With the front-page news dominated by politics and the hurricanes, there is actually not a lot to report on the economic front. This is a good thing, as it signals that economy continues to do well. It does, however, make it necessary to dig a bit deeper to find out what we should be paying attention to.

With the front-page news dominated by politics and the hurricanes, there is actually not a lot to report on the economic front. This is a good thing, as it signals that economy continues to do well. It does, however, make it necessary to dig a bit deeper to find out what we should be paying attention to.

China’s credit rating: It’s a big deal

Today, the most attention-worthy item I noticed was way back in the business sections on how Standard & Poor’s, the credit rating agency, was the third of the three major agencies to reduce China’s credit rating. While still strong, China is now considered somewhat less creditworthy than it had been. This is a big deal.

Why do I call it a big deal? Because despite all of the public worry several years ago about the building debt load in China, the credit rating was still solid—and the economy was still performing. Now, even though the Chinese economy continues to perform, the rating agencies are acting somewhat proactively to reflect the risk of rising debt. This is certainly not a sign of imminent doom. But it is a sign that informed observers see the risk increasing.

What about the U.S.?

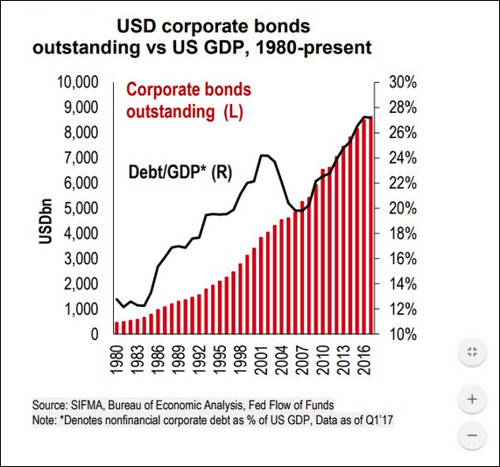

China is not the only offender, or the worst one. Global debt was estimated at $217 trillion earlier this year. And, here in the U.S., federal debt just broke the $20 trillion level. Written out, that is $20,000,000,000,000, or almost $62,000 for every citizen. As illustrated in the following chart from Bloomberg, U.S. corporate debt continues to break records, both in dollar terms and as a proportion of the economy as a whole.

Here’s the thing about debt

The thing about debt is that it is borrowed from the future. It has to be paid back with future dollars, which will not be available for other things. This is fine, even good, if that debt is used to invest in those areas that will generate returns to pay back the debt (e.g., factories or roads). But it is damaging if the money is used to consume, with no return to pay it back.

Here in the U.S., there has been little discussion of the deficit or the debt for the past several years. The reason for this is actually a good one, as the sequester deal (remember that?), which was supposed to cut government spending growth, actually did. The deficit, while it did not go away, has been much smaller and less of a risk since then. This was a very positive outcome. But it was not without costs, the biggest of which has been slow growth. If government spending had continued to grow at historical rates, overall growth would have been much stronger, and we would be living in a very different country. The benefits were real, but so were—and are—the costs.

Despite the success of the sequester deal, however, debt is moving front and center again. This is perhaps an unavoidable reflection of the debt ceiling debate, the budget negotiations, and the tax reform package. All of these will put the deficit and debt back into very public play, plus raise investor concerns.

Panic is the wrong answer

As investors, when we think about the debt and deficit, whether here or in China, it is easy to panic. The sheer size of the numbers induces a sense that this is indeed out of control and that the problem is beyond solution. In fact, as we saw with the sequester, the problem is solvable—both here and abroad. We can cut spending, raise taxes, and balance the budget. It will be painful and damaging, not to mention a political nightmare. But it can be done, as it was not that long ago.

This is the context we should use when we consider the rising coverage of debt issues, which is likely to increase: not the problem itself, but the consequences of the inevitable (if reluctant) solution. As always, panic is the wrong answer. Instead, it is much better to take a look at what is likely to happen and react to that, both the good and the bad.

Print

Print