Brad here. One of the big market topics these days is how concentrated the stock market indices have become, with a handful of companies composing a larger and larger part of each index. This is certainly a problem—but why? And what do we do about it? In today’s post, my colleague, Wayne Richardson, has some thoughts on both. Thanks, Wayne!

Brad here. One of the big market topics these days is how concentrated the stock market indices have become, with a handful of companies composing a larger and larger part of each index. This is certainly a problem—but why? And what do we do about it? In today’s post, my colleague, Wayne Richardson, has some thoughts on both. Thanks, Wayne!

One of the most common pieces of investing advice is to diversify. This has long been accomplished at a low cost by using ever-popular index funds. With this approach, investors use funds that track a popular index (e.g., the S&P 500 or the Nasdaq) and, by doing so, often feel they have accomplished broad diversification. But with some of these popular index funds becoming more concentrated in a handful of names, what are investors to do? Let’s take a closer look at this problem, as well as at some of the potential solutions.

The Magnificent Seven

Increasingly, index concentration has been a hot topic in U.S. equity markets, particularly as the valuation of some of the biggest tech companies has exploded into the hundreds of billions or even trillions of dollars. The group dubbed “the magnificent seven” (i.e., Apple, Microsoft, Amazon, Alphabet, Nvidia, Meta, and Tesla) has been the key driver of this trend, as their stocks and their market value have shot up. To highlight the speed at which this issue has intensified, in mid-2018, Apple became the first company to achieve a market value of $1 trillion. Today, five companies in the magnificent seven have achieved a value of more than $1 trillion, including Microsoft at more than $2 trillion and Apple having peaked above $3 trillion.

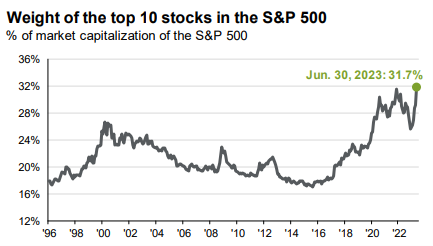

Most popular indices are “market-cap weighted,” meaning that the bigger the company (or the higher its market value), the bigger the weight it receives in such indices. As the value of dominant tech companies has grown faster than the overall market, they’ve represented a larger and larger portion of these indices. This trend can be seen in the chart below, which highlights the S&P 500.

Source: FactSet, Standard & Poor’s, JP Morgan Asset Management

A Growth Problem

Stock market investing is commonly divided into three broad styles: growth, blend, and value. The S&P 500 is in the blend category, as it holds large companies across the growth and value spectrum. This concentration problem is more prominent on the growth side, where most of these large tech companies land.

Popular growth indices such as the Russell 1000 Growth, the Nasdaq, and the Nasdaq-100 (a subset of the Nasdaq focused on high-tech companies) have topped 40 percent allocation to just the top five companies! In fact, the Nasdaq-100 implemented a special rebalance last month to address the issue, something it’s done only two other times in its history and only when it was “determined to be necessary to maintain the integrity of the index.”

Diversifying in a Concentrated World

This scenario creates a tricky problem for investors. On the one hand, the weight of these companies has become greater and greater because their stocks have continued to rise faster than the overall market. Investors don’t want to miss out entirely on all those potential gains because they’re worried about “too much of a good thing.” On the other hand, what works for you today may work against you tomorrow. The whole idea of diversifying is to spread out risk, so a large portion of the investor’s net worth is not in jeopardy if just one or two companies stumble.

If we look at history, it has often been the case that a list of the largest companies in the world at the start of one decade will look very different a decade or two later. In fact, of the six largest companies in the S&P 500 in early 2000, three have generated negative stock returns from that point through midyear 2023, and only one has meaningfully outperformed the S&P 500 over that same period.

Balancing the Risk

So, what are investors to do? Fortunately, there are actions they can take to help balance the risk that arises from this scenario.

Diversify in multiple ways. Of course, this solution has already been mentioned, highlighting just how important it is. It goes without saying that investors should diversify across asset classes (bonds, etc.). But for the purposes of this discussion, let’s focus on diversification within the portion of a portfolio allocated to stocks.

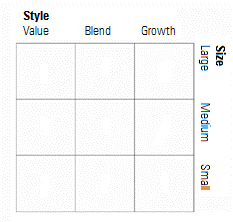

One way to diversify is to invest in different styles (growth vs. value). This can also be accomplished by accounting for size. Just as indices such as the S&P 500 track the largest publicly traded companies, others track medium- and smaller-sized companies (mid-cap and small-cap). These won’t have any exposure to the largest companies currently dominating popular indices. As such, allocating to such areas can further help achieve broad diversification among equity holdings.

Rebalance. The rebalancing process helps ensure that investors don’t end up with too many eggs in one basket. To illustrate this point, let’s use a simple portfolio with two funds, Fund A and Fund B, each with $100 invested. If Fund A doubles in value and Fund B doesn’t change, the investor now has $200 in Fund A, making up 67 percent of a portfolio now worth $300. If the intent was to have the investments spread out as they initially were, 50/50, the investments to this allocation will occasionally need to be reset. In this example, that would entail taking some money from Fund A and putting it in Fund B. That way, there would be $150 in each fund, representing a return to the desired allocation. Further, this practice helps ensure that a portfolio remains consistent with the investor’s level of risk tolerance.

A common timeframe for rebalancing is once per year. But whatever interval is chosen, the time or parameters for rebalancing should be predetermined and executed automatically, taking emotion out of the decision.

The Equity Style Box

This cross-section of taking into consideration company size and investment style is borne out in the equity style box referenced by many market data providers (see chart below). It combines the growth/blend/value styles (usually shown across the top) with the large/mid/small size categories (along the side) to create a 3 x 3 diagram. It serves as a quick and useful reference tool to roughly gauge how diversified a portfolio may be among the various areas of the stock market given the funds that are held. Are most landing in the “large-cap growth” box? Do any funds land on the value side or further down cap? The prominence of the equity style box among investment data resources and materials highlights how critical it is to be aware of investments across the stock market landscape.

Source: Morningstar

Explore the Options

Understandably, some investors do not want to put in the time and work to make sure their money is spread out properly among the differing size and style options within stocks, not to mention figuring out how to allocate their savings between stocks and other assets such as bonds. Fortunately, there are outsourced investment options to consider. Here at Commonwealth, we offer a suite of such models (preset baskets of mutual funds and/or ETFs). They are just one strategy to help with the concentration problem, offering varying degrees of exposure to different asset classes to suit different levels of risk tolerance and the opportunity to rebalance to the target allocations when needed.

Asset allocation programs do not assure a profit or protect against loss in declining markets. No program can guarantee that any objective or goal will be achieved.

Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the fund, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

Print

Print