Brad here. One of the great things about Commonwealth is that we have a team of expert analysts to provide valuable context on pretty much anything we need. Today’s post, from Nathan Parker, highlights the evolving energy landscape in the U.S. We must understand where we came from to know where we are going, and this is a great read that does just that for the energy sector. Over to you, Nathan.

Brad here. One of the great things about Commonwealth is that we have a team of expert analysts to provide valuable context on pretty much anything we need. Today’s post, from Nathan Parker, highlights the evolving energy landscape in the U.S. We must understand where we came from to know where we are going, and this is a great read that does just that for the energy sector. Over to you, Nathan.

In the past few years, the drop in oil prices has dominated the energy sector headlines. An oversupplied market—mainly caused by rising OPEC (the Organization of the Petroleum Exporting Countries) and U.S. production—is a widely known factor. But is renewable energy making meaningful progress in terms of fulfilling our energy needs? U.S. energy consumption data produced by the U.S. Energy Information Administration (EIA) may help answer this question.

U.S. energy sources

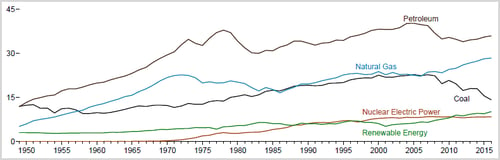

The chart below provides a historical illustration of the types of energy sources used in the U.S. to power commercial and residential buildings, as well as the industrial and transportation sectors.

U.S. Energy Consumption (Quadrillion Btu), 1949–2016

Source: U.S. EIA

Petroleum-based products. These products include diesel, gasoline, and jet fuel. They are derived from crude oil, which remains our largest energy source. The transportation sector generates the biggest demand for petroleum-based products, which are used to power automobiles, commercial vehicles, and airplanes.

Natural gas. The shift from coal to natural gas is the most notable change over the past decade, as natural gas is being used more heavily for electricity generation. The shale revolution produced abundant natural gas supplies, making the fuel cost competitive with coal. In addition, natural gas power plants emit about 50 percent less carbon dioxide compared with coal power plants.

Renewable energy. Renewable energy, mainly hydropower, solar, and wind, gained modest market share over the past decade, with most of the demand coming from electricity generation. Solar and wind have become more competitive with coal and natural gas as costs have fallen sharply over the past decade. Still, renewable energy remains a much smaller portion of our energy supply compared with petroleum and natural gas.

Emerging technologies

Next, let’s turn to emerging technologies. Right now, electric vehicles represent a very small portion of the cars on the road. But they are quickly gaining momentum due to government policies and technological advancements. For example, China may be leading the most aggressive push toward electric vehicles as it battles pollution in its cities. China, along with France, India, the U.K., the Netherlands, and Norway, recently announced plans to phase out the sale of fossil fuel-powered vehicles in the coming decades.

As a result, several car manufacturers have made plans to invest more heavily in electric and hybrid vehicles, which could speed up the pace of innovation and drive down costs. Technologies such as self-driving cars (i.e., autonomous) and ridesharing (e.g., Lyft, Uber) could also hasten the adoption rate of electric vehicles. Of course, infrastructure requirements (e.g., electric vehicle charging stations), charging times, battery ranges, and battery costs remain challenges for the growth trajectory of electric vehicles. Finally, although electric vehicles don’t contribute directly to our energy supply, the potential growth in electric vehicles could alter our energy landscape, as a power source is required to charge their batteries (e.g., the electric grid).

Implications for commodities

From a demand standpoint, our evolving energy landscape could have implications for certain commodities. Silver, for example, is an input used to produce solar panels. Aluminum and steel are materials used to make wind turbines. For electric vehicles, aluminum, cobalt, copper, graphite, lithium, nickel, and manganese are materials and metals used to produce lithium-ion batteries. On the other hand, demand growth could become more challenging for commodities, such as crude oil, gasoline, and diesel, if electric vehicles become more competitive with internal combustion vehicles.

Meeting our energy needs in the years ahead

Over the past decade, solar and wind have experienced strong growth as both are being more heavily used for electricity generation due to falling costs. Market share, however, remains fairly low when compared with fossil fuels, such as coal, oil, and natural gas. Here, geography is an important factor that could affect growth. For instance, solar may be more cost effective and efficient in certain geographic regions (e.g., the Southwestern U.S. due to abundant sunshine), while wind may be more effective in others (e.g., the Midwest).

It is likely that fossil fuels will continue to play an important role in meeting our energy needs in the coming decades, as renewable energy may not be economic or effective in certain regions. Further, renewable energy storage remains a challenge for periods of time when there is no sun or wind. Nonetheless, sources outside of coal, oil, and natural gas could play a larger role in meeting our energy needs in the years ahead.

Print

Print