As stewards of more than $12 billion in client capital (as of July 25, 2021), our job on the Investment Management team at Commonwealth requires a great deal of risk assessment—and there are many risks that require evaluation. But too often in our industry, the talking heads focus on the short-term ones like interest rate moves and market pullbacks. Most investors, however, have long time horizons. So, what we should be considering as an industry are the longer-term risks that match up with our clients’ goal horizons. One of those risks? Climate change.

As stewards of more than $12 billion in client capital (as of July 25, 2021), our job on the Investment Management team at Commonwealth requires a great deal of risk assessment—and there are many risks that require evaluation. But too often in our industry, the talking heads focus on the short-term ones like interest rate moves and market pullbacks. Most investors, however, have long time horizons. So, what we should be considering as an industry are the longer-term risks that match up with our clients’ goal horizons. One of those risks? Climate change.

As Brad mentioned in a previous post, climate change is a material risk that is having a pronounced effect on our daily lives, the global economy, and society as a whole. Take, for instance, the number of wildfires, droughts, and natural disasters that are occurring with more regularity. These extreme weather events pose significant financial risks for individuals, companies, and countries alike.

Regardless of where you stand politically on the issue, or what you believe to be the true cause, we should all acknowledge that the climate is changing. The changes coming forth in the years and decades ahead will have a significant impact on how we collectively live our lives and operate as stewards of capital.

NASA Says . . .

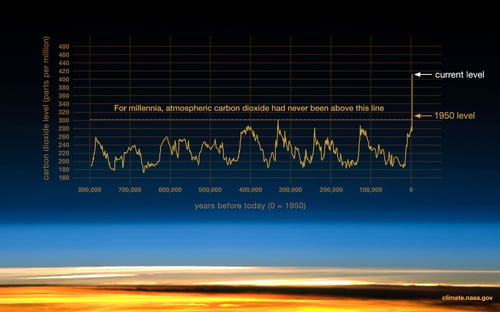

When looking for hard evidence and data on the topic, I turn to the same people who put us on the moon: NASA. NASA has constructed a user-friendly website that walks readers through the evidence, science, and ultimate effects of climate change. One piece of evidence—the atmospheric dioxide levels from the past 800,000 years—is illustrated below. I’d recommend giving the site a review if you’re looking to brush up on some of the facts and figures facing our world today.

Source: climate.NASA.gov

Investors On Alert

Forward-looking investors are becoming increasingly focused on the impacts of climate change on their investment portfolios, including the negative effects on future economic growth or a company’s bottom line, business model, and financial standing. As a result, many investors are seeking investment solutions that intentionally mitigate climate-related risks or proactively embrace the race to net-zero carbon emissions. Other advocates are employing their shareholder rights to proactively engage with management teams and advocate for greater disclosure of climate-related business risks in their annual reports.

From an investment perspective, the ESG portfolios we run through our Preferred Portfolio Services® Select program are now more than a decade old and were designed to help clients meet their goals in a more sustainable, socially responsible manner. The managers in the portfolios integrate environmental principles into the investment process alongside social and governance standards, an approach commonly referred to as ESG investing. The portfolios have become very popular, garnering close to $500 million in assets (as of July 25, 2021), with most of the asset growth occurring in the past two years.

The Time to Consider Climate Risk Is Now

Alongside the demographic headwinds we face as a nation, climate change will be a key risk that companies, municipalities, and governments will be forced to contend with over the coming decades. Our expectation is that demand for sustainability-oriented strategies will continue to accelerate as the globe continues to grapple with an ever-changing climate, and the risks associated with that change become more pronounced.

As practitioners overseeing client assets, we, as an industry, have a fiduciary obligation to consider all risks. Turning a blind eye to this one will result in significant societal and financial damage over the long run if not acted upon now.

Print

Print