Since the 1980s, we have celebrated and honored female trailblazers, who have shaped our history and advocated for change, during Women’s History Month. Today, March 8, is no exception, as we celebrate International Women’s Day by recognizing women’s global achievements and contributions to history, culture, and society. International Women’s Day also serves as a powerful reminder of the ongoing struggles women face in the modern workplace, including gender equality, pay equity, and the lack of visibility of women in leadership positions.

Since the 1980s, we have celebrated and honored female trailblazers, who have shaped our history and advocated for change, during Women’s History Month. Today, March 8, is no exception, as we celebrate International Women’s Day by recognizing women’s global achievements and contributions to history, culture, and society. International Women’s Day also serves as a powerful reminder of the ongoing struggles women face in the modern workplace, including gender equality, pay equity, and the lack of visibility of women in leadership positions.

As one of two females on a predominantly male team, in a male-dominated industry, I can certainly relate to being the only female in the room—a reality many female readers may understand. My experience has certainly given me a unique view into the importance of investing in women.

Closing the Gender Gap

In fact, I’m reminded of the incredible opportunity investing in women presents to us all—and the collective responsibility we have in advancing the pipeline for the next generation. By advancing, empowering, and collectively investing in women, we can achieve an equitable future where all members of society can participate and thrive—while also benefitting the economy. Yes, you heard that right! Closing the gender employment gap could help boost long-term GDP per capita by nearly 20 percent, on average, across countries, according to data from The World Bank.

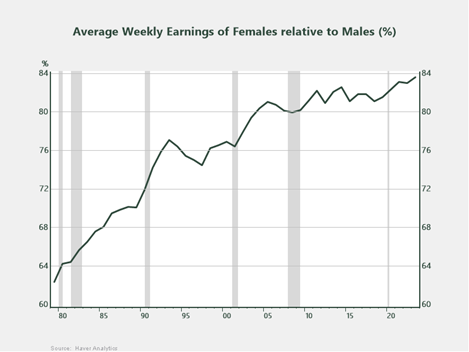

Yet we all know there’s significant work to be done. For instance, the average weekly earnings of females relative to males currently stands at 84 percent.

Source: Haver Analytics

The unfortunate reality is that advancing women in the workplace—let alone achieving gender equality worldwide—will require significant financing, policy, and action (to put it gently). The UN estimates an additional $360 billion is needed per year to achieve gender equality alone—yet the opportunity cost of waiting to invest in women could have adverse economic implications. But what does investing in women really mean? Let’s look at the data to find out.

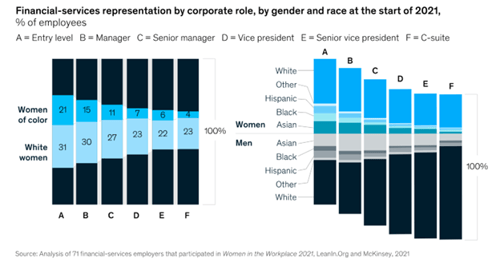

In the U.S., women compose 50.41 percent of the total population. Yet the ongoing growth and advancement of women in the labor force have remained alarmingly stagnant since about 1995. What’s more, women—and women of color—remain significantly underrepresented across the corporate pipeline, especially when it comes to senior leadership positions. McKinsey’s Women in the Workplace study found that women represent 28 percent—or roughly 1 in 4—C-suite leaders, but women of color represent only 1 in 16. Further, the percentage of Fortune 500 companies with female CEOs is around 10.4 percent. Glass ceiling, anyone?

Women and Wealth Management: An Inflection Point?

In a predominantly male-driven field, women account for only 46 percent of financial services employees. Among key industry designations and professions, women account for just:

- 7 percent of CERTIFIED FINANCIAL PLANNER™/CFP® professionals—a mere increase of 0.2 percent over the past year

- 18 percent of CFA® charterholders

- 1 percent of portfolio managers

Clearly, there’s work to do. Not all the data is discouraging, though. While men still outnumber women in the industry, the data suggests slow but steady improvements in female advancement to leadership opportunities. The share of women in C-suite positions in financial services has grown—albeit gradually—from 12.1 percent in 2012 to 18.4 percent in 2023 (per Statista).

From a wealth management perspective, women currently control $10 trillion; however, shifting demographics and the pending generational wealth transfer are projected to amplify that figure threefold by 2030. Over the next decade, women will be well-positioned to control nearly $30 trillion—a figure close to the annual GDP of the U.S.—of the pending money in motion, per McKinsey. And when it comes to managing finances or making financial decisions across households, more women are in the driver’s seat than ever before.

To attract and retain female clients for the long term, financial advisors will need to position their practices to meet the differentiated needs of their female clientele. Part of this shift will require fostering trust and building meaningful relationships, two areas in which women—female advisors included—excel. This cohort bears watching, given that women outlive men by five years in the U.S. and that 70 percent of women report changing financial advisors within one year of their partner passing. From a wealth management perspective, understanding women’s differentiated planning needs and prioritizing their behaviors and preferences when managing money will be paramount to future success. Simply put, women should be included in the overall financial planning discussion earlier and more frequently. Visibility is paramount! And while the financial services industry has been historically male-dominated, the future looks bright for women in wealth management.

Be Bold

Within the Commonwealth community, we continue to see progress in accelerating the participation of women in our industry. Last month, we hosted our sixth annual Summit for Women Advisors in Santa Barbara, California, with record attendance from women advisors, industry partners, and home office staff. We heard inspirational stories from accomplished female entrepreneurs on their pursuits to success, including their losses, failures, and lessons learned along the way. The conference theme, “Be Bold,” encouraged us to celebrate our achievements, instill confidence in our female colleagues, and pave the path for the next generation of female talent in our industry. We shared best practices on attracting and retaining female top talent, leveraging Commonwealth’s resources to grow and scale advisory practices, and discussed key industry topics, such as AI and investing during an election year.

We also had the opportunity to hear firsthand from industry trailblazers like Alexandra Armstrong, CFP®, CRPC®, founder of Armstrong, Fleming, & Moore. Not only is Alex celebrated across the financial planning industry and a cherished member of the Commonwealth community, but she was also the first person in Washington, DC—and among the first women in the country—to earn the CFP® certification. Shortly after sharing her remarkable story with us, Alex was awarded the first inaugural Alexandra Armstrong Empowerment Award, which recognizes the exceptional achievements of a Commonwealth community member who excels professionally while uplifting others in the field of financial planning and advocates for women’s financial well-being. Talk about the power of being bold and investing in women. Kudos to you, Alex!

Empowered Women, Empower Women

As you reflect on the significance of International Women’s Day, we encourage you to recognize the influential women in your life. As financial planners and stewards of client capital, we have a collective responsibility to help women take control of their financial futures sooner and to include women in financial planning discussions more frequently. We should collectively celebrate women’s achievements and acknowledge the need for more representation of female leaders in all aspects of the financial services landscape, not just on International Women’s Day. And to our male allies and sponsors, we thank you for your partnership, your commitment to advancing women in the industry, and your willingness to lend an ear. After all, as Gloria Steinem once said, “The story of women’s struggle for equality belongs to no single feminist nor to any one organization but to the collective efforts of all.” Happy International Women’s Day!

Print

Print