation multiples rebounded quickly.

Going into 2021, much of the heavy lifting will need to be done by earnings growth. Here, the outlook is quite robust. Consensus expectations are for a nearly 30 percent rebound in corporate earnings. Despite the richer multiples relative to history, there is a greater likelihood that emerging market equities will grow into these valuations and reward investors through higher earnings growth.

Source: Goldman Sachs Asset Management

The Long View

Emerging markets offer attractive growth opportunities, both now and over the long term. They have survived multiple stress tests over the years, and their performance during the pandemic is yet more proof of their resilience. Looking ahead, I expect robust risk appetite to support emerging market assets. Post-pandemic recovery of domestic economies, accelerating global growth, and a weak dollar—these are just a handful of the many factors supporting an exposure to emerging markets.

That said, valuations of emerging market equities look rich on a historical basis, with the MSCI Emerging Markets Index’s forward price-to-earnings ratio trading at 16x, versus a five-year average closer to 12x. Gains in 2020 came from multiple expansions, as is the norm when exiting recessions. Going forward, earnings per share growth from a synchronized global economic recovery will drive equity prices. This could lead to a broadening of gains to the more cyclically oriented regions and sectors of emerging markets that lagged the recent rally and offer more attractive valuations.

Print

Print