Inflation has grabbed headlines for the better part of a year now, as the Covid-19 response led to increased demand and supply constraints. That said, short-term inflation expectations have changed dramatically in recent months. In April 2021, inflation expectations for 2022 remained relatively subdued, with the International Monetary Fund (IMF) calling for 1.6 percent consumer price inflation in 2021 and 1.7 percent in 2022 for advanced economies. In October 2021, these numbers had moved up to 2.8 percent and 2.3 percent, respectively. Since then, inflation in the U.S., euro area, and other advanced economies has continued to pick up, with the IMF’s most recent report from this month showing inflation for advanced economies at 5.7 percent in 2022 and 2.5 percent in 2023.

Inflation has grabbed headlines for the better part of a year now, as the Covid-19 response led to increased demand and supply constraints. That said, short-term inflation expectations have changed dramatically in recent months. In April 2021, inflation expectations for 2022 remained relatively subdued, with the International Monetary Fund (IMF) calling for 1.6 percent consumer price inflation in 2021 and 1.7 percent in 2022 for advanced economies. In October 2021, these numbers had moved up to 2.8 percent and 2.3 percent, respectively. Since then, inflation in the U.S., euro area, and other advanced economies has continued to pick up, with the IMF’s most recent report from this month showing inflation for advanced economies at 5.7 percent in 2022 and 2.5 percent in 2023.

What has led to changes in this global inflation outlook? And what conditions are contributing to the IMF’s lowered inflation expectations going into 2023 and beyond?

Russia-Ukraine War Drives Higher Inflation in the Short Term, Long Term in Check

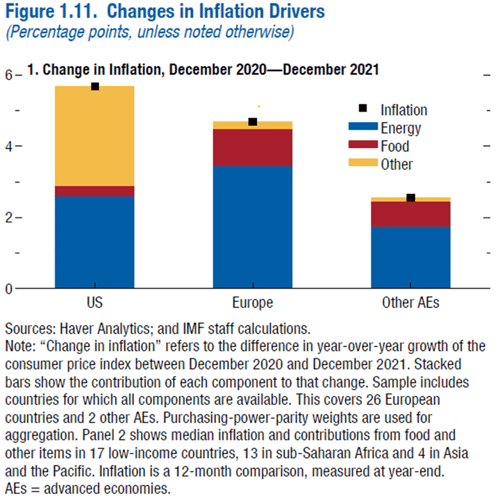

Energy has been among the most prevalent pain points for consumers in the U.S. and around the world, as oil demand has risen dramatically from the 2020 lockdown lows. The chart below demonstrates the impact of energy on changes in inflation from December 2020 to December 2021. As Europe and other advanced economies were slower to reopen, we see them as larger contributors to overall changes in inflation during this period.

Additionally, the war has brought increases in energy and commodity prices across the globe, as both Russia and Ukraine were major exporters of both. According to the Dallas Federal Reserve Bank, Russia accounts for roughly 10 percent of global petroleum production. Further, Russian/Ukrainian grains exports (wheat, barley, and corn) represent 24 percent of the global total, 50 percent of sunflower products (seeds, meal, and oil), and 21 percent of rapeseed products, according to Rabobank. Due to this dynamic, those dependent on these two countries for energy or food have seen a pickup in inflation expectations.

According to the IMF World Economic Outlook, inflation projections increased by 1.8 percent and 2.8 percent in advanced and emerging economies from January to April of this year. This brings inflation projections for 2022 to 5.7 percent and 8.7 percent, respectively, for advanced and emerging economies. The drivers for these economies, however, are specific to each region. For example, emerging and developed European countries, which rely heavily on Russian gas, will see more impact on the energy side than the agricultural commodities side, which hits areas in the Middle East and Central America harder as they depend on Ukraine and Russia for food and grains.

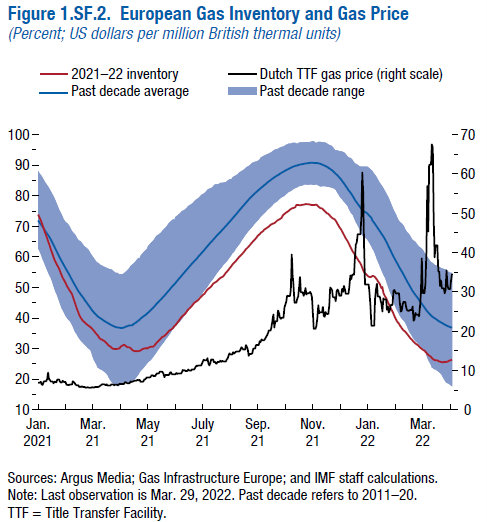

The energy exposure is also supported by historically low natural gas inventories, as shown below in the chart.

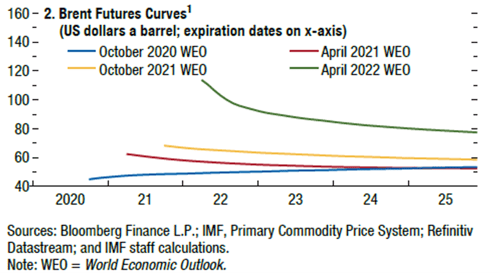

Despite these low inventory levels, we have seen improvement recently, and the Brent futures curve has turned increasingly negative, as shown by the green line in the chart below. This indicates energy prices are expected to move toward $90/barrel in 2022 and continue to decline thereafter. A similar trend is expected in agricultural goods, with prices expected to decline in 2023 due to the lag from the 2022 harvest.

Central Banks Have Global Inflation in Their Crosshairs

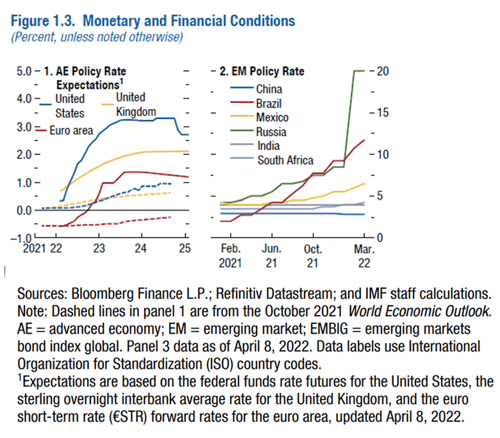

Inflation has also entered the crosshairs of central banks. The chart below shows the policy rate expectations in advanced economies and emerging market policy rates. As of March 2022, the Bank of England has hiked rates in three consecutive meetings. But while they have led the way in terms of rate hikes, their inflation projections for 2022 have moved up to 7.6 percent from just 2 percent in October 2021, according to the IMF.

The U.S. is expected to be notably more aggressive in their next two meetings, with 50-basis-point hikes at each widely expected and the potential for a 75-basis-point hike at the first meeting being discussed by St. Louis Fed President James Bullard.

The European Central Bank is expected to tighten in the second half of 2022 as natural gas prices going into the winter of 2022/2023 remain a major uncertainty. Elsewhere in the world, we have seen Russia raise rates aggressively following sanctions to maintain stability in the ruble. Additionally, Brazil and Mexico have increased their rate expectations as higher energy costs for trucking and commodity prices have led to inflation.

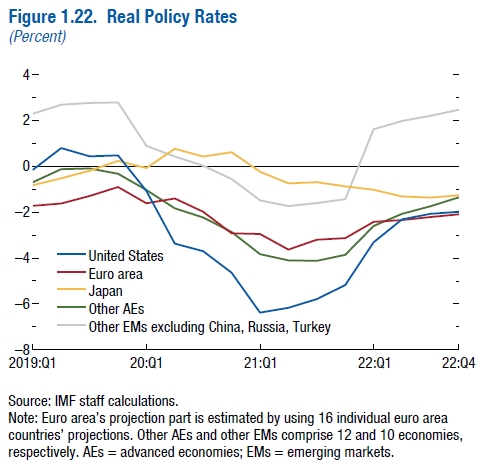

The chart below shows real policy rates. In areas such as the U.S., Europe, Japan, and other advanced economies, we see that these rates are negative as the inflation rate is greater than the interest rate. This means that a rise in rates via central bank tightening could potentially be used as a tool to combat inflation. We also see that in emerging markets excluding Russia, China, and Turkey, this is not the case. Where these emerging markets have high levels of debt, an increase in rates could have negative impacts on growth and their economies.

Looking for Signs That Inflation Is Starting to Peak

We have seen hints that inflation may be closer to peaking. The futures market is clearly pricing in declining oil. Central bank tightening could potentially lighten consumers’ wallets and destroy discretionary demand. Additionally, freight rates in the U.S. suggest the inflationary mix has shifted from goods to services and from products, such as used cars, to discretionary spending on items such as airline fares. While uncertainty remains around global inflation expectations given the continued conflict in Ukraine and lockdowns in China, there are signs that things could be improving.

What This Means for Your Portfolio

As an investor, it is important to be mindful of the relationship your portfolio has to inflation, as it could erode potential returns and growth. Does your portfolio do well in times of slower growth, or is it a high-flying portfolio skewed toward equities that may experience a bumpier ride until inflation and tight policy subside?

Areas such as emerging Europe, Africa and the Middle East, and Latin America may be more exposed to inflation in the intermediate term due to the structure of their economies, currencies, and central banks. That said, these are typically smaller exposures at roughly just 0.15 percent, 1.45 percent, and 1.11 percent in the MSCI All-Country World Index (MSCI ACWI) benchmark. The impact on growth, however, will be felt globally.

World GDP growth expectations for 2022 have dropped from 4.9 percent to 3.6 percent from the IMF’s October 2021 report to April 2022. The real GDP growth for advanced and emerging economies saw a drop from 5.2 percent and 6.4 percent, respectively, to 3.3 percent and 3.8 percent. While the topic of inflation has repeatedly come up in the news of late, it does appear that expectations globally may moderate heading into late 2022 and 2023.

We’ve lived through periods like this before and survived. If you work with a financial advisor, talk with them if you’re worried about how your portfolio will weather this period, and remember that short-term expectations are just that—short term.

The MSCI ACWI Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets.

Print

Print